A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

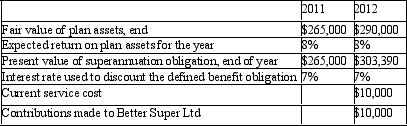

Great Keppel Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement. The company's superannuation plan is managed by Better Super Funds.

The following details are relevant to the superannuation obligation of the company for the years ended 30 June 2011 and 2012:

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

A) No action necessary as the contribution of $10,000 was remitted to better Super Ltd.

B) No action necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13,390 being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38,390 for the year 2012 being the difference between beginning and ending balance of the present value of superannuation obligation.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Entity A contributes to a defined benefit superannuation plan for its employees. It calculates the following: Current service cost 12,785 Interest cost 983 Expected return on plan assets (1,150) Net actuarial gain recognised in period (1,835) 10,783 The 'Expected return on plan assets (1,150) ' represents:

A) The expected return at the start of the period, measured as a proportion of the current service cost.

B) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan obligation.

C) The adjusted return for the period, measured as a proportion of the closing fair value of the plan assets.

D) The adjusted return for the period, measured as a proportion of the opening fair value of the plan assets.

E) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan assets.

Correct Answer

verified

Correct Answer

verified

True/False

Employees generally receive superannuation entitlements as part of their employment agreements. Thus usually involves the employer transferring funds to an independent superannuation fund that is administered by an independent trustee:

Correct Answer

verified

Correct Answer

verified

True/False

In a long service leave liability, conditional period is period during which an employee gains legal entitlement to pro rata payment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee whose contract for service includes an entitlement to 1 week's cumulative sick leave per annum will be entitled to how many weeks' sick leave after 3 years' employment if no sick leave has been taken?

A) One week.

B) Between 1 and 3 weeks depending on annual leave entitlements.

C) Three weeks.

D) Either 1 or 3 weeks depending on long service leave entitlements.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

Non-vesting sick leave that has accumulated will be paid to employees when their employment ceases:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suggested approaches to improving the financial security of employees in the case of the collapse of their employer include:

A) Promoting compulsory, private self-insurance schemes for individuals so that they will be covered in the case of company failure.

B) Providing stronger government funding for unions so they can act as a financial support for members made unemployed by corporate failure.

C) Creating a sub-committee of Cabinet to oversee the raising of funds and investment of these funds to provide a special needs fund for employees severely financially affected by the collapse of their employer.

D) The establishment of central funds, either in the form of government-backed compulsory insurance or a trust to which it is compulsory for employers to contribute, from which employee entitlements could be paid in the case of corporate collapse.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Post-employment benefits include:

A) Cash payments.

B) Pensions payable through a superannuation fund.

C) Insurance costs.

D) All of the given answers.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expense recognised by an employer for a defined benefit superannuation plan:

A) Will always equal the amount of the contribution for the period.

B) Is not necessarily the amount of the contribution for the period.

C) Will never equal the amount of the contribution for the period.

D) Is always greater than the amount of the contribution for the period.

E) Is always less than the amount of the contribution for the period.

Correct Answer

verified

Correct Answer

verified

True/False

If there is no deep market for high quality corporate bonds, AASB 119 "Employee Benefits" permits the use of market yields on government bonds as a discount rate to determine the present value of a defined benefit obligation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kerry Gill works for Kentucky Enterprises for an annual salary of $60,000. Kerry is entitled to 4 weeks' annual leave per year with a leave loading of 17.5 per cent. What entry each week, additional to the one recording wages expense and PAYG tax deduction, would be required to accrue Kerry's entitlement to annual leave? When Kerry takes his 4 weeks' annual leave, what entry would be made to record this (only) ? The tax is calculated at 30 per cent. (Assume that there are 52 weeks in a year and round to the nearest dollar.)

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AASB 119 defines 'employee benefits' as:

A) Salaries and wages, and associated on-costs.

B) All cash payments made to employees.

C) All cash payments made to employees in their roles as employees.

D) All forms of consideration given up by an entity in exchange for service rendered by employees.

E) Salaries, wages, payments for leave and share options.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

AASB 119 divides employee benefits into a number of categories, including:

A) Terminations benefits.

B) Payroll tax.

C) PAYG tax.

D) Performance increments.

E) Contingent payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount represented as a current liability, 'Provision for Long-Service Leave' generally represents:

A) The amount to be expensed as long-service leave expense in the next 12 months.

B) The amount of long-service that has been provided for, for all employees of the entity.

C) The amount of long-service leave remaining to be taken by staff.

D) The amount of long-service leave that is expected to be taken in the 12 months following balance date.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dervish Ltd has an average weekly payroll of $700 000. The employees are entitled to 2 weeks', non-vesting sick leave per annum. Past experience suggests that 66 per cent of employees will take the full 2 weeks' sick leave and 15 per cent will take 1 week's leave each year. The rest of the employees take no sick leave. What weekly entry would Dervish make in relation to sick leave?

A) ![]()

B) None.

C) ![]()

D) ![]()

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

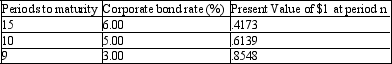

Annette French joined Paris Ltd on 1 July 2011 as a bookkeeper. She is the only permanent employee of Paris Ltd. On 30 June 2012 her salary was $35,000. Annette French's salary is expected to increase with inflation at a rate of 3%. Paris Ltd provides long service leave entitlement of 13 weeks after 15 years of service. A pro rata payment is made after 10 years of service. The probability of Annette French staying in the job until the obligation vests is 35%.

Other information:

What is the long service leave liability (to the nearest $) of Paris Ltd as at 30 June 2012?

What is the long service leave liability (to the nearest $) of Paris Ltd as at 30 June 2012?

A) $133

B) $228

C) $253

D) $976

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

AASB 119 "Employee Benefits" prescribes that all obligations relating to wages and salaries, annual leave and sick-leave entitlements, regardless of whether they were expected to be settled within 12 months of the reporting date be measured at nominal (undiscounted) amounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Entity A contributes to a defined benefit superannuation plan for its employees. It calculates the following: Current service cost 12,785 Interest cost 983 Expected return on plan assets (1,150) Net actuarial gain recognised in period (1,835) 10,783 The $10,783 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

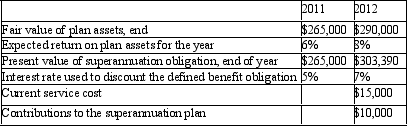

Mackay Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement. The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:

In accordance with AASB 119 "Employee Benefits", what is the interest cost and actuarial gain (loss) for the defined benefit obligation for the year ending 2012?

In accordance with AASB 119 "Employee Benefits", what is the interest cost and actuarial gain (loss) for the defined benefit obligation for the year ending 2012?

A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4 840

D) $18 550; ($4 840)

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 67

Related Exams