Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors would not necessarily contribute to a going-concern problem?

A) Excessive reliance on debt financing.

B) Loss of key personnel without comparable replacement.

C) Inadequate maintenance of long-lived assets.

D) Declining profit margins.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in accounts receivable turnover ratio is indicative of:

A) an increase in sales revenue.

B) slower-selling inventory.

C) an increase in accounts receivable.

D) a decline in cost of goods solD.Accounts receivable turnover = Net sales/Average accounts receivable.If the accounts receivable turnover decreases,this may be the result of a decrease in net sales or an increase in average accounts receivable.

Correct Answer

verified

Correct Answer

verified

True/False

The fixed asset turnover ratio is a measure of the efficiency of a company.Fixed asset turnover ratio = Net sales revenue/Average net fixed assets.This ratio is used to evaluate the efficient use of fixed assets to generate sales revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate solvency?

A) Earnings per share.

B) Fixed asset turnover.

C) Debt-to-assets.

D) Quick ratio.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A current ratio of less than one is not so much of a concern when the company has a:

A) low fixed asset turnover ratio.

B) high days to collect number.

C) high inventory turnover ratio.

D) high debt-to-equity ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net sales divided by average total assets is the calculation for which of the following ratios?

A) Net profit margin

B) Asset turnover

C) Current ratio

D) Return on assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $1,250,000,cost of goods sold of $760,000,and all other expenses of $290,000.The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000.The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000.The return on equity (ROE) ratio is closest to:

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.40.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income divided by Net sales is the calculation for which of the following ratios?

A) Return on equity ratio.

B) Net profit margin ratio.

C) Current ratio.

D) Asset turnover ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $780,000,cost of goods sold of $343,200 and all other expenses of $327,600 for the current year.At the beginning of the year,503,000 shares of common stock were outstanding,and at the end of the year,537,000 shares of common stock were outstanding.The basic EPS for the company is:

A) $1.50.

B) $0.84.

C) $0.21.

D) $0.87.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

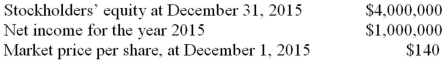

On December 31,2014 and 2015,a company had 10,000 shares of common stock outstanding.The following information is also available: Use the information above to answer the following question.The earnings per share at December 31,2015 is closest to:

A) $100.

B) $400.

C) $40.

D) $500.

Correct Answer

verified

A

Correct Answer

verified

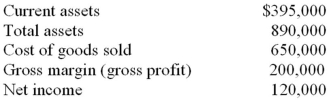

Multiple Choice

The following information is taken from the financial statements of a company for the current year: On a common size balance sheet,the percentage that should be shown for current assets is closest to

A) 100%

B) 44%

C) 30%

D) 33%

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following analysis techniques does not pertain to changes over time?

A) Trend analysis.

B) Horizontal analysis.

C) Time-series analysis.

D) Vertical analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $1,250,000,cost of goods sold of $760,000,and all other expenses of $290,000.The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000.The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000.The fixed asset turnover ratio is closest to:

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.80.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a common size income statement,each item on the income statement is expressed as a percentage of:

A) Net income.

B) Gross margin (gross profit) .

C) Total expenses.

D) Sales revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debt to assets ratio of .45 and a return on equity ratio of 10%.If the company then issues common stock,which of the following is a true statement?

A) The debt to assets ratio will decrease and the return on equity ratio will decrease.

B) The debt to assets ratio will increase and the return on equity ratio will increase.

C) The debt to assets ratio will not change and the return on equity ratio will not change.

D) The debt to assets ratio will decrease and the return on equity ratio will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the gross profit percentage indicates that:

A) cost of goods sold as a percentage of sales has decreased.

B) cost of goods sold as a percentage of sales has increased.

C) operating expenses as a percentage of sales have increased.

D) operating expenses as a percentage of sales have decreaseD.Gross profit percentage = Gross profit/net sales.If the gross profit % increases,it means that cost of goods sold has decreased as a % of sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If cost of goods sold remains unchanged,an increase in the inventory turnover rate is indicative of:

A) a reduction in the cost of goods sold.

B) a decrease in inventory.

C) an increase in inventory.

D) an increase in sales revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A current ratio of 2.5 means that for every dollar of:

A) accounts payable,there is $2.50 of cash.

B) current liabilities,there is $2.50 of current assets.

C) current assets,there is $2.50 of current liabilities.

D) total liabilities,there is $2.50 of cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Although the inventory turnover ratio is an important analytical tool for many companies,it would be most crucial for a company that:

A) provides legal services.

B) sells cell phones and notebook computers.

C) manufactures steel.

D) sells paint.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 110

Related Exams