A) Liquidity.

B) Market share.

C) Profitability.

D) Solvency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures how many times a company replenishes its inventory in a year is the:

A) Days to sell.

B) Accounts receivable turnover ratio.

C) Inventory turnover ratio.

D) Days to collect ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the solvency of a company?

A) Debt-to-assets ratio.

B) Fixed asset turnover ratio.

C) Return on equity ratio.

D) Quick ratio.

Correct Answer

verified

Correct Answer

verified

True/False

Benchmarks are required to evaluate a company's performance.Benchmarks are necessary when interpreting a company's financial ratios.These benchmarks may be the company's own results for prior years,the results of competitors,or an average for the industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's comparative balance sheet show total assets for 2015 and 2014 as $990,000 and $900,000,respectively.What is the percentage change to be reported in the horizontal analysis?

A) Increase of 10%

B) Increase of 9%

C) Increase of 5%

D) Increase of 4%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is a solvency ratio?

A) Net profit margin ratio.

B) Current ratio.

C) Asset turnover ratio.

D) Debt to assets ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a current ratio of 2.0 and a quick ratio of 1.5.Assume the company then paid previously declared dividends in the amount of $20,000.Which of the following statements is true?

A) The current ratio will decrease and the quick ratio will decrease.

B) The current ratio will decrease and the quick ratio will not change.

C) The current ratio and the quick ratio will not change.

D) The current ratio will increase and the quick ratio will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is calculated by dividing current assets by current liabilities?

A) Quick ratio.

B) Solvency ratio.

C) Debt ratio.

D) Current ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding liquidity and solvency ratios is true?

A) Unlike solvency ratios,liquidity ratios relate to the company's long-run survival.

B) Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C) Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D) Solvency ratios include the current ratio and the net profit margin ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debt to assets ratio of 0.45.If the company then borrows cash from the bank to finance a building acquisition,which of the following is a true statement?

A) The debt to assets ratio will be unchanged.

B) The debt to assets ratio will increase.

C) The debt to assets ratio will decrease.

D) The debt to assets ratio will increase as a result of the cash received and then decrease as a result of the building acquisition.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is calculated by dividing liquid assets by current liabilities?

A) Current ratio.

B) Quick ratio.

C) Turnover ratio.

D) Working capital ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a current ratio of 2.0 and a quick ratio of 1.4.If the company then collects an accounts receivable,which of the following is a true statement?

A) The current ratio will not change and the quick ratio will increase.

B) The current ratio will increase and the quick ratio will increase.

C) The current ratio and the quick ratio will not change.

D) The current ratio will increase and the quick ratio will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

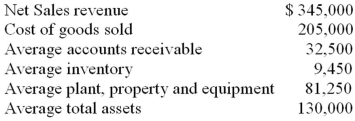

The following information is available for a company for the current year: Use the information above to answer the following question.Which of the following is closest to the fixed asset turnover ratio?

A) 2.65

B) 1.72

C) 4.25

D) 3.80

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold divided by average inventory is the calculation for which of the following ratios?

A) Net profit margin ratio.

B) Current ratio.

C) Inventory turnover ratio.

D) Asset turnover ratio.

Correct Answer

verified

Correct Answer

verified

True/False

The higher the times interest earned ratio,the greater the risk of nonpayment of interest.The higher the times interest earned ratio,the better able the company is to meet its interest obligations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debt-to-assets ratio is the:

A) ratio of current liabilities to current assets.

B) ratio of long term liabilities to fixed assets.

C) ratio of total liabilities to total assets.

D) proportion of short-term liabilities to total liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the company's ability to meet required interest payments is the:

A) Debt to equity ratio.

B) Current ratio.

C) Price/earnings ratio.

D) Times interest earned ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a liquidity ratio?

A) Inventory turnover.

B) Price earnings (P/E) .

C) Net profit margin.

D) Times interest earneD.Liquidity ratios measure the company's ability to use current assets to pay its current obligations as they become due.Inventory turnover is one of the liquidity ratios.P/E and net profit margin are profitability ratios.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net income by average total stockholders' equity?

A) Return on assets ratio.

B) Return on equity ratio.

C) Earnings per share.

D) Net profit margin ratio.

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity measures the ability of a company to meet its current financial obligations.Liquidity relates to a company's ability to survive in the short term by converting assets to cash that can be used to pay current liabilities as they come due.Ratios used to measure liquidity include the receivable turnover,the inventory turnover,the current ratio,and the quick ratio.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 110

Related Exams