A) It is designed to measure the performance of managers in terms of controllable costs.

B) It assigns responsibility for costs to the appropriate managerial level that controls those costs.

C) It should not hold a manager responsible for costs over which the manager has no influence.

D) It can be applied at any level of an organization.

E) It is only relevant in manufacturing companies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allocating joint costs to products using a value basis method is based on their relative:

A) Sales values.

B) Direct costs.

C) Gross margins.

D) Total costs.

E) Variable costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part 7B costs the Midwest Division of Frackle Corporation $30 to make,of which $21 is variable.Midwest Division sells Part 7B to other companies for $47.The Northern Division of Frackle Corporation can use Part 7B in one of its products.The Midwest Division has enough idle capacity to produce all of the units of Part 7B that the Northern Division would require.What is the lowest transfer price at which the Midwest Division should be willing to sell Part 7B to the Northern Division?

A) $30

B) $21

C) $47

D) $17

E) $20

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expenses that are easily traced and assigned to a specific department because they are incurred for the sole benefit of that department are called:

A) Direct expenses.

B) Indirect expenses.

C) Controllable expenses.

D) Uncontrollable expenses.

E) Fixed expenses.

Correct Answer

verified

Correct Answer

verified

True/False

Direct expenses require allocation across departments because they cannot be readily traced to one department.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

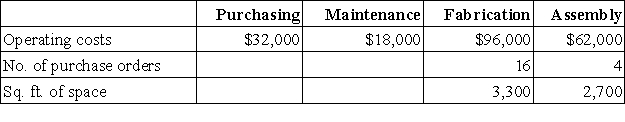

The following is a partially completed lower section of a departmental expense allocation spreadsheet for Brickland.It reports the total amounts of direct and indirect expenses for the four departments.Purchasing department expenses are allocated to the operating departments on the basis of purchase orders.Maintenance department expenses are allocated based on square footage.Compute the amount of Purchasing department expense to be allocated to Fabrication.

A) $6,400.

B) $9,900.

C) $8,100.

D) $17,600.

E) $25,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

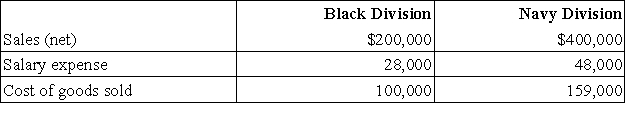

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

A) $52,000;$163,000.

B) $172,000;$352,000.

C) $72,000;$163,000.

D) $72,000;$193,000.

E) $100,000;$241,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter Company reported the following financial numbers for one of its divisions for the year;average total assets of $4,100,000;sales of $4,525,000;cost of goods sold of $2,550,000;and operating expenses of $1,372,000.Assume a target income of 10% of average invested assets.Compute residual income for the division:

A) $203,000.

B) $193,000.

C) $150,500.

D) $60,300.

E) $197,500.

Correct Answer

verified

Correct Answer

verified

True/False

Decentralization refers to companies that have multiple locations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

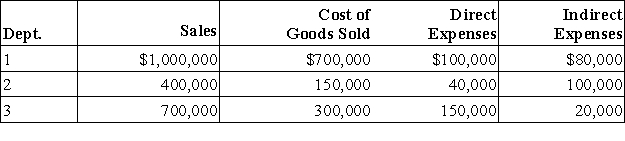

Ultimo Co.operates three production departments as profit centers.The following information is available for its most recent year.Department 2's contribution to overhead in dollars is:

A) $210,000.

B) $350,000.

C) $10,000.

D) $260,000.

E) $150,000.

Correct Answer

verified

Correct Answer

verified

Essay

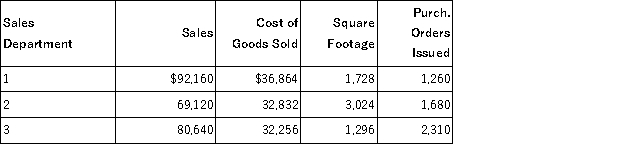

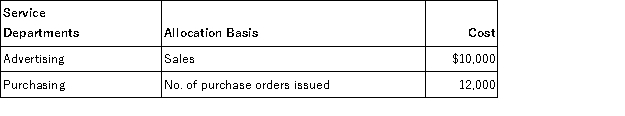

Arkansas Toys,a retail store,has three sales departments supported by two service departments.Cost and operational data for each department follow:

Determine the service department expenses to be allocated to Sales Department 1 for (round answers to whole dollars):

Advertising ___________________

Purchasing ___________________

Determine the service department expenses to be allocated to Sales Department 1 for (round answers to whole dollars):

Advertising ___________________

Purchasing ___________________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data pertaining to a company's joint production for the current period follows:  Compute the cost to be allocated to Product L for this period's $660 of joint costs if the value basis is used.

Compute the cost to be allocated to Product L for this period's $660 of joint costs if the value basis is used.

A) $264.

B) $396.

C) $330.

D) $1,364.

E) $796.

Correct Answer

verified

Correct Answer

verified

True/False

Departmental salary expenses are direct expenses of that department.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has two departments,Y and Z that incur delivery expenses.An analysis of the total delivery expense of $9,000 indicates that Dept.Y had a direct expense of $1,000 for deliveries and Dept.Z had no direct expense.The indirect expenses are $8,000.The analysis also indicates that 40% of regular delivery requests originate in Dept.Y and 60% originate in Dept.Z.Departmental delivery expenses for Dept.Y and Dept.Z,respectively,are:

A) $4,500;$4,500.

B) $4,200;$4,800.

C) $5,500;$3,500.

D) $4,800;$4,200.

E) $5,400;$3,600.

Correct Answer

verified

Correct Answer

verified

True/False

In a decentralized organization,decisions are made by managers throughout the company rather than by a few top executives.

Correct Answer

verified

Correct Answer

verified

True/False

Since service departments do not generate revenues,it is unnecessary to accumulate and allocate their costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Within an organizational structure,the person most likely to be evaluated in terms of controllable costs would be:

A) A payroll clerk.

B) A cost center manager.

C) A production line worker.

D) A maintenance worker.

E) A sales representative.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

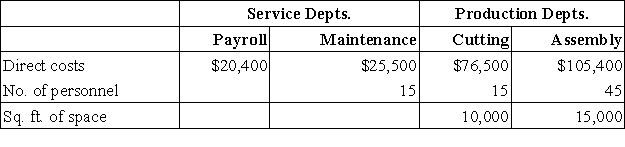

Brownley Company has two service departments and two operating (production) departments.The Payroll Department services all three of the other departments in proportion to the number of employees in each.The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each.Listed below are the operating data for the current period:  The total cost of operating the Cutting Department for the current period is:

The total cost of operating the Cutting Department for the current period is:

A) $14,280.

B) $15,912.

C) $76,500.

D) $90,780.

E) $92,412.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

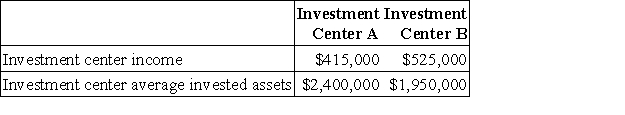

Two investment centers at Marshman Corporation have the following current-year income and asset data:  The return on investment (ROI) for Investment Center B is:

The return on investment (ROI) for Investment Center B is:

A) 371.4%

B) 26.9%

C) 24.1%

D) 39.2%

E) 21.7%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

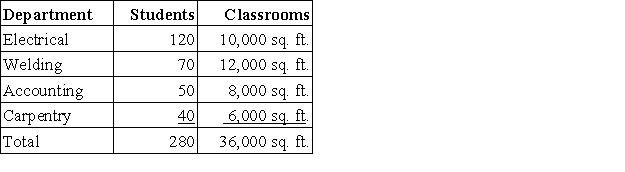

Canfield Technical School allocates administrative costs to its respective departments based on the number of students enrolled,while maintenance and utilities are allocated per square feet of the classrooms.Based on the information below,what is the total amount allocated to the Welding Department (rounded to the nearest dollar) if administrative costs for the school were $50,000,maintenance fees were $12,000,and utilities were $6,000?

A) $0.

B) $17,000.

C) $18,500.

D) $22,667.

E) $30,000.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 162

Related Exams