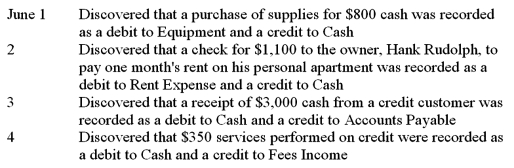

The following errors in recording the transactions for June were discovered in the general journal the next month after the data had been posted to the ledger.Record the necessary correcting entries on page 2 of a general journal.Omit the descriptions.

Correct Answer

verified

Correct Answer

verified

Which of the following statements is CORRECT?

A) All transactions require compound entries.

B) Compound entries include only debits.

C) Accounts being debited should always follow the accounts being credited in a compound entry.

D) Compound entries affect more than one debit and/or more than one credit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified