Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financing activities is not correct?

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash, it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash, it reports a cash outflow for financing activities.

D) When a company repays a loan, it reports a cash inflow from financing activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In arriving at cash from operating activities, subtracting a decrease in Salaries and Wages Payable from net income includes the cash effects of transactions that:

A) increased cash, but did not affect net income.

B) increased cash and increased net income.

C) decreased cash, but did not affect net income.

D) decreased cash and decreased net income.

Correct Answer

verified

Correct Answer

verified

True/False

Maya Company's purchase of 100 shares of Labrador Inc. common stock would be reported as a financing activity on its statement of cash flows

Correct Answer

verified

Correct Answer

verified

Multiple Choice

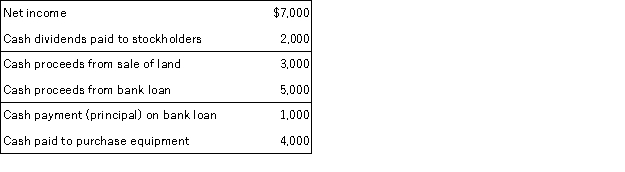

The company would report net cash provided by (used in) financing activities of:

The company would report net cash provided by (used in) financing activities of:

A) ($2,500) .

B) $2,000.

C) $5,000.

D) $6,000.

Correct Answer

verified

Correct Answer

verified

True/False

A healthy company typically shows positive cash flows in the financing activities section of the statement of cash flows

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method, changes in current assets are used in determining cash flows from operating activities and changes in current liabilities are used in determining cash flows from financing activities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow may be used for all of the following except:

A) expanding the business.

B) paying off debt.

C) building up the cash balance.

D) paying employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from operating activities?

A) Cash received from customers

B) Cash received from an issuance of bonds

C) Cash dividends paid to stockholders

D) Cash used for purchases of equipment

Correct Answer

verified

Correct Answer

verified

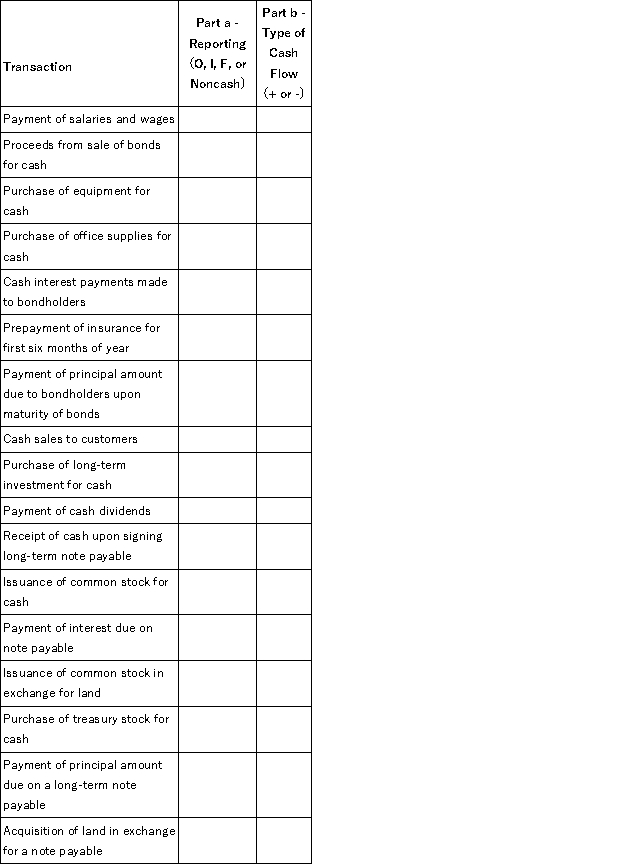

Essay

Complete the last two columns in the following table by indicating whether each transaction would be reported:

Part a. In the operating (O), investing (I), or financing (F) activities section of the statement of cash flows or if the transaction would be reported instead as a noncash investing and/or financing transaction (Noncash).

Part b. As a cash inflow (+) or a cash outflow (-) on the statement of ash flows. (Leave this cell blank if you entered "Noncash" for part a.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dover Co.'s comparative balance sheet indicated that the Equipment account increased by $40,000. Upon further investigation of the account changes, it is determined that Dover purchased equipment totaling $70,000 for the year. It also sold equipment with an original cost of $30,000 for $8,000 cash. Assuming these are the only transactions affecting the investing activities, Dover will report net cash flows provided by (used in) investing activities of:

A) ($40,000) .

B) ($70,000) .

C) ($32,000) .

D) ($62,000) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Company issued 30,000 shares of common stock in January. In August, the company repurchased 5,000 shares for the treasury. When reporting these transactions in the statement of cash flows, ABC Company ______ combine them into one transaction in the ______ activities section.

A) can; financing

B) cannot; financing

C) cannot; investing

D) can; investing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The T-account approach:

A) may be used with the direct method.

B) creates one big T-account for cash that replaces separate schedules to show all the changes in the cash account.

C) shows cash provided as credits and cash used as debits.

D) does not determine the change in each balance sheet account.

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock purchases made with cash are classified as cash outflows from financing activities on the statement of cash flows

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows. If Inventory decreases and Unearned Revenue increases during an accounting period, what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in inventory is added to net income; the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income; the change in inventory is subtracteD.

Decreases in current assets (Inventory) and increases in current liabilities (Unearned Revenue) are added to convert net income to cash flows from operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities, which of the following adjustments must be made to interest expense to determine total interest payments?

A) Add all changes in Interest Payable

B) Add decreases in Interest Payable and subtract increases in Interest Payable

C) Add increases in Interest Payable and subtract decreases in Interest Payable

D) Subtract all changes in Interest Payable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is a positive cash flow from operating activities:

A) beyond what is needed to replace current property, plant, and equipment and pay cash dividends.

B) across all three activity components of the statement of cash flows.

C) beyond what has been allotted for future property, plant, and equipment replacement and expansion.

D) across both financing and investing activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the statements below is correct when comparing the direct and indirect methods of reporting operating cash flows?

A) The direct method starts with net income and makes adjustments to arrive at the net cash provided by or used in operations.

B) The indirect method starts with cash collected from customers and details cash inflows and outflows from operations.

C) The indirect method starts with net income and makes adjustments to arrive at the net cash provided by or used in operations.

D) The net cash provided by or used in operations will be different depending on whether the direct or indirect method is useD.

The indirect method starts with net income and makes adjustments, such as adding back depreciation, to arrive at the net cash provided by or used in operations. The direct method starts with cash collected from customers and details cash inflows and outflows from operations to arrive at the net cash provided by or used in operations. Both methods will arrive at the same net cash provided by or used in operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company took out $665,000 of new debt this year and repaid $1,000,000 of older debt in the same year. The company also issued stock for $442,000 cash and paid dividends of $99,000 for the year. The company's financing cash flows appearing the statement of cash flows will show:

A) Net cash used in financing activities of $434,000

B) Net cash used in financing activities of $335,000

C) Net cash provided by financing activities of $8,000

D) Net cash provided by financing activities of $107,000

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities include receiving cash from the sale of land and also the resulting gain or loss on the sale

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 208

Related Exams