A) Is an unknown liability of a certain amount

B) Can be the result of a lawsuit

C) Is a liability that may occur if a future event occurs

D) Is a known obligation of an uncertain amount

E) None of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross pay is

A) Take-home pay

B) Deductions withheld by an employer

C) Salaries after taxes are deducted

D) Total compensation earned by an employee

E) The amount of the pay cheque

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A contingent liability

A) Is a liability of a specific amount

B) Is a potential obligation that depends on a future event arising out of a past transaction

C) Is an obligation not requiring immediate payment

D) Is an obligation arising from the purchase of goods or services on credit

E) None of these

Correct Answer

verified

Correct Answer

verified

True/False

A contingent liability exists when a potential liability that depends on a future event arising out of a past transaction liability is either not probable or it cannot be reliably estimated.

Correct Answer

verified

Correct Answer

verified

Essay

On June 5,BB Company borrowed $120,000 from AH Bank.The loan had an interest rate of 10% and was due in 90 days.BB Company's fiscal year-end is December 31.Prepare the journal entry to record the receipt of the cash.

Correct Answer

verified

Correct Answer

verified

True/False

A gift card is an example of a contingent liability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities

A) Can be reliably estimated

B) Must be certain

C) Must be for a specific amount

D) Must have a date for payment

E) Must have a known payee

Correct Answer

verified

Correct Answer

verified

Essay

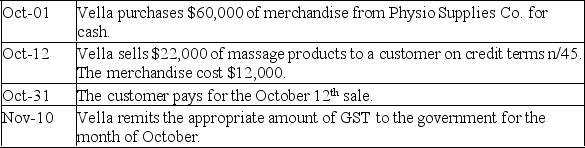

Vella Physio Company is located in Ponoka,Alberta and is a retailer of physio supplies.Beginning inventory is $20,000,and Vella uses the perpetual inventory system.Complete the journal entries on the following dates,including 5% GST as applicable.

Correct Answer

verified

Correct Answer

verified

True/False

Long-term liabilities are obligations of a company requiring payment within one year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Obligations not expected to be paid within one year are reported as

A) Current assets

B) Current liabilities

C) Long term liabilities

D) Operating cycle liabilities

E) Revenues

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fees accepted in advance from a client

A) are recorded as earned revenues on the income statement.

B) increase income.

C) are recorded as liabilities.

D) do not increase assets.

E) none of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Major Company borrowed $12,000 by signing an 8% interest-bearing 45-day note payable to replace an overdue accounts payable.To record this transaction,Major Company should prepare a journal entry that includes a

A) credit to Accounts Payable for $12,000.

B) credit to Notes Payable for $12,000.

C) debit to Cash for $12,000.

D) debit to Notes Payable for $12,000.

E) debit to Cash for $12,300.

Correct Answer

verified

Correct Answer

verified

True/False

A liability is a future payment of assets or services that a company is currently obligated to make as a result of past transactions or events.

Correct Answer

verified

Correct Answer

verified

Essay

On August 1,Droid Co.borrowed $80,000 from Simpli Financial.The loan had an interest rate of 7% and was due in 60 days.Prepare the journal entry for Droid Co.to record the note.

Correct Answer

verified

Correct Answer

verified

True/False

A long-term liability can have a current component.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Provincial sales tax payable:

A) Is an estimated liability

B) Is a contingent liability

C) Is a current liability for retailers

D) Is a business expense

E) All of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items below is recorded as an estimate when initially recognized?

A) CPP payable

B) Unearned revenue

C) Warranty obligation

D) Notes payable

Correct Answer

verified

Correct Answer

verified

True/False

All expected future payments are liabilities.

Correct Answer

verified

Correct Answer

verified

Essay

On July 16,Freedom Flight gave a 120-day note payable to Slick and Slide Co.,instead of cash payment of an overdue account.The amount of the note was $75,000 at an interest rate of 14%.Prepare the journal entry and determine the maturity date for Freedom Flight to record payment of the note.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Obligations due to be paid within one year or the company's operating cycle,whichever is longer,are

A) current assets.

B) revenues.

C) current liabilities.

D) operating cycle liabilities.

E) non-current liabilities.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 91

Related Exams