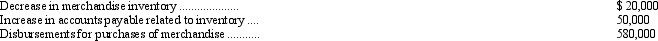

The following information is available for Avalon Company for 2011:

What amount should Avalon report as cost of goods sold for 2011?

What amount should Avalon report as cost of goods sold for 2011?

A) $510,000

B) $550,000

C) $610,000

D) $650,000

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

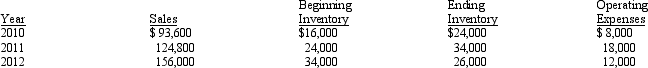

The following data are available for Carlton Products, a partnership:

Compute the purchases and the net income for the partnership for 2010, 2011, and 2012, assuming that the firm sells its merchandise at 25 percent above cost.

Compute the purchases and the net income for the partnership for 2010, 2011, and 2012, assuming that the firm sells its merchandise at 25 percent above cost.

Correct Answer

verified

Correct Answer

verified