A) Allowance for Doubtful Accounts.

B) Notes Payable.

C) Prepaid Expense.

D) Cost of Goods Sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Supplies on Hand account balance at the beginning of the period was $6,600. Supplies totaling $12,825 were purchased during the period and debited to Supplies on Hand. A physical count shows $3,825 of Supplies on Hand at the end of the period. The proper journal entry at the end of the period

A) debits Supplies on Hand and credits Supplies Expense for $9,000.

B) debits Supplies Expense and credits Supplies on Hand for $12,825.

C) debits Supplies on Hand and credits Supplies Expense for $15,600.

D) debits Supplies Expense and credits Supplies on Hand for $15,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arid Company paid $1,704 on June 1, 2013, for a two-year insurance policy and recorded the entire amount as Insurance Expense. The December 31, 2013, adjusting entry is

A) debit Prepaid Insurance and credit Insurance Expense, $497.

B) debit Insurance Expense and credit Prepaid Insurance, $497.

C) debit Insurance Expense and credit Prepaid Insurance, $1,207.

D) debit Prepaid Insurance and credit Insurance Expense, $1,207.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

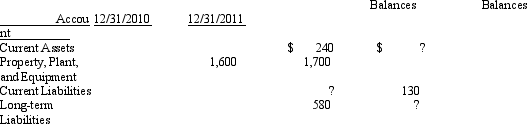

Carbon Company's accounting records provided the following information (all amounts in thousands of dollars) :

All assets and liabilities of the firm are reported in the schedule above. Working capital of $92 remained unchanged from 2010 to 2011. Net income in 2011 was $64. No dividends were declared during 2011 and there were no other changes in owners' equity. Total long-term liabilities at the end of 2011 would be

All assets and liabilities of the firm are reported in the schedule above. Working capital of $92 remained unchanged from 2010 to 2011. Net income in 2011 was $64. No dividends were declared during 2011 and there were no other changes in owners' equity. Total long-term liabilities at the end of 2011 would be

A) $340.

B) $432.

C) $580.

D) $616.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In November and December 2011, Bee Company, a newly organized newspaper publisher, received $72,000 for 1,000 three-year subscriptions at $24 per year, starting with the January 2, 2012, issue of the newspaper. How much should Bee report in its 2011 income statement for subscription revenue?

A) $0

B) $12,000

C) $24,000

D) $72,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last step in the accounting cycle is to

A) prepare a post-closing trial balance.

B) journalize and post closing entries.

C) prepare financial statements.

D) journalize and post adjusting entries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Company shows $22,000 of insurance expense for the fiscal year. The company records showed a balance in prepaid insurance at the beginning of the year of $5,000 and a balance at the end of the year of $3,000. What amount of cash was paid for insurance during the year?

A) $2,000

B) $22,000

C) $20,000

D) $25,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjusting entry will not take the format of which one of the following entries?

A) A debit to an expense account and a credit to an asset account

B) A debit to an expense account and a credit to a revenue account

C) A debit to an asset account and a credit to a revenue account

D) A debit to a liability account and a credit to a revenue account

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The work sheet of PSI Company shows Income Tax Expense of $9,000 and Income Tax Payable of $9,000 in the Adjustments columns. What will be the ultimate disposition of these items on the work sheet?

A) Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Balance Sheet columns.

B) Income Tax Expense will appear as a debit of $9,000 and Income Tax Payable as credit in the Income Statement columns.

C) Income Tax Expense will appear as a debit of $9,000 in the Balance Sheet columns and Income Tax Payable as credit in the Income Statement columns.

D) Income Tax Expense will appear as a debit of $9,000 in the Income Statement columns and Income Tax Payable as credit in the Balance Sheet columns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following regarding accrual versus cash-basis accounting is true?

A) The FASB believes that the cash basis is appropriate for some smaller companies, especially those in the service industry.

B) The cash basis is less useful in predicting the timing and amounts of future cash flows of an enterprise.

C) Application of the cash basis results in an income statement reporting revenues and expenses.

D) The cash basis requires a complete set of double-entry records.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comet Corporation's liability account balances at June 30, 2011, included a 10 percent note payable. The note is dated October 1, 2009, and carried an original principal amount of $600,000. The note is payable in three equal annual payments of $200,000 plus interest. The first interest and principal payment was made on October 1, 2010. In Comet's June 30, 2011, balance sheet, what amount should be reported as Interest Payable for this note?

A) $10,000

B) $15,000

C) $30,000

D) $45,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is consistent with the cash-basis of accounting?

A) Recording a liability for a lawsuit the company is expected to lose

B) Recording bad debt expense when an account proves uncollectible

C) Recording salaries payable at the end of an accounting period

D) Recording revenue when earned

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crescent Corporation's interest revenue for 2011 was $13,100. Accrued interest receivable on December 31, 2011, was $2,275 and $1,875 on December 31, 2010. The cash received for interest during 2011 was

A) $1,350.

B) $10,825.

C) $12,700.

D) $13,100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debit and credit analysis of a transaction normally takes place when the

A) entry is posted to a subsidiary ledger.

B) entry is recorded in a journal.

C) trial balance is prepared.

D) financial statements are prepared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an item that is reportable in the financial records of an enterprise?

A) The value of goodwill earned through business operations

B) The value of human resources

C) Changes in personnel

D) Changes in inventory costing methods

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is notan appropriate account title?

A) Dividends Expense

B) Prepaid Expense

C) Insurance Expense

D) Unearned Revenue

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A routine collection on a customer's account was recorded and posted as a debit to Cash and a credit to Sales Revenue. The journal entry to correct this error would be

A) a debit to Sales Revenue and a credit to Accounts Receivable.

B) a debit to Sales Revenue and a credit to Unearned Revenue.

C) a debit to Cash and a credit to Accounts Receivable.

D) a debit to Accounts Receivable and a credit to Sales Revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following errors were made in preparing a trial balance: the $1,350 balance of Inventory was omitted; the $450 balance of Prepaid Insurance was listed as a credit; and the $300 balance of Salaries Expense was listed as Utilities Expense. The debit and credit totals of the trial balance would differ by

A) $1,350.

B) $1,800.

C) $2,100.

D) $2,250.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Iowa Cattle Company uses a perpetual inventory system. Iowa purchased cattle from Big D Ranch at a cost of $19,500, payable at time of delivery. The entry to record the delivery would be

A) Purchases ........................... 19,500 Accounts Payable .................. 19,500

B) Inventory ........................... 19,500 Accounts Payable .................. 19,500

C) Purchases ........................... 19,500 Cash .............................. 19,500

D) Inventory ........................... 19,500 Cash .............................. 19,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carlton Company sold equipment for $3,700 that originally cost $22,000. The balance of the Accumulated Depreciation account related to this equipment was $19,000. The entry to record the disposal of this equipment would include a

A) debit to Loss on Sale of Equipment of $700.

B) credit to Gain on Sale of Equipment of $700.

C) credit to Equipment of $3,000.

D) debit to Gain on Sale of Equipment of $700.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 94

Related Exams