A) underpriced.

B) overpriced.

C) fairly priced.

D) Cannot be determined from data provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your personal opinion is that a security has an expected rate of return of 0.11.It has a beta of 1.5.The risk-free rate is 0.05 and the market expected rate of return is 0.09.According to the Capital Asset Pricing Model, this security is

A) underpriced.

B) overpriced.

C) fairly priced.

D) Cannot be determined from data provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is not true regarding the capital market line (CML) ?

A) The CML is the line from the risk-free rate through the market portfolio.

B) The CML is the best attainable capital allocation line.

C) The CML is also called the security market line.

D) The CML always has a positive slope.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the CAPM, the risk premium an investor expects to receive on any stock or portfolio increases

A) directly with alpha.

B) inversely with alpha.

C) directly with beta.

D) inversely with beta.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your opinion is that CSCO has an expected rate of return of 0.15.It has a beta of 1.3.The risk-free rate is 0.04 and the market expected rate of return is 0.115.According to the Capital Asset Pricing Model, this security is

A) underpriced.

B) overpriced.

C) fairly priced.

D) Cannot be determined from data provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a financial analyst, you are tasked with evaluating a capital-budgeting project.You were instructed to use the IRR method, and you need to determine an appropriate hurdle rate.The risk-free rate is 4%, and the expected market rate of return is 11%.Your company has a beta of 1.4, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past.According to CAPM, the appropriate hurdle rate would be

A) 13.8%.

B) 7%.

C) 15%.

D) 4%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

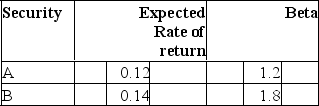

Given are the following two stocks A and B:  If the expected market rate of return is 0.09, and the risk-free rate is 0.05, which security would be considered the better buy, and why?

If the expected market rate of return is 0.09, and the risk-free rate is 0.05, which security would be considered the better buy, and why?

A) A because it offers an expected excess return of 1.2%.

B) B because it offers an expected excess return of 1.8%.

C) A because it offers an expected excess return of 2.2%.

D) B because it offers an expected return of 14%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your opinion is that CSCO has an expected rate of return of 0.1375.It has a beta of 1.3.The risk-free rate is 0.04 and the market expected rate of return is 0.115.According to the Capital Asset Pricing Model, this security is

A) underpriced.

B) overpriced.

C) fairly priced.

D) Cannot be determined from data provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A "fairly-priced" asset lies

A) above the security-market line.

B) on the security-market line.

C) on the capital-market line.

D) above the capital-market line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Capital Asset Pricing Model (CAPM) , a well diversified portfolio's rate of return is a function of

A) market risk.

B) unsystematic risk.

C) unique risk.

D) reinvestment risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If investors do not know their investment horizons for certain,

A) the CAPM is no longer valid.

B) the CAPM underlying assumptions are not violated.

C) the implications of the CAPM are not violated as long as investors' liquidity needs are not priced.

D) the implications of the CAPM are no longer useful.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 71 of 71

Related Exams