A) European Union imports from the United States increase.

B) U.S. exports to the European Union increase.

C) U.S. imports from the European Union increase.

D) European Union exports to the United States decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario: Gizmovia The Republic of Gizmovia wants to maintain the exchange rate of its currency, the gizmo, at $0.50, but the current exchange rate for the gizmo is $0.40. If Gizmovia uses exchange market intervention to increase the value of its currency to $0.50, it should _____ gizmos and _____ dollars in the foreign exchange market.

A) sell; sell

B) sell; buy

C) buy; sell

D) buy; buy

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the equilibrium interest rate in the U.S. market for loanable funds is 3% prior to any international capital flows in the United States. The equilibrium interest rate in the Japanese market for loanable funds is 7%. If lenders in both nations believe that loans to foreigners are just as good as loans to their own citizens, capital will flow from _____, making interest rates _____ in Japan and _____ in the United States.

A) the United States to Japan; rise; fall

B) Japan to the United States; fall; rise

C) Japan to the United States; rise; fall

D) the United States to Japan; fall; rise

Correct Answer

verified

Correct Answer

verified

Multiple Choice

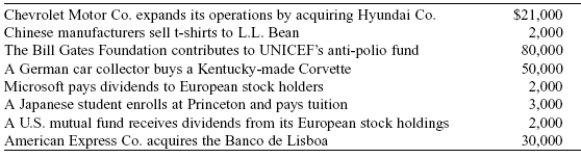

Use the following to answer questions:  -(Table: International Transactions) Refer to Table: International Transactions. The balance of payments on goods and services is:

-(Table: International Transactions) Refer to Table: International Transactions. The balance of payments on goods and services is:

A) $51,000.

B) $48,000.

C) $3,000.

D) -$29,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the foreign exchange market is trading the domestic currency at a rate (U.S. dollars per unit of the domestic currency) above the rate fixed by the government. To maintain the fixed exchange rate, the government must:

A) decrease foreign exchange reserves.

B) lower the domestic interest rate.

C) facilitate the domestic purchase of foreign financial assets.

D) raise the domestic interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A devaluation will make exports _____expensive and imports _____ expensive.

A) more; more

B) more; less

C) less; less

D) less; more

Correct Answer

verified

Correct Answer

verified

True/False

Assume the nominal exchange rate is £0.593 per dollar, the price level in the United States is 250, and the price level in Britain is 225. The real exchange rate is £0.659 per dollar.

Correct Answer

verified

Correct Answer

verified

True/False

Fixed exchange rates are set by the market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

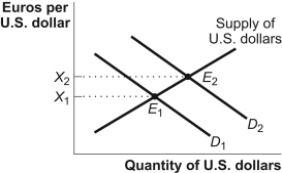

Use the following to answer questions:  -(Figure: Change in the Demand for U.S. Dollars) Refer to Figure: Change in the Demand for U.S. Dollars. The change from D1 to D2 will occur, all other things being equal, if the:

-(Figure: Change in the Demand for U.S. Dollars) Refer to Figure: Change in the Demand for U.S. Dollars. The change from D1 to D2 will occur, all other things being equal, if the:

A) supply of euros decreases.

B) demand for euros increases.

C) demand for euros decreases.

D) demand for dollars increases.

Correct Answer

verified

Correct Answer

verified

True/False

The purchasing power parity between two currencies is the exchange rate at which a given basket of goods and services would cost the same amount in each country.

Correct Answer

verified

Correct Answer

verified

True/False

An argument against Britain's adopting the euro was that using the euro would make trade more difficult and decrease British productivity.

Correct Answer

verified

Correct Answer

verified

True/False

If the exchange rate for the euro is $1.38, $1 exchanges for €0.7246.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country wants to maintain a fixed exchange rate with the dollar, but at the current exchange rate its currency is in excess. Which policy can the country NOT adopt to maintain its exchange rate?

A) Buy domestic currency and sell U.S. dollars in the foreign exchange market.

B) Sell domestic currency and buy U.S. dollars in the foreign exchange market.

C) Impose foreign exchange controls.

D) Contract the money supply to raise domestic interest rates.

Correct Answer

verified

Correct Answer

verified

True/False

Since the adoption of the euro in 2001, monetary policy has become much more effective in individual European countries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Brazilian bank buys shares of stock in Intel, a U.S. high-tech company. In the U.S. balance of payments, this transaction causes the balance on the _____ account to _____.

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a government fixes the exchange rate so as to generate a surplus of the domestic currency, the exchange rate (U.S. dollars per unit of the other currency) will tend to _____. To maintain the fixed exchange rate, the government must _____ the domestic currency.

A) fall; increase the international demand for

B) rise; increase the international demand for

C) fall; decrease the international demand for

D) fall; increase the domestic supply of

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 2014 to 2015, many U.S. companies that sell a lot overseas experienced declining profits due to the:

A) depreciation of the dollar.

B) appreciation of the dollar.

C) appreciation of the yen.

D) depreciation of the euro.

Correct Answer

verified

Correct Answer

verified

True/False

A floating rate system eliminates uncertainty about the future value of a currency.

Correct Answer

verified

Correct Answer

verified

True/False

If a country adopts a fixed rate, it is committing not to engage in inflationary policies because inflationary policies would destabilize the exchange rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Danish krone is a fixed exchange rate currency. If Denmark intervenes in the foreign exchange market to change the krone from $0.18 to $0.15, the krone has:

A) depreciated.

B) been devalued.

C) appreciated.

D) been revalued.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 411

Related Exams