A) net sales equals cost of goods sold.

B) cost of goods sold equals gross margin.

C) operating expenses equal net sales.

D) gross profit equals operating expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A credit sale of $3,800 is made on April 25, terms 2/10, net/30, on which a return of $200 is granted on April 28. What amount is received as payment in full on May 4?

A) $3,528

B) $3,724

C) $3,800 d $3,600

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a true statement about a multiple-step income statement?

A) Operating expenses do not include income tax expense.

B) There may be a section for non-operating activities.

C) There may be a section for operating assets.

D) There is a section for cost of goods sold.

Correct Answer

verified

Correct Answer

verified

True/False

Sales allowances and Sales discounts are both designed to encourage customers to pay their accounts promptly.

Correct Answer

verified

Correct Answer

verified

True/False

The purchase of inventory and its eventual sale lengthen the operating cycle of a merchandising company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary difference between a periodic and perpetual inventory system is that a periodic system

A) keeps a record showing the inventory on hand at all time.

B) provides better control over inventories.

C) records the cost of the sale on the date the sale is made.

D) determines the inventory on hand only at the end of the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sales discount does not

A) provide the purchaser with a cash saving.

B) reduce the amount of cash received from a credit sale.

C) increase a contra revenue account.

D) increase an operating expense account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory becomes part of cost of goods sold when a company

A) pays for the inventory.

B) purchases the inventory.

C) sells the inventory.

D) receives payment from the customer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the perpetual inventory system, which of the following accounts would not be used?

A) Sales Revenue

B) Purchases

C) Cost of Goods Sold

D) Inventory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross profit for a merchandising company is net sales minus

A) operating expenses.

B) cost of goods sold.

C) sales discounts.

D) cost of goods available for sale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income from operations appears on

A) both a multiple-step and a single-step income statement.

B) neither a multiple-step nor a single-step income statement.

C) a single-step income statement.

D) a multiple-step income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

United Services and Supplies reports net income of $60,000 and cost of goods sold of $360,000. If US&S's gross profit rate was 40%, net sales were

A) $600,000.

B) $900,000.

C) $960,000.

D) $660,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales revenue less cost of goods sold is called

A) gross profit.

B) net profit.

C) net income.

D) marginal income.

Correct Answer

verified

Correct Answer

verified

True/False

If net sales are $750,000 and cost of goods sold is $600,000, the gross profit rate is 20%.

Correct Answer

verified

Correct Answer

verified

Short Answer

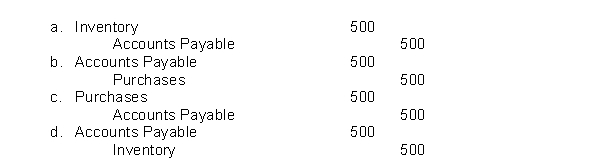

Erin Corporation purchases $500 of merchandise on credit. Using the periodic inventory approach, Erin would record this transaction as:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the president of Harter Company, you notice that no discounts have been taken when settling accounts payables. What would be an acceptable explanation?

A) All invoices have credit terms of n/30.

B) There is not sufficient cash to pay within the discount period.

C) Discounts are missed because no one knows how to enter them in the new accounting software.

D) The full amount of the invoice is being paid within the discount period and the treasurer is pocketing the discount amount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using a perpetual inventory system, why are discounts credited to Inventory?

A) The discounts are debited to discount expense and thus the credit has to be made to merchandise inventory.

B) The discounts reduce the cost of the inventory.

C) The discounts are a reduction of business expenses.

D) None of these answers choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two categories of expenses in merchandising companies are

A) cost of goods sold and financing expenses.

B) operating expenses and financing expenses.

C) cost of goods sold and operating expenses.

D) other expenses and cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under GAAP, companies generally classify income statement items by

A) function.

B) nature.

C) nature or function

D) date incurred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information is presented below: Gross profit would be

A) $61,000.

B) $64,000.

C) $54,000.

D) $67,000.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 221

Related Exams