A) they do business in multiple states.

B) they pay more than $2,500 in a given quarter.

C) they pay less than $2,500 in a given quarter.

D) The company would never have to pay electronically.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payment of FUTA would include:

A) a debit to FUTA Payable.

B) a credit to FUTA Payable.

C) a debit to FUTA Expense.

D) a credit to FUTA Expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employer's total FICA,SUTA,and FUTA tax is recorded as:

A) a debit to Payroll Tax Expense.

B) a credit to Payroll Tax Expense.

C) a credit to Accounts Payable.

D) a debit to Payroll Tax Payable.

Correct Answer

verified

Correct Answer

verified

Short Answer

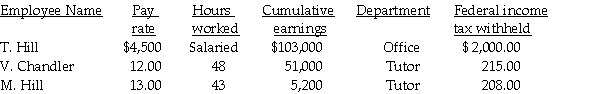

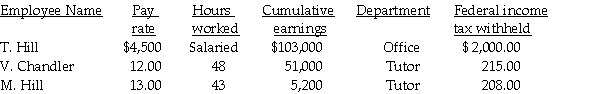

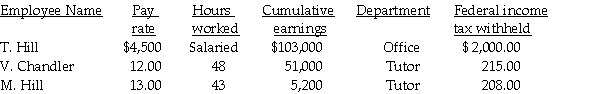

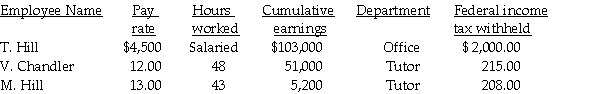

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Correct Answer

verified

Correct Answer

verified

Short Answer

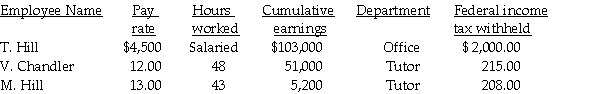

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total gross earnings for the office.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total gross earnings for the office.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash - Payroll Checking is a(n) :

A) contra-asset.

B) liability.

C) asset.

D) expense.

Correct Answer

verified

Correct Answer

verified

True/False

The balance in the Wages and Salaries Expense account is equal to net pay.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What liability account is reduced when the employees are paid?

A) Payroll Taxes Payable

B) Federal Income Taxes Payable

C) Wages and Salaries Payable

D) Wages and Salaries Expense

Correct Answer

verified

Correct Answer

verified

Short Answer

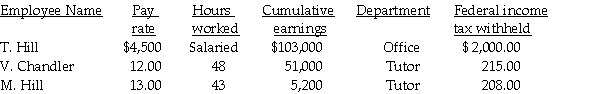

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total regular earnings.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total regular earnings.

Correct Answer

verified

Correct Answer

verified

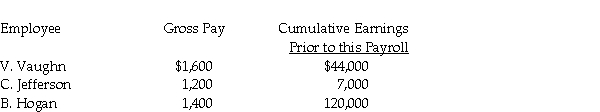

Essay

Using the information provided below,prepare a journal entry to record the payroll tax expense for Mr.B's Carpentry.

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $117,000 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $117,000 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Correct Answer

verified

Correct Answer

verified

True/False

Form 941 taxes include OASDI,Medicare,and federal unemployment tax.

Correct Answer

verified

Correct Answer

verified

True/False

Different deposit rules apply to employers based on the amount collected and owed by that employer for payroll taxes.

Correct Answer

verified

Correct Answer

verified

Short Answer

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the employees' FICA-OASDI.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the employees' FICA-OASDI.

Correct Answer

verified

Correct Answer

verified

Short Answer

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total federal income tax.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total federal income tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Payroll Tax Expense is an expense account.

B) FICA-OASDI Payable increases on the credit side of the account.

C) Payroll Tax Expense increases on the debit side of the account.

D) FUTA Tax Payable increases on the debit side of the account.

Correct Answer

verified

Correct Answer

verified

True/False

The form used for the annual federal unemployment taxes is Form 941.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Form SS-4 is:

A) completed to obtain an EIN.

B) submitted to summarize the W-2 forms to the Social Security Administration.

C) submitted quarterly to pay FIT and FICA taxes.

D) submitted annually to pay unemployment taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Plymouth Sharks Hockey Accessories had the following transactions involving the sale of merchandise.You are to prepare the necessary general journal entries.All sales are subject to a 6% sales tax and have a 2/10,n/30 discount terms. December 2 Sold merchandise priced at to Cathy Norton on account. December 4 Sold merchandise priced at to a cash customer. Decem ber 10 Payment from Cathy Norton received. Decem ber 16 Cash customer returned worth of merchandise. -A monthly depositor:

A) is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day) .

B) is determined by the amount of Form 941 taxes that they paid in the look-back-period.

C) will remain a monthly depositor,once classified,for one year at which time they will be reevaluated.

D) All of the above answers are correct.

Correct Answer

verified

Correct Answer

verified

Short Answer

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2) Assume: FICA-OASDI is 6.2% based on a limit of $117,000. FICA-Medicare is 1.45%. FUTA is .8% based on a limit of $7,000. SUTA is 5.6% based on a limit of $7,000. State income tax is 2.8%. -Compute the total overtime earnings.

Correct Answer

verified

Correct Answer

verified

Short Answer

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total overtime earnings.

Assume:

FICA-OASDI applied to the first $117,000 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total overtime earnings.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 113

Related Exams