Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A statement that explains the change in the amount of retained earnings during the year.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

Correct Answer

verified

Correct Answer

verified

True/False

Unappropriated Retained Earnings will decrease because of net losses, declarations of cash or stock dividends, and appropriations.

Correct Answer

verified

Correct Answer

verified

True/False

A stock dividend may be distributed even if the company is short of cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a dividend is paid in cash, it is known as a

A) liquidating dividend.

B) dividend payable.

C) cash dividend.

D) property dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of 100 shares of stock of a corporation with 2,000 shares of stock outstanding has a 5% interest in the total stockholders' equity. If a 20% stock dividend is declared and distributed a 5% interest in the total stockholders' equity prior to the stock dividend, would have which of the following interests in the equity after the stock dividend was distributed?

A) 5%

B) 6%

C) 20%

D) 25%

Correct Answer

verified

Correct Answer

verified

True/False

A statement of retained earnings is used to explain the change in the amount of retained earnings between two successive balance sheet dates.

Correct Answer

verified

Correct Answer

verified

True/False

Most corporations must estimate their annual income taxes and make quarterly tax payments.

Correct Answer

verified

Correct Answer

verified

True/False

The balance of the income summary account of a corporation is transferred to the capital stock account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be shown on the statement of retained earnings?

A) declaration of a cash dividend

B) declaration of a stock dividend

C) an appropriation for plant expansion

D) the purchase of treasury stock

Correct Answer

verified

Correct Answer

verified

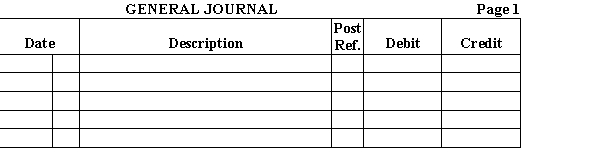

Essay

Prepare journal entries for each of the following transactions of Telecommunications, InC.Apr. 15

Declared a dividend of $1.43 per share on 11,000 shares of preferred stock outstandinG.May 19

Paid the dividend declared on April 15.

Correct Answer

verified

Correct Answer

verified

True/False

Upon the date of declaration of a dividend, the corporation has incurred a liability for the dividend.

Correct Answer

verified

Correct Answer

verified

True/False

A proportionate distribution of shares of a corporation's own stock to its stockholders is called a property dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry made on the date of declaration of a cash dividend to common stockholders includes

A) a debit to Cash Dividends and a credit to Common Dividends Payable.

B) a debit to Cash Dividends and a credit to Cash.

C) a debit to Common Dividends Payable and a credit to Cash Dividends.

D) a debit to Cash and a credit to Common Dividends Payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A distribution of earnings by a corporation to its stockholders.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

Correct Answer

verified

Correct Answer

verified

True/False

Three dates are involved in the declaration and payment of dividends-the date of declaration, the date of record, and the date of payment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a stock dividend is distributed, the account to be debited would be

A) Retained Earnings.

B) Stock Dividends Distributable.

C) Paid-In Capital in Excess of Par.

D) Capital Stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -An exchange of one share of an old issue of stock for multiple shares of a new issue with a reduced par or stated value.

A) cash dividend

B) date of declaration

C) date of payment

D) date of record

E) dividend

F) retained earnings appropriation

G) retained earnings statement

H) stock dividend

I) stock split

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most corporations must estimate their annual income taxes and make

A) annual payments.

B) semiannual payments.

C) monthly payments.

D) quarterly payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements concerning appropriation of retained earnings are true EXCEPT

A) the practice of appropriating retained earnings is unusual today.

B) stockholders generally expect all unappropriated retained earnings to be distributed in the form of dividends.

C) it is necessary to advise balance sheet readers that retained earnings is not totally available for dividends.

D) simply noting the restriction of retained earnings is not sufficient.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams