A) $0.

B) $93,750.

C) $107,812.

D) $112,500.

Correct Answer

verified

Correct Answer

verified

True/False

While IFRS requires an impairment test at each reporting date for long-lived assets, it requires no such test for intangibles once a legal or useful life has been determined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IFRS and U.S. GAAP

A) are diametrically opposed in their accounting for impairments of assets held for disposal.

B) are similar in the accounting for impairments of assets held for disposal.

C) are moving toward common ground in their accounting for impairments of assets held for disposal.

D) are moving further apart in their accounting for impairments of assets held for disposal.

Correct Answer

verified

Correct Answer

verified

Short Answer

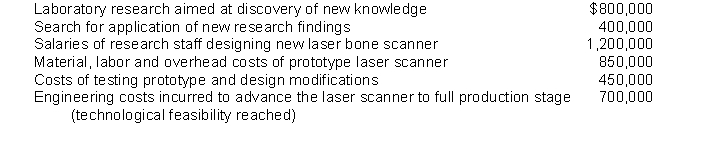

The following costs are incurred during the research and development phases of a laser bone scanner  Identify which of these are research phase items and will be immediately expensed underU.S. GAAP and IFRS.

Identify which of these are research phase items and will be immediately expensed underU.S. GAAP and IFRS.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of intangible assets result from interactions and relationships with outside parties?

A) Marketing-related intangible assets

B) Customer-related intangible assets

C) Contract-related intangible assets

D) Artistic-related intangible assets

Correct Answer

verified

Correct Answer

verified

Essay

Define the following terms. (a) Goodwill (b) Negative goodwill

Correct Answer

verified

(a) Varying approaches are used to define goodwill. They are:

\(\bullet\)Goodwill should be measured initially as the excess of the fair value of the acquisition cost over the fair value of the net assets acquired.

\(\bullet\)Goodwill is sometimes defined as one or more unidentified intangible assets and identifiable intangible assets that are not reliably measurable. Examples of elements of goodwill include new channels of distribution, synergies of combining sales forces, and a superior management team.

\(\bullet\)Goodwill may also be defined as the intrinsic value that a business has acquired beyond the mere value of its net assets whether due to the personality of those conducting it, the nature of its location, its reputation, or any other circumstance incidental to the business and tending to make it permanent. Another definition is the capitalized value of the excess of estimated future profits of a business over the rate of return on capital considered normal in the industry.

(b) Negative goodwill develops when the fair value of the assets purchased is higher than the cost. This situation may develop from a market imperfection. In this case, the seller would have been better off to sell the assets individually than in total. However, situations do occur (e.g., a forced liquidation or distressed sale due to the death of the company founder), in which the purchase price is less than the value of the identifiable net assets.

Correct Answer

verified

Multiple Choice

According to a Financial Accounting Standards Board Statement, how are research and development costs accounted for?

A) They must be capitalized when incurred and then amortized over their estimated useful lives.

B) They must be expensed in the period incurred.

C) They may be either capitalized or expensed when incurred, depending upon the materiality of the amounts involved.

D) They must be expensed in the period incurred unless it can be clearly demonstrated that the expenditure will have alternative future uses or unless contractually reimbursable.

Correct Answer

verified

Correct Answer

verified

True/False

Internally generated intangible assets are initially recorded at fair value.

Correct Answer

verified

Correct Answer

verified

Essay

Intangible assets may be internally generated or purchased from another party. In either case, what costs should be included in the initial valuation of the asset is an issue. Instructions (a) Identify the typical costs included in the cash purchase of an intangible asset. (b) Discuss how to determine the cost of an intangible asset acquired in a non-cash transaction. (c) Describe how to determine the cost of several intangible assets acquired in a "basket purchase." Provide a numerical example involving intangibles being acquired for a total price of $90,000.

Correct Answer

verified

(a) The typical costs included in the purchase of an intangible asset are: purchase price, legal fees, and other incidental expenses.

(b) In a non-cash acquisition of an intangible asset, the initial cost of the intangible is either the fair value of the consideration given or the fair value of the intangible received, whichever is more clearly evident.

(c) When several intangible assets are acquired in a "basket purchase", the cost of the individual assets is based on their relative fair values. For example:

11eb11d6_0b8d_ae43_ad38_1dc6e670e3d2_TB3102_00

Correct Answer

verified

True/False

All intangibles are subject to periodic consideration of impairment with corresponding potential write-downs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following principles best describes the current method of accounting for research and development costs?

A) Associating cause and effect

B) Systematic and rational allocation

C) Income tax minimization

D) Immediate recognition as an expense

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Dennis Company purchases Miles Company for $4,200,000 cash on January 1, 2015. The book value of Miles Company's net assets reported on its December 31, 2014 financial statement was $3,800,000. An analysis indicated that the fair value of Miles's tangible assets exceeded the book value by $600,000, and the fair value of identifiable intangible assets exceeded book value by $320,000. What amount of gain or goodwill is recognized by Dennis?

A) $920,000 gain.

B) $400,000 goodwill.

C) $520,000 gain.

D) $520,000 goodwill.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating losses incurred during the start-up years of a new business should be

A) accounted for and reported like the operating losses of any other business.

B) written off directly against retained earnings.

C) capitalized as a deferred charge and amortized over five years.

D) capitalized as an intangible asset and amortized over a period not to exceed 20 years.

Correct Answer

verified

Correct Answer

verified

True/False

Costs in the research phase are expensed under U.S. GAAP, but capitalized under IFRS.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is reported as part of discontinued operations?

A) Amortization expense.

B) Impairment losses for intangible assets.

C) Research and development costs.

D) None of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As in U.S. GAAP, under IFRS the costs associated with research and development are segregated into

A) two components, the research phase and the production phase.

B) two components, the research phase and the development phase.

C) three components, the planning phase, the research phase and the production phase.

D) three components, the analysis phase, the development phase and the production phase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The intangible asset goodwill may be

A) capitalized only when purchased.

B) capitalized either when purchased or created internally.

C) capitalized only when created internally.

D) written off directly to retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered research and development costs?

A) Routine efforts to refine an existing product.

B) Periodic alterations to existing production lines.

C) Marketing research to promote a new product.

D) Construction of prototypes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thompson Company incurred research and development costs of $100,000 and legal fees of $30,000 to acquire a patent. The patent has a legal life of 20 years and a useful life of 10 years. What amount should Thompson record as Patent Amortization Expense in the first year?

A) $ -0-.

B) $ 3,000.

C) $ 6,500.

D) $13,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a business combination, companies record identifiable intangible assets that they can reliably measure. All other intangible assets, too difficult to identify or measure, are recorded as

A) other assets.

B) indirect costs.

C) goodwill.

D) direct costs.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 171

Related Exams