A) Gross profit, $180,000.

B) Gross profit, $400,000.

C) Gross profit, $420,000.

D) Gross profit, $240,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

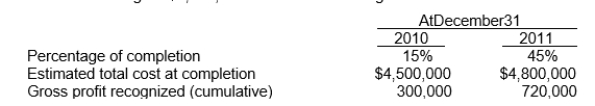

Shore Construction Co.has consistently used the percentage-of-completion method of recognizing revenue.During 2010, Shore entered into a fixed-price contract to construct an office building for $6,000,000.Information relating to the contract is as follows:  Under the earnings approach, contract costs incurred during 2011 were

Under the earnings approach, contract costs incurred during 2011 were

A) $1,440,000.

B) $1,485,000.

C) $1,575,000.

D) $2,160,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of commercial substance in purchase and sales transactions means that

A) The transaction is a bona fide purchase and sale

B) The entity's cash flows are expected to change

C) The transaction must involve tangible assets

D) (a) and (b)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under an earnings approach to accounting for revenues, the main focus is placed on

A) the creation of contractual rights of the underlying sales agreement.

B) the adherence to relevant contractual obligations.

C) the earnings process itself and how value is added.

D) the presentation on the financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lear Constructors, Ltd.has consistently used the percentage-of-completion method of recognizing income.In 2010, Lear started work on a $7,000,000 construction contract that was completed in 2011.The following information was taken from Lear's 2010 accounting records:  Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?

Under the earnings approach, what amount of gross profit should Lear have recognized in 2010 on this contract?

A) $700,000.

B) $466,667.

C) $350,000.

D) $233,333.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a project that was correctly accounted for under the percentage-of-completion method.At the end of the project, the construction in process account includes total debits and credits of $3.5 Mill.Assuming that gross profit of $1.2 Mill.was recognized throughout the contract, total constructions costs were:

A) $2.3 Mill.

B) $3.5 Mill.

C) $2.1 Mill.

D) $4.6 Mill.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The completed contract method for accounting for long-term construction projects

A) requires that no revenue is recognized until the project is completed.

B) requires that costs are accumulated and revenue is recognized in proportion to cash collected.

C) is not compatible with the contract-based approach to revenue recognition

D) (a) and (c)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a sale involves goods and services, the selling price should not be

A) allocated to each of these parts

B) allocated only to the part with the higher value

C) allocated using the relative fair value method

D) allocated using the residual method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2010, Bissel Co.sold land that cost $90,000 for $120,000, receiving a note bearing interest at 10 percent.The note will be paid in three annual instalments of $48,255 starting on December 31, 2010.Assuming that collection of the note is very uncertain, how much revenue from this sale should Bissel recognize in 2010?

A) $0.

B) $9,000.

C) $12,000.

D) $30,000.

Correct Answer

verified

Correct Answer

verified

Short Answer

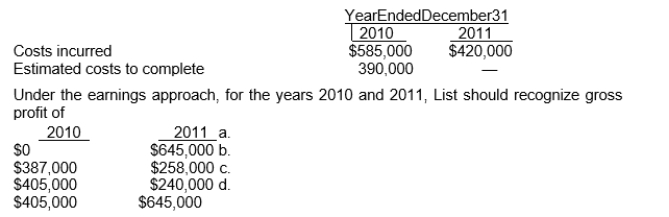

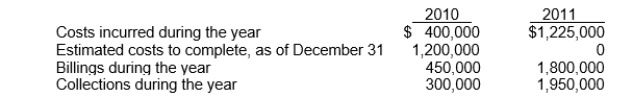

List Construction Co.uses the percentage-of-completion method.In 2010, List began work on a contract for $1,650,000 and it was completed in 2011.Data on the costs are:  Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of

$2,400,000.Other details follow:

Use the following information for questions 44 and 45: Spark Ltd.began work in 2010 on contract #731 which provided for a contract price of

$2,400,000.Other details follow:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of a constructive obligation in business law refers to an obligation

A) that may not be explicitly stated in the contract

B) that may have been created through past practice

C) that may be enforceable under common law

D) All of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Berlak Company entered into a contract with Charles Corporation.Berlak agreed to provide Charles with building supplies.Charles agreed to pay a total of $18,000 at delivery.Under the contract-based view, Berlak's net contract position can be assumed to be

A) nil

B) $18,000

C) $9,000

D) $4,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a reason why revenue is recognized at time of sale under the earnings approach?

A) The earning process is substantially complete.

B) The amount is reasonably measured.

C) Title legally passes from seller to buyer.

D) All of these are reasons to recognize revenue at time of sale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The new revenue recognition model currently studied by the IASB and FASB

A) is the contract-based approach

B) is the earnings approach

C) the percentage of completion method

D) the completed contract method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Spark uses the completed-contract method of accounting.The portion of the total gross profit to be recognized as income in 2011 is

A) $300,000.

B) $450,000.

C) $775,000.

D) $2,400,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In selecting an accounting method for a newly contracted long-term construction project under private entity GAAP, the principal factor to be considered should be

A) the terms of payment in the contract.

B) the degree to which a reliable estimate of the costs to complete and extent of progress toward completion is practicable.

C) the method commonly used by the contractor to account for other long-term construction contracts.

D) the inherent nature of the contractor's technical facilities used in construction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under both private entity GAAP and IFRS,

A) the earnings approach to revenue recognition is followed.

B) all of these

C) the percentage of completion methods are allowed.

D) warranty costs are accrued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Malek Inc.is a retailer of home appliances and offers a service contract on each appliance sold.Elton sells appliances on instalment contracts, but all service contracts must be paid in full at the time of sale.Collections received for service contracts should be recorded as an increase in a

A) deferred revenue account.

B) sales contracts receivable valuation account.

C) shareholders' valuation account.

D) service revenue account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

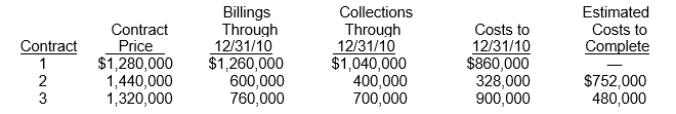

Use the following information for questions

Peske Construction Co.began operations in 2010.Construction activity for 2010 is shown below.Peske uses the completed-contract method.

-Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 2?

-Which of the following should be shown on the balance sheet at December 31, 2010 related to Contract 2?

A) Inventory, $272,000.

B) Inventory, $328,000.

C) Current liability, $272,000.

D) Current liability, $600,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Losses in long-term construction projects

A) are recognized immediately under the completed-contract method

B) are recognized immediately under the percentage-of-completion method

C) are generally deferred

D) (a) and (b)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 63

Related Exams