A) allocated to expense on the date of acquisition.

B) allocated to identifiable assets to the extent of their fair values, with any remainder allocated to goodwill.

C) allocated to goodwill, with any remainder allocated to the identifiable assets.

D) set up as a liability to the controlling interest.

Correct Answer

verified

Correct Answer

verified

True/False

In accordance with the historical cost principle, brokerage fees should be added to the cost of an investment.

Correct Answer

verified

Correct Answer

verified

True/False

A decline in the fair value of a trading security is recorded by debiting an unrealized loss account and crediting the Fair Value Adjustment account.

Correct Answer

verified

Correct Answer

verified

True/False

An unrealized gain or loss on trading securities is reported as a separate component of stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blaine Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for $51,000 cash. June 1 Received cash dividends of $3 per share on Horton stock. Oct) 1 Sold 1,200 shares of Horton stock for $32,400. The entry to record the receipt of the dividends on June 1 would include a

A) debit to Stock Investments for $6,000.

B) credit to Dividend Revenue for $6,000.

C) debit to Dividend Revenue for $6,000.

D) credit to Stock Investments for $6,000.

Correct Answer

verified

Correct Answer

verified

True/False

In accordance with the historical cost principle, the cost of debt investments includes brokerage fees and accrued interest.

Correct Answer

verified

Correct Answer

verified

True/False

Under the cost method, the investment is recorded at cost and revenue is recognized only when cash dividends are received.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the first year of operations, the total cost of the trading securities portfolio is $245,000. Total fair value is $250,000. The financial statements should show

A) an addition to an asset of $5,000 and a realized gain of $5,000.

B) an addition to an asset of $5,000 and an unrealized gain of $5,000 in the stockholders' equity section.

C) an addition to an asset of $5,000 in the current assets section and an unrealized gain of $5,000 in "Other revenues and gains."

D) an addition to an asset of $5,000 in the current assets section and a realized gain of $5,000 in "Other revenues and gains."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company that acquires less than 20% ownership interest in another company should account for the stock investment in that company using

A) the cost method.

B) the equity method.

C) the significant method.

D) consolidated financial statements.

Correct Answer

verified

Correct Answer

verified

True/False

The Stock Investments account is debited at acquisition under both the equity method and cost method of accounting for investments in common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

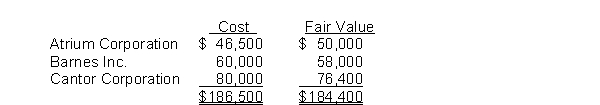

At the end of its first year, the trading securities portfolio consisted of the following common stocks.  The unrealized loss to be recognized under the fair value method is

The unrealized loss to be recognized under the fair value method is

A) $2,000.

B) $5,600.

C) $2,100.

D) $3,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company may purchase a noncontrolling interest in another firm in a related industry

A) to house excess cash until needed.

B) to generate earnings.

C) for strategic reasons.

D) for speculative reasons.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term investments are listed on the balance sheet immediately below

A) cash.

B) inventory.

C) accounts receivable.

D) prepaid expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bay Company acquires 60, 8%, 5 year, $1,000 Community bonds on January 1, 2014 for $60,000. Assume Community pays interest on January 1 and July 1, and the July 1 entry was done correctly. The journal entry at December 31, 2014 would include a credit to

A) Interest Receivable for $2,400.

B) Interest Revenue for $4,800.

C) Accrued Expense for $4,800.

D) Interest Revenue for $2,400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equity method of accounting for an investment in the common stock of another company should be used by the investor when the investment

A) is composed of common stock and it is the investor's intent to vote the common stock.

B) ensures a source of supply of raw materials for the investor.

C) enables the investor to exercise significant influence over the investee.

D) is obtained by an exchange of stock for stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of debt investments includes each of the following except

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A typical investment to house excess cash until needed is

A) stocks of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) stock securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Penny Company owns 20% interest in the stock of Lynn Corporation. During the year, Lynn pays $25,000 in dividends, and reports $200,000 in net income. Penny Company's investment in Lynn will increase by

A) $25,000.

B) $40,000.

C) $45,000.

D) $35,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blaine Company had these transactions pertaining to stock investments: Feb. 1 Purchased 2,000 shares of Horton Company (10%) for $51,000 cash. June 1 Received cash dividends of $2 per share on Horton stock. Oct) 1 Sold 1,200 shares of Horton stock for $32,400. The entry to record the purchase of the Horton stock would include a

A) debit to Stock Investments for $45,900.

B) credit to Cash for $45,900.

C) debit to Stock Investments for $51,000.

D) debit to Investment Expense for $5,100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term investments are securities that are readily marketable and intended to be converted into cash within the next

A) year.

B) two years.

C) year or operating cycle, whichever is shorter.

D) year or operating cycle, whichever is longer.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 128

Related Exams