A) provide almost no guidance to accountants

B) allow accountants to choose among different methods for depreciation and for the valuation of inventory

C) require accountants to use only one specific method of depreciation, but permit several methods of inventory valuation

D) require accountants to use one specific method for valuing inventory, but permit several methods for depreciating fixed assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a key step in the accounting cycle?

A) Recording information into journals

B) Collecting data from customers

C) Forecasting expenses and revenues

D) Preparing the advertising message

Correct Answer

verified

Correct Answer

verified

Multiple Choice

is the monetary value that is received for goods sold, services rendered and money received from other sources.

A) Revenue

B) Gross margin

C) Net income

D) Cost of goods sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of a trial balance is to:

A) Affirm whether the figures in the account ledgers are correct and balanced.

B) Prepare a mock up of a real balance sheet.

C) Review the income statement accounts.

D) Meet a reporting requirement of the Securities and Exchange Commission (SEC) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

is the accounting practice of recording each transaction in two places in the accounting journal.

A) Double-entry bookkeeping

B) Trial balancing

C) Account matching

D) Entry duplication

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tyler works as an accountant for a mid-sized retail store. He has just completed a trial balance that resulted in no unexpected problems. Tyler's next task is likely to be:

A) Conducting the full audit.

B) Preparing a tax return for the company.

C) Preparing the store's balance sheet and other major financial statements.

D) Presenting the trial balance to the company owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A balance sheet lists assets in order of their .

A) Dollar value, from smallest to largest

B) Date of acquisition, with the most recently acquired assets listed first

C) Liquidity, with the most liquid assets listed first

D) Income generating ability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phil O'Keefe is opening a small sports store in his town. At the advice of a friend who is a bookkeeper, he keeps the receipts of everything he purchases for the business in the bottom drawer of his desk, along with all other business expenses, such as his retail license, his rent expense, and insurance expense. You suggest that .

A) Phil continues with this procedure, but only until the store opens, at which time he will need an additional drawer for his sales transactions.

B) Phil invests some time in exploring an accounting system that will make it easier to classify and summarize accounting information.

C) Phil continues with this procedure because there is very little difference between one expense and another.

D) Phil stops wasting valuable time saving the receipts because accountants only record sales transactions.

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover ratio measures the speed of inventory moving through the firm and its conversion into sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of the current ratio is to evaluate the firm's ability to:

A) Generate sales with a given level of current assets.

B) Utilize current assets profitably.

C) Pay its bills in the short run.

D) Effectively use borrowed funds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accountants not only provide financial information to the firm, they:

A) Replace the firm's need for managers.

B) Also provide information regarding competitors.

C) Assist in interpreting that information.

D) Design the computer information systems.

Correct Answer

verified

C

Correct Answer

verified

True/False

Assets are economic resources that are owned by a firm.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

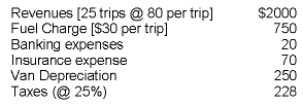

Carole Grand and Bonnie Lamore run a shuttle service from Western Illinois to the busy Chicago O'Hare airport. Last month, they recorded the following:  Carole and Bonnie's gross profit for the past month was:

Carole and Bonnie's gross profit for the past month was:

A) $682.00

B) Carole: $341.00; Bonnie: $341.00

C) $1250.00

D) $2750.00

Correct Answer

verified

Correct Answer

verified

True/False

The income statement reports the difference between a firm's assets and its liabilities as of a certain date.

Correct Answer

verified

Correct Answer

verified

True/False

Independent audits are prepared by accountants within the organization to ensure that proper accounting procedures are followed.

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO method of inventory valuation assumes the newest items in inventory are sold first.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net Profit refers to:

A) The result of deducting liabilities from the assets of the firm.

B) The result of subtracting cost of good sold from revenues.

C) The result of deducting depreciation expense from revenues.

D) The net earnings after the deduction of all expenses, including tax expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The is an accounting statement that reports the financial condition of a firm at a specific point in time.

A) income statement

B) balance sheet

C) statement of cash flows

D) trial balance

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet reflects the fact that assets equal the sum of liabilities and owners' equity.

Correct Answer

verified

Correct Answer

verified

True/False

The acid-test ratio emphasizes the ability to convert inventory quickly into cash.

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 365

Related Exams