A) not shift.

B) shift down.

C) shift up.

D) become flatter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-5  -Refer to Table 6-5. Suppose the government imposes a price ceiling of $3 on this market. What will be the size of the shortage in this market?

-Refer to Table 6-5. Suppose the government imposes a price ceiling of $3 on this market. What will be the size of the shortage in this market?

A) 0 units

B) 30 units

C) 45 units

D) 75 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding price ceiling (i) Causes a surplus. (ii) Causes a shortage.(iii) Is set at a price above the equilibrium price.(iv) Is set at a price below the equilibrium price.

A) (ii) only

B) (iv) only

C) (i) and (iii) only

D) (ii) and (iv) only

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price ceiling is rent control.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of sofas

A) increases the size of the sofa market.

B) decreases the size of the sofa market.

C) has no effect on the size of the sofa market.

D) may increase, decrease, or have no effect on the size of the sofa market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate

A) the exact wage that firms must pay workers.

B) a maximum wage that firms may pay workers.

C) a minimum wage that firms may pay workers.

D) both a minimum wage and a maximum wage that firms may pay workers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the sellers of blueberries

A) increases sellers' costs, reduces profits, and shifts the supply curve up.

B) increases sellers' costs, reduces profits, and shifts the supply curve down.

C) decreases sellers' costs, increases profits, and shifts the supply curve up.

D) decreases sellers' costs, increases profits, and shifts the supply curve down.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payroll tax is a

A) fixed number of dollars that every firm must pay to the government for each worker that the firm hires.

B) tax that each firm must pay to the government before the firm can hire workers and operate its business.

C) tax on the wages that firms pay their workers.

D) tax on all wages above the minimum wage.

Correct Answer

verified

Correct Answer

verified

True/False

Rent subsidies and wage subsidies are better than price controls at helping the poor because they have no costs associated with them.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the short run, rent control causes the quantity supplied

A) and quantity demanded to fall.

B) to fall and quantity demanded to rise.

C) to rise and quantity demanded to fall.

D) and quantity demanded to rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $2 tax on buyers of cigars and imposes the same $2 tax on sellers of cigars, then the price paid by buyers will

A) not change, and the price received by sellers will not change.

B) not change, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will not change.

D) decrease, and the price received by sellers will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

Correct Answer

verified

Correct Answer

verified

True/False

Who bears the majority of a tax burden depends on whether the tax is placed on the buyers or the sellers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on buyers of tea,

A) buyers of tea and sellers of tea both are made worse off.

B) buyers of tea are made worse off, and the well-being of sellers is unaffected.

C) buyers of tea are made worse off, and sellers of tea are made better off.

D) the well-being of both buyers of tea and sellers of tea is unaffected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

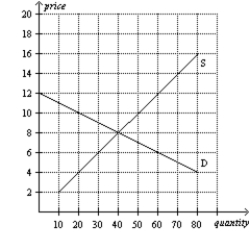

Figure 6-6  -Refer to Figure 6-6. If the government imposes a price ceiling of $6 on this market, then there will be

-Refer to Figure 6-6. If the government imposes a price ceiling of $6 on this market, then there will be

A) no shortage.

B) a shortage of 10 units.

C) a shortage of 20 units.

D) a shortage of 30 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The presence of a price control in a market for a good or service usually is an indication that

A) an insufficient quantity of the good or service was being produced in that market to meet the public's need.

B) the usual forces of supply and demand were not able to establish an equilibrium price in that market.

C) policymakers believed that the price that prevailed in that market in the absence of price controls was unfair to buyers or sellers.

D) policymakers correctly believed that price controls would generate no inequities of their own once imposed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a binding rent control law is repealed in San Francisco. As a result, we would expect the total number of units rented in the city to

A) increase.

B) decrease.

C) remain unchanged.

D) decrease, then increase.

Correct Answer

verified

Correct Answer

verified

True/False

The burden of a luxury tax most likely falls more heavily on sellers because demand is more elastic and supply is more inelastic.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 671

Related Exams