A) Gross profit

B) Operating expenses

C) Sales revenue

D) Cost of goods sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts normally have debit balances?

A) Sales Discounts

B) Sales Returns and Allowances.

C) Both Sales Discounts and Sales Returns and Allowances have debit balances.

D) Neither Sales Discounts or Sales Returns and Allowances have debit balances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is an advantage of using the multiple-step income statement?

A) It highlights the components of net income.

B) Gross profit is not a separate item.

C) It is easier to prepare than the single-step income statement.

D) Net income will be higher than net income computed using the single-step income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

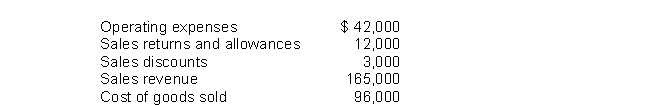

Financial information is presented below:  The gross profit rate would be

The gross profit rate would be

A) .64.

B) .42.

C) .36.

D) .37.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

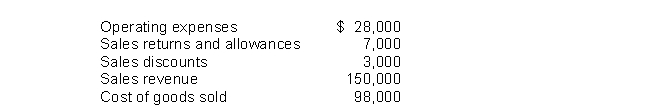

Financial information is presented below:  Gross profit would be

Gross profit would be

A) $49,000.

B) $42,000.

C) $45,000.

D) $52,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory becomes part of cost of goods sold when a company

A) pays for the inventory.

B) purchases the inventory.

C) sells the inventory.

D) receives payment from the customer.

Correct Answer

verified

Correct Answer

verified

True/False

Net sales minus cost of goods sold is called gross profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally, the revenue account for a merchandising enterprise is called

A) Sales Revenue or Sales.

B) Investment Income.

C) Gross Profit.

D) Net Sales.

Correct Answer

verified

Correct Answer

verified

Short Answer

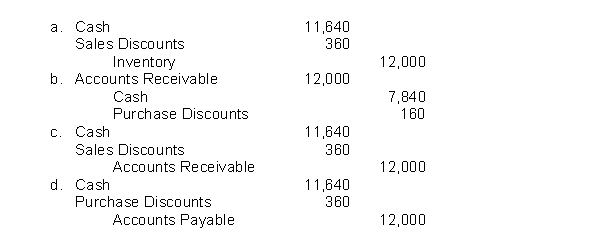

Ramos Company receives a payment on account from Martinez Industries.Based on the original sale of $12,000 using the periodic inventory approach, Ramos honors the 3% cash discount and records the payment.Which of the following is the correct entry for Ramos to record?

Correct Answer

verified

Correct Answer

verified

True/False

Under the periodic system, when a customer returns goods, Purchases Returns and Allowances is debited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following companies would be most likely to use a perpetual inventory system?

A) Grain company

B) Beauty salon

C) Clothing store

D) Fur dealer

Correct Answer

verified

Correct Answer

verified

Multiple Choice

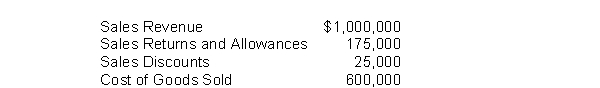

A company shows the following balances:  What is the company's gross profit rate?

What is the company's gross profit rate?

A) 60%

B) 75%

C) 40%

D) 25%

Correct Answer

verified

Correct Answer

verified

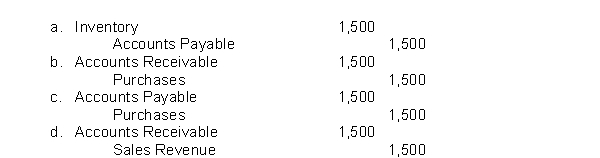

Short Answer

Taylor Corporation purchases $1,500 of merchandise on account from Enterprise Company, terms 2/10, n/30.Taylor and Enterprise both use periodic inventory systems.Enterprise's entry record this transaction is:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adams Company is a retailer and uses a perpetual inventory system.Which statement is correct?

A) Returns of merchandise by Adams Company to a manufacturer are credited to Inventory.

B) Freight paid to get merchandise to Adams Company's store is debited to Freight Expense.

C) A return of merchandise by one of Adams Company's customers is credited to Inventory.

D) Discounts taken by Adams Company's customers are credited to Inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Detailed records of goods held for resale are not maintained under a

A) perpetual inventory system.

B) periodic inventory system.

C) double entry accounting system.

D) single entry accounting system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the president of Harter Company, you notice that no discounts have been taken when settling accounts payables.What would be an acceptable explanation?

A) All invoices have credit terms of n/30.

B) There is not sufficient cash to pay within the discount period.

C) Discounts are missed because no one knows how to enter them in the new accounting software.

D) The full amount of the invoice is being paid within the discount period and the treasurer is pocketing the discount amount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indicate which one of the following would not appear on both a single-step income statement and a multiple-step income statement.

A) Gross profit

B) Operating expenses

C) Sales revenue

D) Cost of goods sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tony's Market recorded the following events involving a recent purchase of inventory: Received goods for $80,000, terms 2/10, n/30. Returned $1,600 of the shipment for credit. Paid $400 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company's inventory

A) increased by $76,832.

B) increased by $78,800.

C) increased by $77,224.

D) increased by $77,232.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure for which of the following items is determined at a different time under the perpetual inventory method than under the periodic method?

A) Sales Revenue

B) Cost of Goods Sold

C) Purchases

D) Accounts Receivable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sales Returns and Allowances account does not provide information to management about

A) possible inferior merchandise.

B) the percentage of credit sales versus cash sales.

C) inefficiencies in filling orders.

D) errors in billing customers.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 211

Related Exams