A) increase; decrease; decrease

B) increase; increase; decrease

C) decrease; increase; increase

D) decrease; decrease; increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

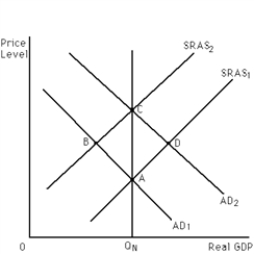

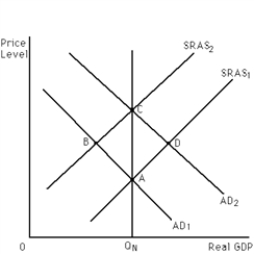

Exhibit 15-1

-Refer to Exhibit 15-1. A Keynesian would say that market forces work more quickly in taking the economy from point______________ than from point _______________.

-Refer to Exhibit 15-1. A Keynesian would say that market forces work more quickly in taking the economy from point______________ than from point _______________.

A) A to point D; D to point C

B) A to point D; A to point B

C) D to point C; B to point A

D) C to point D; C to point B

Correct Answer

verified

Correct Answer

verified

True/False

The money supply curve is usually horizontal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the money market is in the liquidity trap and that the economy is experiencing a recessionary gap. A Keynesian economist would most likely advocate

A) expansionary monetary policy.

B) contractionary monetary policy.

C) expansionary fiscal policy.

D) contractionary fiscal policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the investment demand curve is vertical, a decrease in the interest rate will __________ investment, and therefore aggregate demand will __________.

A) increase; increase

B) decrease; increase

C) decrease; decrease

D) decrease; remain unchanged

E) not affect; remain unchanged

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The demand curve for money balances represents a direct relationship between the quantity demanded of money balances and the price of holding money balances.

B) In the United States, the position of the money supply curve is determined exclusively by the Fed.

C) The "money market" discussed in this chapter refers to the market for short-term securities.

D) If, at a given interest rate, individuals want to hold less money than is supplied, this will put downward pressure on the interest rate.

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply increased and the AD curve did not shift to the right. This is consistent with the

A) Keynesian transmission mechanism when there is either a liquidity trap or interest-insensitive investment.

B) monetarist transmission mechanism when there is interest-insensitive investment.

C) Keynesian transmission mechanism when there is a liquidity trap.

D) monetarist transmission mechanism when there is a liquidity trap.

E) c and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand-for-money curve illustrates the __________ relationship between the quantity demanded of money and __________.

A) inverse; the interest rate

B) direct; GDP.

C) direct; the interest rate

D) inverse; GDP

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economist Jones favors a constant-money-growth-rate rule. She says that if the annual money supply growth rate each year is equal to the average annual growth rate in Real GDP, price stability will exist over time. What would economist Smith, who favors activist monetary policy, say to economist Jones?

A) Your analysis assumes that Real GDP is constant over time, and it is not.

B) Your analysis assumes that velocity is constant, and it is not.

C) Your analysis assumes that you can correctly define the money supply.

D) b and c

E) a, b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Keynesian transmission mechanism, if the Fed conducts an open market sale of government securities, it may cause which of the following in the investment goods market?

A) a rightward shift in the investment demand curve

B) a leftward shift in the investment demand curve

C) a movement down and along a given investment demand curve

D) a movement up and along a given investment demand curve

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed that investment demand was interest-insensitive.

B) Keynesians would not advocate an expansionary monetary policy to eliminate a recessionary gap if they believed the money market was in the liquidity trap.

C) Keynesians would advocate an expansionary monetary policy to eliminate a recessionary gap if they believed investment spending was insensitive to changes in the interest rate.

D) Keynesians believe that money wages are inflexible in the downward direction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetarists believe that changes in the supply of money

A) do not affect aggregate demand.

B) affect aggregate demand through the loanable funds market only.

C) affect only the investment component of aggregate demand.

D) affect aggregate demand directly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The existence of a liquidity trap implies that

A) a decrease in the interest rate might not increase investment spending.

B) an increase in the demand for money will be followed by an equal increase in the supply of money.

C) an increase in the supply of money may not lower interest rates.

D) a and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

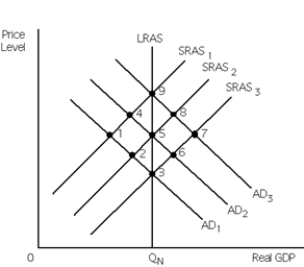

Exhibit 15-3

-Refer to Exhibit 15-3. The economy is currently at point 4. The Fed increases the money supply and the economy ends up at point 8. Has monetary policy been effective at moderating the business cycle?

-Refer to Exhibit 15-3. The economy is currently at point 4. The Fed increases the money supply and the economy ends up at point 8. Has monetary policy been effective at moderating the business cycle?

A) Yes, since it eliminated the recessionary gap.

B) Yes, since it decreased the unemployment rate.

C) Yes, since it increased Real GDP.

D) No, since it has moved the economy from a recessionary gap to an inflationary gap.

E) a, b and c

Correct Answer

verified

Correct Answer

verified

True/False

When an economist states that the monetarist transmission mechanism is "direct" it means that a change in the money supply creates a direct impact on the goods and services market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following may block the Keynesian transmission mechanism?

A) the loanable funds market

B) aggregate demand

C) interest-insensitive investment

D) the liquidity trap

E) c and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity demanded of money is

A) inversely related to the interest rate.

B) directly related to the interest rate.

C) inversely related to the general price level.

D) inversely related to GDP.

E) a, c, and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Real GDP increases at an annual rate of 4 percent and velocity increases at a rate of 2 percent per year, then rules-based monetary policy advocates who wish to maintain a stable price level would set the annual money supply growth rate at

A) -2 percent.

B) 0 percent.

C) 1 percent.

D) 2 percent.

E) -1 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 15-1

-Refer to Exhibit 15-l. A Keynesian monetary policy to eliminate a recessionary gap can be portrayed as a move between points

-Refer to Exhibit 15-l. A Keynesian monetary policy to eliminate a recessionary gap can be portrayed as a move between points

A) A and B.

B) B and C.

C) C and D.

D) D and A.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy is experiencing an inflationary gap. Based on available data, the Fed starts implementing contractionary monetary policy, but this moves the economy into a recessionary gap. The most probable explanation is that, because of the total lag in monetary policy, the government did not realize that the economy was already healing itself, i.e., that the

A) AD curve was shifting rightward.

B) AD curve was shifting leftward.

C) SRAS curve was shifting rightward.

D) SRAS curve was shifting leftward.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 185

Related Exams