A) $720 unfavorable

B) $540 favorable

C) $900 unfavorable

D) $180 unfavorable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following variances is least likely to provide useful information for making decisions, if calculated as part of a comprehensive set of variances?

A) Variable overhead spending

B) Production volume variance

C) Direct material price

D) Direct labor efficiency

Correct Answer

verified

Correct Answer

verified

True/False

The standard cost of direct materials is computed as the standard price per unit of input times the standard quantity per unit of input.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rewarding employees in one production department for meeting or exceeding standard cost benchmarks can create new sets of problems for organizations. Which of the following is not one of them?

A) An unfavorable efficiency variance because of rework needed on work from another department

B) Variances in another production department

C) Unmotivated employees in that production department

D) Poor quality finished goods

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 4 questions.

White, Inc. produces a chemical product whose primary component is purchased on credit and any discounts are always taken. The following material and labor elements make up the costs of the product:  Each container of the chemical product contains 5.7 quarts of material. During the process 5% of the material is lost due to waste. Each container of product also requires 1.2 hours of labor. Each day 2 hours are taken for set-up, cleaning, and breaks. Also, the wage rate is $15 per hour and fringes/payroll taxes are 20% of wages. Clients can take a 3% discount if they pay invoices within 10 days; otherwise, the entire invoice amount is due within 30 days. 1 gallon equals 4 quarts.

-The standard hours per finished unit is

Each container of the chemical product contains 5.7 quarts of material. During the process 5% of the material is lost due to waste. Each container of product also requires 1.2 hours of labor. Each day 2 hours are taken for set-up, cleaning, and breaks. Also, the wage rate is $15 per hour and fringes/payroll taxes are 20% of wages. Clients can take a 3% discount if they pay invoices within 10 days; otherwise, the entire invoice amount is due within 30 days. 1 gallon equals 4 quarts.

-The standard hours per finished unit is

A) 1.2 hours

B) 1.5 hours

C) 1.6 hours

D) 1.45 hours

Correct Answer

verified

Correct Answer

verified

True/False

The fixed overhead spending variance is normally zero because fixed costs are constant within a relevant range of activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a typical step in variance analysis?

A) Calculate variances

B) Identify reasons for variances

C) Report variances in financial statements

D) Draw conclusions and take action

Correct Answer

verified

Correct Answer

verified

Multiple Choice

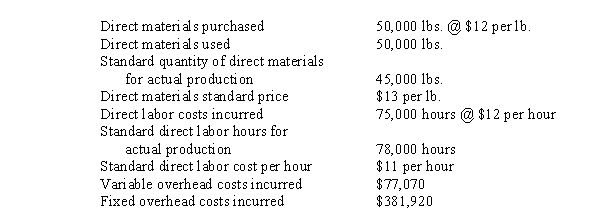

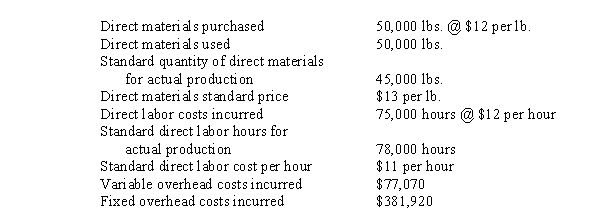

Use the following information for the next 5 questions.

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:  -The direct materials efficiency variance is

-The direct materials efficiency variance is

A) $60,000 Favorable

B) $60,000 Unfavorable

C) $65,000 Favorable

D) $65,000 Unfavorable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

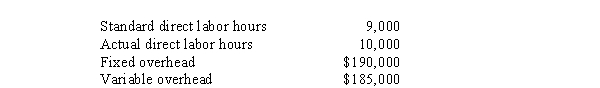

Use the following information for the next 4 questions.

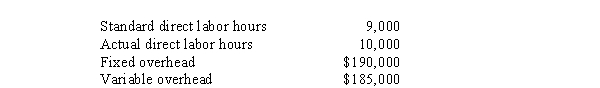

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:  -The over- or underapplied overhead was

-The over- or underapplied overhead was

A) $50,000 under

B) $10,000 over

C) $60,000 under

D) $20,000 over

Correct Answer

verified

Correct Answer

verified

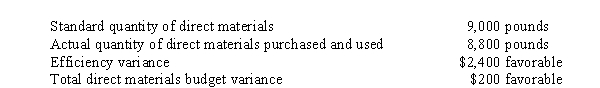

Multiple Choice

Use the following information for the next 3 questions.

Vashon Corporation had the following activity during a recent period:  -The standard price per pound was

-The standard price per pound was

A) $12.00

B) $12.25

C) $12.50

D) $13.00

Correct Answer

verified

Correct Answer

verified

True/False

The total direct labor variance can be broken down into two components: the efficiency variance and the price variance.

Correct Answer

verified

Correct Answer

verified

True/False

A standard cost variance is a difference between a standard cost and an actual cost.

Correct Answer

verified

Correct Answer

verified

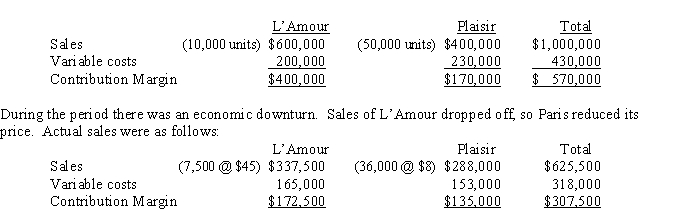

Multiple Choice

Use the following information for the next 7 questions.

Paris Perfumery sells two perfumes, L'Amor and Plaisir. The expected sales mix is one bottle of L'Amour to five bottles of Plaisir. Planned sales and variable costs for last period were as follows:  -(Appendix 11A) The contribution margin sales mix variance was

-(Appendix 11A) The contribution margin sales mix variance was

A) $11,330 F

B) $9,150 U

C) $9,150 F

D) $10,250 U

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 4 questions.

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:  -The fixed overhead production volume variance was

-The fixed overhead production volume variance was

A) $15,000 F

B) $20,000 U

C) $10,000 F

D) $10,000 U

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 2 questions.

Bellingham, Inc. incurred the following during a recent period:  -(Appendix 11A) Contribution margin sales volume variance can be further subdivided into

-(Appendix 11A) Contribution margin sales volume variance can be further subdivided into

A) Contribution margin budget variance and contribution margin variance

B) Contribution margin variance and contribution margin sales mix variance

C) Contribution margin sales quantity variance and contribution margin sales mix variance

D) Contribution margin sales quantity variance and contribution margin budget variance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 5 questions.

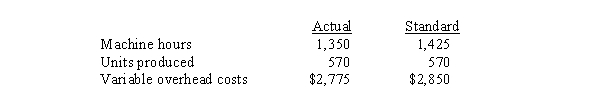

Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:  -The variable overhead spending variance is

-The variable overhead spending variance is

A) $930 Favorable

B) $2,070 Unfavorable

C) $33,000 Unfavorable

D) $33,000 Favorable

Correct Answer

verified

Correct Answer

verified

True/False

Variance analysis is used for monitoring and performance evaluation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for the next 3 questions. Anacortes, Inc. uses a standard cost system. At the beginning of the year, it budgeted $50,000 for fixed overhead. The estimated variable overhead allocation rate was $3.30 per machine hour, and machine hours is the cost allocation base for both variable and fixed overhead. The static budget was based on 16,000 units of production and sales, and each unit was expected to use 2.5 machine hours. Actual total overhead was $170,000, and Anacortes produced and sold 15,000 units during the year. Actual machine hours for the year were 36,000. -(Appendix 11A) The contribution margin sales mix variance will be unfavorable when the

A) Actual sales in total units is less than total unit sales in the static budget

B) Actual contribution margin is less than the static budget contribution margin

C) Actual sales mix includes a lower proportion of the product with the highest contribution margin per unit than its proportion in the static budget sales mix

D) Actual average selling price is less than the average selling price in the static budget

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LST Corporation entered into a new contract with one of its raw material suppliers. The new contract required the supplier to deliver raw materials with a 24-hour notice from LST. This reduces LST's material handling costs, but has increased the cost of the raw materials delivered. Which of the following variances is most likely to result?

A) Unfavorable direct material price variance

B) Favorable direct price variance

C) Unfavorable variable overhead spending variance

D) Unfavorable fixed overhead spending variance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

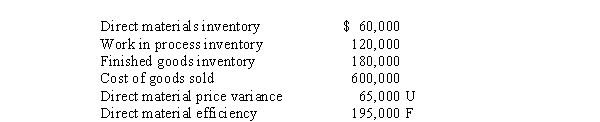

Use the following information for the next 2 questions.

Given the following account balances at the end of the first year of operations:  -Assuming that variances are considered material, the entry and amount of the direct material price variance allocated to Cost of Goods Sold is

-Assuming that variances are considered material, the entry and amount of the direct material price variance allocated to Cost of Goods Sold is

A) Debit $40,625

B) Debit $41,082

C) Credit $43,333

D) Debit $39,935

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 126

Related Exams