Correct Answer

verified

Correct Answer

verified

True/False

Dividends in arrears are liabilities of the corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate board of directors does not generally

A) select officers.

B) formulate operating policies.

C) declare dividends.

D) execute policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sizemore, Inc. has 10,000 shares of 5%, $100 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2014. If the board of directors declares a $30,000 dividend, the

A) preferred stockholders will receive 1/10th of what the common stockholders will receive.

B) preferred stockholders will receive the entire $30,000.

C) $30,000 will be held as restricted retained earnings and paid out at some future date.

D) preferred stockholders will receive $15,000 and the common stockholders will receive $15,000.

Correct Answer

verified

Correct Answer

verified

Short Answer

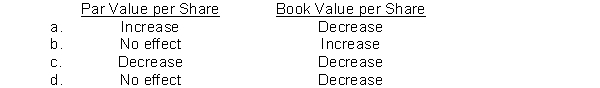

Identify the effect the declaration of a stock dividend has on the par value per share and book value per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements about preferred stock are true except

A) preferred stock will have a paid-in capital account that is separate from other stock.

B) preferred stock is presented first on the stockholder's equity section.

C) preferred stock can be either par value or no-par value.

D) there can be only one class of preferred stock.

Correct Answer

verified

Correct Answer

verified

Essay

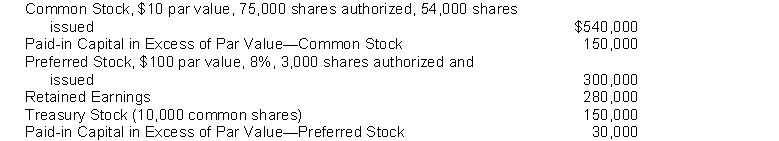

The following are selected accounts and balances from the records of Doran Corporation on June 30, 2014.  Instructions

Prepare in proper form the stockholders' equity section of the balance sheet.

Instructions

Prepare in proper form the stockholders' equity section of the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan Corporation issues 50,000 shares of $50 par value preferred stock for cash at $60 per share. The entry to record the transaction will consist of a debit to Cash for $3,000,000 and a credit or credits to

A) Preferred Stock for $3,000,000.

B) Preferred Stock for $2,500,000 and Paid-in Capital in Excess of Par Value-Preferred Stock for $500,000.

C) Preferred Stock for $2,500,000 and Retained Earnings for $500,000.

D) Paid-in Capital from Preferred Stock for $3,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total stockholders' equity based on the following account balances?

A) $1,000,000.

B) $975,000.

C) $950,000.

D) $800,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Watson, Inc. has 10,000 shares of 6%, $100 par value, cumulative preferred stock and 20,000 shares of $1 par value common stock outstanding at December 31, 2014. There were no dividends declared in 2012. The board of directors declares and pays a $100,000 dividend in 2013 and in 2014. What is the amount of dividends received by the common stockholders in 2014?

A) $20,000.

B) $60,000.

C) $100,000.

D) $0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation purchases 20,000 shares of its own $10 par common stock for $25 per share, recording it at cost. What will be the effect on total stockholders' equity?

A) Increase by $200,000.

B) Decrease by $500,000.

C) Increase by $500,000.

D) Decrease by $200,000.

Correct Answer

verified

Correct Answer

verified

Essay

On November 1, 2014, Kalen Corporation's stockholders' equity section is as follows:  On November 1, Kalen declares and distributes a 15% stock dividend when the market value of the stock is $16 per share.

Instructions

Indicate the balances in the stockholders' equity accounts after the stock dividend has been distributed.

On November 1, Kalen declares and distributes a 15% stock dividend when the market value of the stock is $16 per share.

Instructions

Indicate the balances in the stockholders' equity accounts after the stock dividend has been distributed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The chief accounting officer in a company is known as the

A) controller.

B) treasurer.

C) vice-president.

D) president.

Correct Answer

verified

Correct Answer

verified

Essay

Manning Company has $1,000,000 in assets and $1,000,000 in stockholders' equity, with 50,000 shares outstanding the entire year. It has a return on assets ratio of 9%. In the past year it had net income of $75,000. On January 1, 2014, it issued $300,000 in debt at 5% and immediately repurchased 25,000 shares for $300,000. Management expected that, had it not issued the debt, it would have again had net income of $75,000. Instructions (a) Determine the Company's net income and earnings per share for 2013 and 2014. (Ignore taxes in your computations.) (b) Compute the Company's return on common stockholders' equity for 2013 and 2014. (c) Compute the company's debt to assets ratio for 2013 and 2014.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

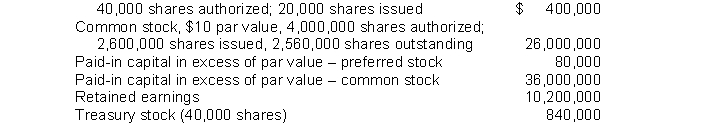

Racer Corporation's December 31, 2014 balance sheet showed the following: 8% preferred stock, $20 par value, cumulative,  Racer's total paid-in capital was

Racer's total paid-in capital was

A) $62,480,000.

B) $63,320,000.

C) $61,640,000.

D) $36,080,000.

Correct Answer

verified

Correct Answer

verified

True/False

A liability arises when the board of directors declares a stock dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If no-par stock is issued without a stated value, then

A) the par value is automatically $1 per share.

B) the entire proceeds are considered to be legal capital.

C) there is no legal capital.

D) the corporation is automatically in violation of its state charter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of directors must assign a per share value to a stock dividend declared that is

A) greater than the par or stated value.

B) less than the par or stated value.

C) equal to the par or stated value.

D) at least equal to the par or stated value.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is not an entity that is separate and distinct from its owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the board of directors authorizes a $100,000 restriction of retained earnings for a future plant expansion, the effect of this action is to

A) decrease total assets and total stockholders' equity.

B) increase stockholders' equity and to decrease total liabilities.

C) decrease total retained earnings and increase total liabilities.

D) reduce the amount of retained earnings available for dividend declarations.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 263

Related Exams