A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the economy is in a mild recession, and as a result interest rates and money costs generally are relatively low. The WACC for two mutually exclusive projects that are being considered is 8%. Project S has an IRR of 20% while Project L's IRR is 15%. The projects have the same NPV at the 8% current WACC. However, you believe that the economy is about to recover, and money costs and thus your WACC will also increase. You also think that the projects will not be funded until the WACC has increased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following statements is CORRECT?

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

C) You should recommend Project L, because at the new WACC it will have the higher NPV.

D) You should recommend Project S, because at the new WACC it will have the higher NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An NPV profile graph shows how a project's payback varies as the cost of capital changes.

B) The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases.

C) An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life.

D) An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then the MIRR will be less than the IRR.

D) If a project's IRR is greater than its WACC, then the MIRR will be greater than the IRR.

E) To find a project's MIRR, we compound cash inflows at the IRR and then discount the terminal value back to t = 0 at the WACC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

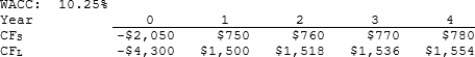

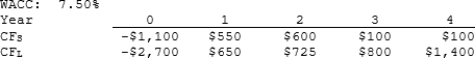

Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

Correct Answer

verified

Correct Answer

verified

True/False

In theory, capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital. The decision criterion should not be affected by managers' tastes, choice of accounting method, or the profitability of other independent projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project has "normal" cash flows, then its IRR must be positive.

B) If a project has "normal" cash flows, then its MIRR must be positive.

C) If a project has "normal" cash flows, then it will have exactly two real IRRs.

D) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

E) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

Correct Answer

verified

Correct Answer

verified

True/False

The regular payback method is deficient in that it does not take account of cash flows beyond the payback period. The discounted payback method corrects this fault.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR.

C) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the risk-free rate.

D) The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

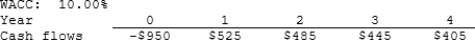

Warr Company is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 14.05%

B) 15.61%

C) 17.34%

D) 19.27%

E) 21.20%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is choosing between two projects. The larger project has an initial cost of $100,000, annual cash flows of $30,000 for 5 years, and an IRR of 15.24%. The smaller project has an initial cost of $50,000, annual cash flows of $16,000 for 5 years, and an IRR of 16.63%. The projects are equally risky. Which of the following statements is CORRECT?

A) Since the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC.

B) Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC.

C) If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is.

D) Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thorley Inc. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 9.43%

B) 9.91%

C) 10.40%

D) 10.92%

E) 11.47%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

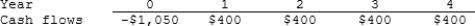

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose?

A) $188.68

B) $198.61

C) $209.07

D) $219.52

E) $230.49

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Masulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?

A) 1.61 years

B) 1.79 years

C) 1.99 years

D) 2.22 years

E) 2.44 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mansi Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 1.91 years

B) 2.12 years

C) 2.36 years

D) 2.59 years

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that their NPVs based on the firm's cost of capital are equal, the NPV of a project whose cash flows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a project whose cash flows come in later in its life.

Correct Answer

verified

Correct Answer

verified

True/False

Both the regular and the modified IRR (MIRR) methods have wide appeal to professors, but most business executives prefer the NPV method to either of the IRR methods.

Correct Answer

verified

Correct Answer

verified

True/False

Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one first. In theory, such conflicts should be resolved in favor of the project with the higher positive NPV.

Correct Answer

verified

Correct Answer

verified

True/False

For a project with one initial cash outflow followed by a series of positive cash inflows, the modified IRR (MIRR) method involves compounding the cash inflows out to the end of the project's life, summing those compounded cash flows to form a terminal value (TV), and then finding the discount rate that causes the PV of the TV to equal the project's cost.

Correct Answer

verified

Correct Answer

verified

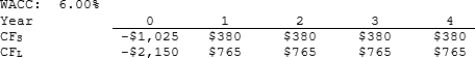

Multiple Choice

Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost.

A) $138.10

B) $149.21

C) $160.31

D) $171.42

E) $182.52

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams