A) A fall in the dollar price of foreign currency

B) An increase in the dollar price of foreign currency

C) A loss of foreign-exchange reserves for the U.S.

D) An intervention in the international money market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

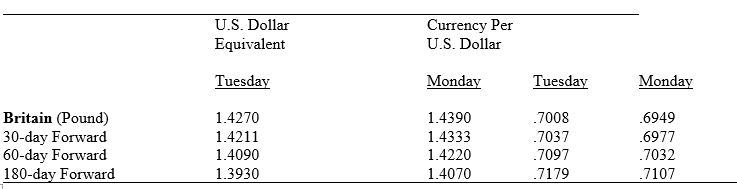

Table 11.1 gives the exchange rate quotations for the U.S.dollar and the British pound.

Table 11.1.Foreign Exchange Quotations

-Consider Table 11.1.If one were to buy pounds for immediate delivery,on Tuesday the dollar cost of each pound would be:

-Consider Table 11.1.If one were to buy pounds for immediate delivery,on Tuesday the dollar cost of each pound would be:

A) $0.7008

B) $0.7037

C) $1.4211

D) $1.4270

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the real exchange rate of Japan's yen appreciates

A) the yen's nominal exchange rate must remain constant

B) the yen's nominal exchange rate must also appreciate

C) the yen's nominal exchange rate must depreciate

D) none of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the Swiss demand for dollars is inelastic,an appreciation of the dollar against the franc will lead to a greater quantity of francs being supplied to the foreign exchange market to obtain dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the interbank market for foreign exchange,the ____ refers to the difference between the offer rate and the bid rate.

A) Cross rate

B) Option

C) Arbitrage

D) Spread

Correct Answer

verified

Correct Answer

verified

True/False

If a Citibank dealer expects the Swiss franc to appreciate against the U.S.dollar,she will attempt to lower both bid and offer rates for the franc,attempting to persuade other dealers to buy francs from Citibank and dissuade other dealers from selling francs to Citibank.

Correct Answer

verified

Correct Answer

verified

True/False

If Chase Manhattan Bank quotes bid and offer rates for the Swiss franc at $.5250/$.5260,the bank would realize profits of $1,000 on the purchase and sale of 1 million francs.

Correct Answer

verified

Correct Answer

verified

True/False

The demand schedule for Swiss francs is always downsloping while the supply schedule of francs is always upsloping.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 11.1 Assume the following: (1) the interest rate on 6-month treasury bills is 8 percent per annum in the United Kingdom and 4 percent per annum in the United States; (2) today's spot price of the pound is $1.50 while the 6-month forward price of the pound is $1.485. -Assume that you are the Chase Manhattan Bank of the United States,and you have 1 million Swiss francs in your vault that you will need to use in 30 days.Moreover,you need 500,000 British pounds for the next 30 days.You arrange to loan your francs to Barclays Bank of London for 30 days in exchange for 500,000 pounds today,and reverse the transaction at the end of 30 days.You have just arranged a:

A) Forward contract

B) Futures contract

C) Spot contract

D) Currency swap

Correct Answer

verified

Correct Answer

verified

True/False

If the dollar's real exchange rate index increases,American products become more affordable to foreign buyers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The pound shows a forward premium against the dollar (the forward rate is greater than the spot rate) when

A) interest rates in the United Kingdom are higher than those in the United States

B) interest rates in the United Kingdom are lower than those in the United States

C) real GDP is higher in the United Kingdom than in the United States

D) real GDP is lower in the United Kingdom than in the United States

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the dollar price of other currencies tends to cause:

A) U.S.goods to be cheaper than foreign goods

B) U.S.goods to be more expensive than foreign goods

C) Foreign goods to be more expensive to residents of foreign nations

D) Foreign goods to be cheaper to residents of the United States

Correct Answer

verified

Correct Answer

verified

True/False

International investors who hedge against exchange rate risk often use currency forward contracts.

Correct Answer

verified

Correct Answer

verified

True/False

A commercial bank profits from foreign-exchange trading when its bid rate exceeds its offer rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not induce the U.S.demand curve for foreign exchange to shift backward to the left?

A) Worsening American tastes for goods produced overseas

B) Decreasing interest rates in the U.S.compared to those overseas

C) A fall in the level of U.S.income

D) A depreciation in the U.S.dollar against foreign currencies

Correct Answer

verified

Correct Answer

verified

Multiple Choice

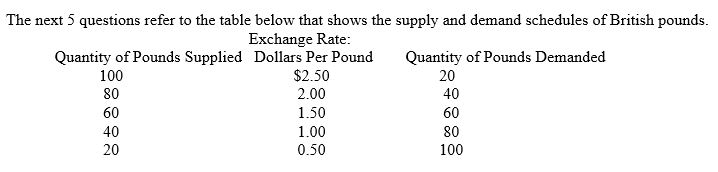

-In the table above,a change in the ______ will result in a movement along the demand schedule for pounds

-In the table above,a change in the ______ will result in a movement along the demand schedule for pounds

A) dollar/pound exchange rate

B) rate of interest in the United States

C) per-capita income of Americans

D) level of technology in the United States

Correct Answer

verified

Correct Answer

verified

True/False

A person needing foreign exchange immediately would purchase it on the spot market.

Correct Answer

verified

Correct Answer

verified

True/False

If it takes $1.5515 to buy 1 pound and $0.6845 to buy 1 franc,it takes 2.27 francs to buy 1 pound.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Concerning foreign exchange trading,wholesale transactions involving more than 1 million currency units generally

A) occur between banks or with large corporate customers

B) occur only in Hong Kong and Frankfurt

C) are limited to transactions in the spot market

D) are limited to transactions in the forward market

Correct Answer

verified

Correct Answer

verified

True/False

Most foreign exchange transactions involve the transfer of cash,rather than electronic balances,between commercial banks or foreign exchange dealers.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 206

Related Exams