A) $91,000

B) $128,199

C) $77,650

D) $48,199

Correct Answer

verified

Correct Answer

verified

True/False

All cash inflows are taxable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

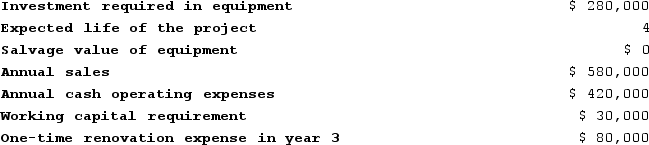

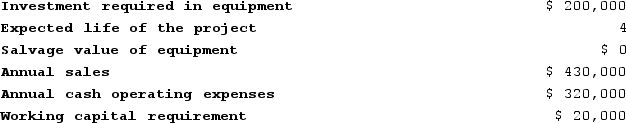

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

A) $196,000

B) $61,763

C) $81,533

D) $122,469

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is pondering an investment project that has an internal rate of return which is equal to the company's discount rate. The profitability index of this investment project is:

A) 0.0

B) 0.5

C) 1.0

D) 1.5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trovato Corporation is considering a project that would require an investment of $56,000. No other cash outflows would be involved. The present value of the cash inflows would be $66,640. The profitability index of the project is closest to (Ignore income taxes.) :

A) 0.81

B) 0.19

C) 1.19

D) 0.16

Correct Answer

verified

Correct Answer

verified

Multiple Choice

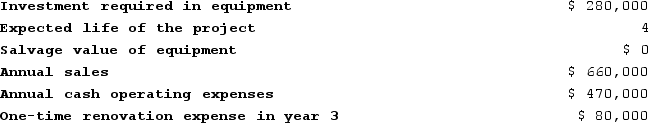

Rollans Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A) $105,000

B) $39,000

C) $180,000

D) $24,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

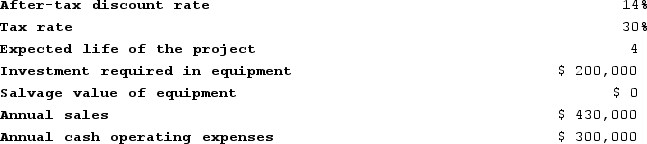

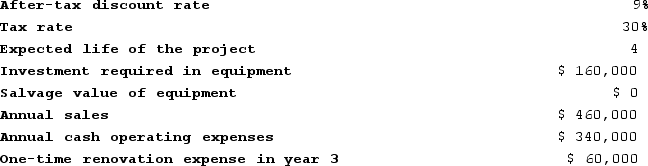

Reye Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the entire project is closest to:

A) $92,148

B) $150,450

C) $77,988

D) $168,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hinger Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $350,000 and annual incremental cash operating expenses would be $250,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 11%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 2 is:

A) $49,000

B) $100,000

C) $79,000

D) $70,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suddeth Corporation has entered into a 6 year lease for a building it will use as a warehouse. The annual payment under the lease will be $2,468. The first payment will be at the end of the current year and all subsequent payments will be made at year-ends. If the discount rate is 5%, the present value of the lease payments is closest to (Ignore income taxes.) :Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. (Round your intermediate calculations to 3 decimal places.)

A) $12,528

B) $14,103

C) $14,808

D) $11,050

Correct Answer

verified

Correct Answer

verified

Multiple Choice

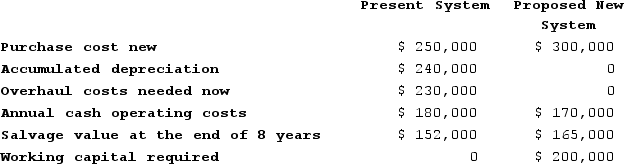

Westland College has a telephone system that is in poor condition. The system either can be overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives (Ignore income taxes.) :  Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Westland College uses a 10% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. The working capital would be released for use elsewhere when the project is completed.The net present value of the alternative of purchasing the new system is closest to:

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Westland College uses a 10% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. The working capital would be released for use elsewhere when the project is completed.The net present value of the alternative of purchasing the new system is closest to:

A) $(1,076,495)

B) $(1,236,495)

C) $(1,169,895)

D) $(969,895)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

A) $118,520

B) $224,000

C) $278,520

D) $150,944

Correct Answer

verified

Correct Answer

verified

Multiple Choice

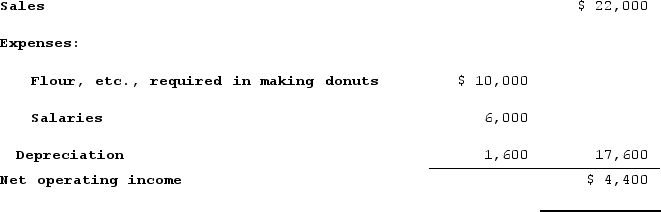

Fast Food, Incorporated, has purchased a new donut maker. It cost $16,000 and has an estimated life of 10 years. The following annual donut sales and expenses are projected (Ignore income taxes.) :  Assume cash flows occur uniformly throughout a year except for the initial investment.The simple rate of return for the new machine is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment.The simple rate of return for the new machine is closest to:

A) 20%

B) 37.5%

C) 27.5%

D) 80.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

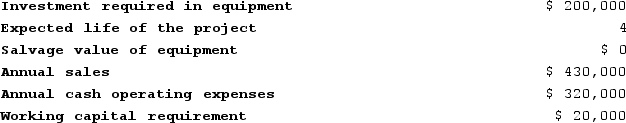

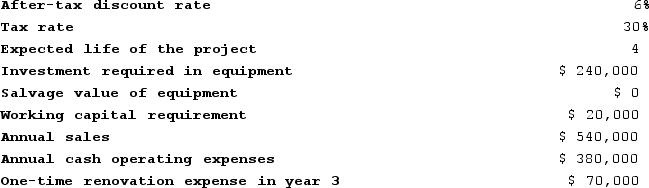

Vanzant Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

A) $30,000

B) $21,000

C) $9,000

D) $48,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

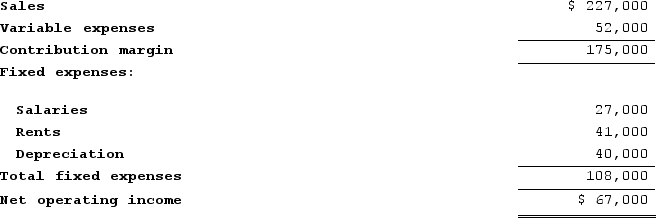

Olinick Corporation is considering a project that would require an investment of $343,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.) :  The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A) 3.0 years

B) 5.1 years

C) 3.2 years

D) 4.8 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year the sales at Summit Corporation were $400,000 and were all cash sales. The expenses at Summit were $250,000 and were all cash expenses. The tax rate was 30%. The after-tax net cash inflow at Summit last year was:

A) $150,000

B) $45,000

C) $105,000

D) $400,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reye Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A) $129,000

B) $15,000

C) $18,000

D) $96,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paletta Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

A) $98,000

B) $110,000

C) $74,000

D) $154,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rhoads Corporation is considering a capital budgeting project that would require an investment of $160,000 in equipment with a 4-year expected life and zero salvage value. Annual incremental sales will be $460,000 and annual incremental cash operating expenses will be $330,000. The company's income tax rate is 30% and the after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $40,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1 to determine the appropriate discount factor(s) using table.The net present value of the project is closest to:

A) $178,252

B) $252,000

C) $97,040

D) $134,168

Correct Answer

verified

Correct Answer

verified

True/False

The salvage value of new equipment should not be considered when using the internal rate of return method to evaluate a project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ataxia Fitness Center is considering an investment in some additional weight training equipment. The equipment has an estimated useful life of 11 years with no salvage value at the end of the 11 years. Ataxia's internal rate of return on this equipment is 6%. Ataxia's discount rate is also 6%. The payback period on this equipment is closest to (Ignore income taxes.) :Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.

A) 11 years

B) 7.887 years

C) 6 years

D) 8.987 years

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 405

Related Exams