A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Operating Activities

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Balance Sheet

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income is the amount:

A) the company earned after subtracting expenses and dividends from revenue.

B) by which assets exceed expenses.

C) by which assets exceed liabilities.

D) by which revenues exceed expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If total liabilities decreased by $50,000 and stockholders' equity increased by $10,000 during a period of time,then total assets must change by what amount and direction during that same time period?

A) $40,000 increase

B) $40,000 decrease

C) $60,000 increase

D) $60,000 decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A creditor might look at a company's financial statements to determine if the:

A) company is likely to have the resources to repay its debts.

B) company's stock price is likely to fall,signaling a good time to sell.

C) company's stock price is likely to rise,signaling a good time to buy.

D) company pays a dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's financial records at the end of the year included the following amounts: What is the amount of net income on the income statement for the year?

A) $30,000

B) $38,000

C) $88,000

D) $47,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial statement information is correct?

A) If a company has total revenues of $80,000,total expenses of $50,000 and dividends of $10,000,they will have net income of $20,000.

B) A company with total stockholders' equity of $45,000 and total assets of $75,000 must have total liabilities of $120,000.

C) A company with liabilities of $80,000 and stockholders' equity of $50,000 will have assets of $30,000.

D) A company with total stockholders' equity of $120,000 and common stock of $75,000 must have total retained earnings of $45,000.

Correct Answer

verified

Correct Answer

verified

Essay

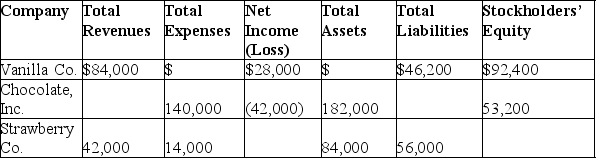

Each of the following independent companies is missing numerical data.

Required:

Use your knowledge of the financial statement equations and their interrelationships to fill in the missing amounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of last year,the company's assets totaled $430,000 and its liabilities totaled $370,000.During the current year,the company's total assets increased by $29,000 and its total liabilities increased by $12,000.At the end of the current year,stockholders' equity was:

A) $77,000.

B) $60,000.

C) $17,000.

D) $89,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear in the cash flows from operating activities section of the statement of cash flows?

A) Cash paid to suppliers and employees

B) Cash paid to purchase equipment

C) Cash paid on notes payable

D) Cash paid for dividends

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these appears on both the income statement and the statement of retained earnings?

A) Cash

B) Revenues

C) Expenses

D) Net income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the first year of operations,a company sold $80,000 of goods to customers and received $72,000 in cash from customers.The remainder is owed to the company at the end of the year.The company incurred $56,000 in expenses for the year and paid $52,000 in cash for these expenses.The remainder is owed by the company at the end of the year.Based on this information,what is the amount of net income for the year?

A) $20,000

B) $28,000

C) $16,000

D) $24,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relevance is an objective of external financial reporting that means:

A) the financial reports of a business are assumed to include the results of only that business's activities.

B) financial information can be compared across businesses because similar accounting methods have been applied.

C) the financial information possesses a feature that allows it to influence a decision.

D) the financial information depicts the economic substance of business activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Fin started the current year with assets of $840,000,liabilities of $420,000 and common stock of $240,000.During the current year,assets increased by $480,000,liabilities decreased by $60,000 and common stock increased by $330,000.There was no payment of dividends to owners during the year. What was the amount of Blue Fin's change in total stockholders' equity during the year?

A) $420,000 increase

B) $540,000 increase

C) $300,000 increase

D) $240,000 increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Every financial statement should have "who,what,and when" in its heading.These include the:

A) name of the person preparing the statement,the type of financial statement,and when the financial statement was reported to the SEC.

B) name of the person preparing the statement,the name of the company,and the date the statement was prepared.

C) name of the company,the type of financial statement,and the time period or date from which the data were taken.

D) name of the company,the purpose of the statement,and when the financial statement was reported to the IRS.

Correct Answer

verified

Correct Answer

verified

True/False

If a company reports net income on the income statement,then the statement of cash flows will report the same amount as cash flows from operating activities for the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Golden Enterprises started the year with the following: Assets $50,000;Liabilities $15,000;Common Stock $30,000;Retained Earnings $5,000.During the year,the company earned revenue of $2,500,all of which was received in cash,and incurred expenses of $1,500,all of which were unpaid as of the end of the year.In addition,the company paid dividends of $500 to owners.Assume no other activities occurred during the year. The amount of Golden's assets at the end of the year is:

A) $52,500.

B) $54,000.

C) $52,000.

D) $53,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from (used in) investing activities include amounts:

A) received from a company's stockholders for the sale of stock.

B) received from the sale of the company's office building.

C) paid for dividends to the company's stockholders.

D) paid for salaries of employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner(s) of a business are not taxed on the profits of the business if the business is a:

A) sole proprietorship.

B) partnership.

C) corporation.

D) public partnership.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 228

Related Exams