Correct Answer

verified

Correct Answer

verified

Multiple Choice

An arrangement where receivables are sold to another company for immediate cash is called:

A) factoring.

B) leasing.

C) depreciating.

D) Renting.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grandview Grinding,Inc.had net accounts receivable of $135,800 at the beginning of the year and $144,800 at the end of the year.If the company's net sales revenue during the year was $1,753,750,what is the receivables turnover ratio?

A) 12.5

B) 29.2

C) 0.08

D) 0.034

Correct Answer

verified

Correct Answer

verified

True/False

Under the allowance method for uncollectible accounts,the write-off of a specific account will not affect total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest is calculated for periods shorter than a year,the formula to calculate interest is:

A) I = P × R × T,where I = interest calculated,P = principal,R = annual interest rate,and T = number of months.

B) I = P × R × T,where I = interest calculated,P = principal,R = annual interest rate,and T = (number of months ÷ 12) .

C) I = P × R × T,where I = interest calculated,P = principal,R = monthly interest rate,and T = (number of months ÷ 12) .

D) I = (MV − P) /T,where I = interest calculated,MV = maturity value,P = principal and T = number of months.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The days to collect receivables increased from 32 days last year to 48 days this year.Which of the following statements is correct?

A) The company is likely to see its Bad Debt Expense decrease.

B) The company is becoming more efficient at collecting payment.

C) The receivables turnover rate must have increased from last year to this year.

D) The receivables turnover rate decreased from approximately 11.4 to 7.6 from last year to this year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1,2018,a company lends a new employee $20,000 to assist with her relocation expenses.The employee signs a 6-month note,with interest of 9%.The company prepares year-end financial statements at December 31.What is the required adjusting entry at December 31 as a result of this note transaction?

A) Debit Interest Revenue and credit Interest Receivable for $900.

B) Debit Interest Receivable and credit Interest Revenue for $900.

C) Debit Interest Revenue and credit Interest Receivable for $150.

D) Debit Interest Receivable and credit Interest Revenue for $150.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Portillo,Inc.lends a corporate customer $240,000 at 6% interest.The amount of interest revenue that should be recorded for the quarter ending March 31 equals:

A) $14,400.

B) $3,600.

C) $1,200.

D) $4,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best,Inc.loaned $100,000 for three months on November 1 to one of its customers at the rate of 6%.The principal amount of the loan plus interest is due on the following February 1.The related adjusting entry was recorded on December 31.What is the amount of interest revenue that should be included in the entry dated February 1?

A) 0

B) $2,000

C) $1,000

D) $500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Knoll Manufacturing lends its supplier $300,000 for 3 years at a 6% annual interest rate.Interest payments are to be made twice a year.Each interest payment will be for:

A) $18,000.

B) $27,000.

C) $9,000.

D) $54,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best,Inc.loaned $100,000 for three months on November 1 to one of its customers at the rate of 6%.The principal amount of the loan plus interest is due on the following February 1.Which of the following is the adjusting journal entry that will be recorded on December 31?

A) Debit Cash and credit Interest Revenue for $4,000.

B) Debit Interest Receivable and credit Interest Revenue for $4,000.

C) Debit Interest Receivable and credit Interest Revenue for $1,000.

D) Debit Interest Receivable and credit Interest Revenue for $500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

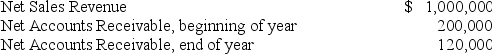

The financial statements of Pomegranate Produce contained the following information:  The average length of time it takes for Pomegranate Produce to collect accounts receivable is approximately:

The average length of time it takes for Pomegranate Produce to collect accounts receivable is approximately:

A) 120 days.

B) 72 days.

C) 84 days.

D) 58 days.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Katy Company uses the allowance method.Katy writes off a customer account balance when it becomes clear that the particular customer will never pay.How will this write-off affect the company's net income and accounts receivable turnover ratio?

A) Net income and the account receivable turnover ratio will both decrease.

B) Net income will decrease;the account receivable turnover ratio will not change.

C) Net income will not change;the account receivable turnover ratio will decrease.

D) Net income will not change;the account receivable turnover ratio will not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Allowance for Doubtful Accounts has a $1,000 debit balance prior to making the end-of-period adjusting entry for bad debts using the aging of accounts receivable method,then it must mean that the:

A) debit to Bad Debt Expense will be $1,000 more than the desired ending balance in the Allowance for Doubtful Accounts.

B) debit to Bad Debt Expense will be $1,000 less than if the Allowance balance had been $0.

C) direct write-off method was used.

D) percentage of sales method was used.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Maturity Date

A) The portion of Accounts Receivable that the company expects to collect.

B) The time at which a loan must be repaid.

C) An agreement by a borrower to repay the lending company with interest during a specified time period.

D) The days of the year divided by the net sales revenue.

E) A financial statement that shows the calculation of Bad Debt Expense for a company.

F) Total money owed the company for sales made on credit.

G) An account that is debited for the amount of credit sales estimated as uncollectible.

H) A contra-asset account.

I) The time at which a borrower must make annual interest payments.

J) Net credit sales revenue divided by the average net receivables.

K) Net credit sales revenue divided by the net income.

L) The days of the year divided by the receivables turnover ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the Hart Company uses the allowance method.When the company writes off a customer's account balance that has no chance of collection:

A) total assets will decrease.

B) total liabilities will increase.

C) expenses and revenues will both increase.

D) total assets do not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company uses the aging of accounts receivable method.Net credit sales are unchanged from last year,the year-end balance in Accounts Receivable is unchanged from the previous year's ending balance,and there were no write-offs during the current year.The company previously averaged about 20% of its total accounts receivable in the "over 90 days past due" category and now has 35% in this category at the end of the current year.The dollar amount of the adjustment to record Bad Debt Expense in the current year:

A) declines,thus increasing the ending balance of the Allowance for Doubtful Accounts account.

B) increases,thus increasing the ending balance of the Allowance for Doubtful Accounts account.

C) declines,thus reducing the ending balance of the Allowance for Doubtful Accounts account.

D) increases,thus reducing the ending balance of the Allowance for Doubtful Accounts account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Although there are some clear disadvantages associated with extending credit to customers,such as bad debt costs,most managers believe a particular advantage outweighs the costs.To which primary advantage do they refer?

A) Increased labor costs

B) Increased bad debt expense

C) Delayed receipt of cash

D) Additional sales revenue

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1,Cents,Inc.lent $1,000 to an employee at a rate of 6% for 3 months.The entry to record the loan of $1,000 to its employee includes a:

A) credit to Cash of $1,000.

B) debit to Cash of $1,000.

C) credit to Notes Receivable of $1,000.

D) credit to Interest Revenue of $15.

E) debit to Interest Revenue of $15.

Correct Answer

verified

Correct Answer

verified

True/False

The decision to sell to extend credit to customers will decrease wage costs.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 240

Related Exams