Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the consumer price index (CPI) for Year X is 130. This means the average price of goods and services is:

A) currently $130.

B) 130 percent more in Year X than in the base year.

C) 130 percent more in the base year than in Year X.

D) priced at 30 percent more in Year X than in the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As inflation drives up prices, people attempt to find substitutes and adjust what they buy. The resulting substitution bias problem causes the CPI to:

A) overstate the impact of higher prices on consumers.

B) consistently underestimate the true inflation rate.

C) omit the benefits of product quality improvements.

D) have larger fluctuations than other price indexes.

Correct Answer

verified

Correct Answer

verified

True/False

The consumer price index (CPI) includes only a market basket of goods and services purchased by the typical urban consumer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tina Cole and her husband bought a deferred annuity that started paying them $700 a month in retirement benefits. They, along with millions of other people who live on fixed incomes, are examples of:

A) those who are responsible for inflation.

B) the big winners from inflation.

C) the big losers from inflation.

D) the paradox of thrift.

E) stock market losers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is 5 percent and there is no inflation, then the real interest rate:

A) exceeds 5 percent.

B) is less than 5 percent.

C) is 5 percent.

D) is zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correctly defines inflation?

A) An increase in the price of a particular good or service.

B) An increase in the general (average) price level of goods and services in the economy.

C) The growth rate in real GDP.

D) None of the above.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The real interest rate is defined as the:

A) actual interest rate.

B) fixed-rate on consumer loans.

C) nominal interest rate minus the inflation rate.

D) expected interest rate minus the inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following years was inflation in the United States the highest?

A) 1960.

B) 1970.

C) 1980.

D) 1990.

E) 2007.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The base year in the consumer price index (CPI) is:

A) given a value of zero.

B) a year chosen as a reference for prices in all other years.

C) always the first year in the current decade.

D) established by law.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you received a 5 percent increase in your nominal wage. Over the year, inflation ran about 2 percent. Which of the following is true ?

A) Your real wage increased.

B) Your nominal wage decreased.

C) Both your nominal and real wages decreased.

D) Although your nominal wage rose, your real wage decreased.

Correct Answer

verified

Correct Answer

verified

True/False

Disinflation and deflation mean a decrease in the average price level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the real rate of interest is 5 percent and a lender charges a nominal interest rate of 15 percent. If a borrower expects that the rate of inflation next year will be 10 percent and the actual rate of inflation next year is 12 percent:

A) neither the borrower nor the lender benefits from inflation.

B) both the borrower and the lender lose from inflation.

C) the borrower benefits from inflation, while the lender loses from inflation.

D) the lender benefits from inflation, while the borrower loses from inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Consumer Price Index compares the:

A) prices of all goods and services in the economy compared to the prices of those goods and services in a base year.

B) prices of consumer goods and services that a household purchases to the prices of those goods and services purchased in a base year.

C) prices of producer goods and services that are made for consumers to the prices of those goods and services in a base year.

D) prices of goods and services that are purchased by producers to the prices of those goods and services in a base year.

E) prices of goods and services that are purchased by consumer manufacturers to the prices of those goods and services in a base year.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

If the consumer price index (CPI) in Year 1 was 200 and the CPI in Year 2 was 215, the rate of inflation was:

A) 215 percent.

B) 15 percent.

C) 5 percent.

D) 7.5 percent.

E) 8 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

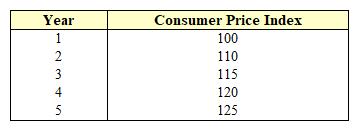

Exhibit 13-1 Consumer Price Index  As shown in Exhibit 13-1, the rate of inflation for Year 2 is:

As shown in Exhibit 13-1, the rate of inflation for Year 2 is:

A) 5 percent.

B) 10 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

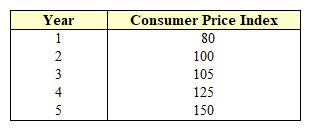

Exhibit 13-2 Consumer Price Index  As shown in Exhibit 13-2, the rate of inflation for Year 5 is:

As shown in Exhibit 13-2, the rate of inflation for Year 5 is:

A) 5 percent

B) 10 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

If the consumer price index in Year 1 was 200 and the CPI for Year 2 was 230, the rate of inflation was:

A) 15 percent.

B) 7.5 percent.

C) 30 percent.

D) 230 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hyperinflation refers to a situation in which:

A) prices are rising extremely rapidly.

B) prices are falling extremely rapidly.

C) the price level is extremely high.

D) the price level is extremely low.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Losers from inflation include:

A) savers and borrowers.

B) landlords and the government.

C) borrowers and the government.

D) those on a fixed income and borrowers.

E) those on a fixed income and savers.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 131

Related Exams