A) Excess reserves = total reserves minus required reserves.

B) Required reserves = the minimum reserves required by the Fed.

C) Required reserve ratio = required reserves as a percentage to total deposits.

D) All of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Federal Reserve System wants to increase the money supply, which of the following actions would the Fed choose?

A) It purchases U.S. government securities.

B) It increases the discount rate.

C) It increases the required reserve ratio.

D) It sells bonds on the open market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

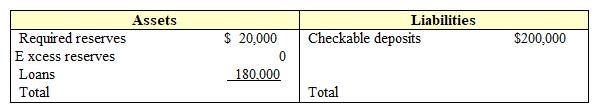

Exhibit 19-6 Balance sheet of Tucker National Bank  Suppose Connie Rich deposits $100,000 into her checking account in the bank shown in Exhibit 19-6. The result would be a:

Suppose Connie Rich deposits $100,000 into her checking account in the bank shown in Exhibit 19-6. The result would be a:

A) zero change in required reserves.

B) $10,000 increase in required reserves.

C) $100,000 increase in required reserves.

D) $20,000 increase in excess reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

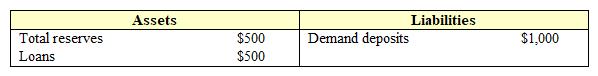

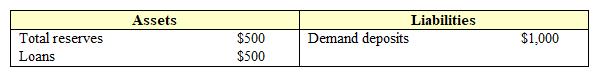

Exhibit 19-2 Balance Sheet of Springfield National Bank  In Exhibit 19-2, if Springfield National has excess reserves equal to $300, and the required reserve ratio increases to 35 percent, it will:

In Exhibit 19-2, if Springfield National has excess reserves equal to $300, and the required reserve ratio increases to 35 percent, it will:

A) be able to cover its increased reserve requirements from its excess reserves.

B) have to call in loans worth $350.

C) have to call in loans worth $250.

D) have to call in loans worth $200.

E) have to call in loans worth $150.

Correct Answer

verified

Correct Answer

verified

True/False

Reserve of banks appears on their balance sheet as liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money multiplier equals:

A) 1/excess reserves.

B) excess reserves/loans.

C) required reserve ratio/excess reserves.

D) 1/actual reserves.

E) 1/required reserve ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 19-2 Balance Sheet of Springfield National Bank  In Exhibit 19-2, if Springfield National finds that it has excess reserves of $300, then the required reserve ratio must be:

In Exhibit 19-2, if Springfield National finds that it has excess reserves of $300, then the required reserve ratio must be:

A) 30 percent.

B) 0.30 percent.

C) 0.80 percent.

D) 0.20 percent.

E) 20 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Fed bought $150 million of U.S. securities from security dealers. The reserve requirement is 20 percent, and there are no initial excess reserves. A few weeks later, if the public's holdings of currency are constant and the banks have loaned all excess reserves, the money supply will increase by:

A) $150 million.

B) $300 million.

C) $600 million.

D) $750 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

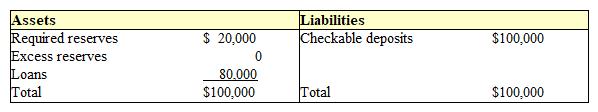

Exhibit 19-3 Balance sheet of Tucker National Bank  Assume all banks in the system started with balance sheets as shown in Exhibit 19-3 and the Fed made a $100,000 open market purchase. The result would be a(n) :

Assume all banks in the system started with balance sheets as shown in Exhibit 19-3 and the Fed made a $100,000 open market purchase. The result would be a(n) :

A) $500,000 expansion of the money supply.

B) $100,000 expansion of the money supply.

C) $20,000 contraction of the money supply.

D) infinite contraction of the money supply.

E) infinite expansion of the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists estimate that the total lag for monetary policy is about:

A) 1-2 days.

B) 2 weeks to 1 month.

C) 3-12 months.

D) 2-4 years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions by the Fed would increase the money supply?

A) Reducing the required reserve ratio.

B) Selling government bonds in the open market.

C) Increasing the discount rate.

D) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is the interest rate charged by:

A) banks for loans to other banks.

B) the Fed for overnight loans.

C) the Fed for borrowed reserves.

D) the federal government on loans to member banks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed decides to engage in an open market operation to increase the money supply, what will it do?

A) Sell Treasury bonds, bills, or notes on the bond market.

B) Buy Treasury bonds, bills, or notes on the bond market.

C) Increase the required reserve ratio.

D) Increase the fed funds rate.

Correct Answer

verified

Correct Answer

verified

True/False

As discussed in the text, a bank can extend new loans equal to the amount by which its excess reserves increase.

Correct Answer

verified

Correct Answer

verified

True/False

The total lag for fiscal policy tends to be shorter than the total lag for monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed sells government securities, it:

A) lowers the cost of borrowing from the Fed, encouraging banks to make loans to the general public.

B) raises the cost of borrowing from the Fed, discouraging banks from making loans to the general public.

C) increases the amount of excess reserves that banks hold, encouraging them to make loans to the general public.

D) increases the amount of excess reserves that banks hold, discouraging them from making loans to the general public.

E) decreases the amount of excess reserves that banks hold, discouraging them from making loans to the general public.

Correct Answer

verified

Correct Answer

verified

True/False

In a simplified banking system, the money multiplier falls as the required reserve ratio decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed wishes to reduce the economy's money supply, it:

A) lowers the discount rate.

B) lowers the required reserve ratio.

C) reduces the margin requirement.

D) sells some of its government securities.

E) prints more money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a simplified banking system subject to a 10 percent required reserve ratio. If there is an initial increase in excess reserves of $90,000 and all possible loans are made, the money supply:

A) increases $90,000.

B) increases $900,000.

C) increases $990,000.

D) decreases $90,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

European banks began with which of the following?

A) Monarchs were the first bankers, lending out cash to help the poor learn a craft.

B) Churches were the first bankers, lending out cash to help the poor learn a craft.

C) Goldsmiths were the first bankers, and the paper receipts they issued for gold held on deposit became valued as money.

D) Fishermen were the first bankers, and the paper receipts they issued for the fish they stored in the hulls of their ships became valued as money.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 250

Related Exams