A) Wolken increased its short-term bank debt in 2013.

B) Wolken issued long-term debt in 2013.

C) Wolken issued new common stock in 2013.

D) Wolken repurchased some common stock in 2013.

E) Wolken had negative net income in 2013.

Correct Answer

verified

Correct Answer

verified

True/False

Its retained earnings is the actual cash that the firm has generated through operations less the cash that has been paid out to stockholders as dividends.Retained earnings are kept in cash or near cash accounts and,thus,these cash accounts,when added together,will always be equal to the firm's total retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Analysts following Armstrong Products recently noted that the company's operating net cash flow increased over the prior year,yet cash as reported on the balance sheet decreased.Which of the following factors could explain this situation?

A) The company issued new long-term debt.

B) The company cut its dividend.

C) The company made a large investment in a profitable new plant.

D) The company sold a division and received cash in return.

E) The company issued new common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Net cash flow (NCF) is defined as follows:

NCF = Net income - Depreciation and Amortization.

B) Changes in working capital have no effect on free cash flow.

C) Free cash flow (FCF) is defined as follows:

FCF = EBIT(1 - T)

+ Depreciation and Amortization

-Capital expenditures required to sustain operations

-Required changes in net operating working capital.

D) Free cash flow (FCF) is defined as follows:

FCF = EBIT(1 -T) + Depreciation and Amortization + Capital expenditures.

E) Net cash flow is the same as free cash flow (FCF) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

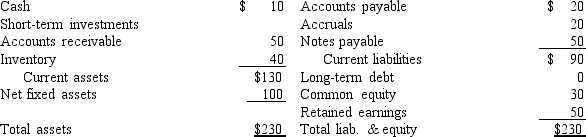

Rao Corporation has the following balance sheet.How much net operating working capital does the firm have?

A) $54.00

B) $60.00

C) $66.00

D) $72.60

E) $79.86

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On its 2012 balance sheet,Barngrover Books showed $510 million of retained earnings,and exactly that same amount was shown the following year in 2013.Assuming that no earnings restatements were issued,which of the following statements is CORRECT?

A) Dividends could have been paid in 2013, but they would have had to equal the earnings for the year.

B) If the company lost money in 2013, they must have paid dividends.

C) The company must have had zero net income in 2013.

D) The company must have paid out half of its earnings as dividends.

E) The company must have paid no dividends in 2013.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

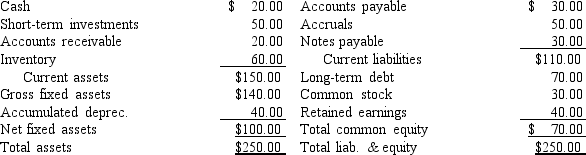

Zumbahlen Inc.has the following balance sheet.How much total operating capital does the firm have?

A) $114.00

B) $120.00

C) $126.00

D) $132.30

E) $138.92

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or tax rate.Prior to the new provision,BRB's net income after taxes was forecasted to be $4 million.Which of the following best describes the impact of the new provision on BRB's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.

A) Net fixed assets on the balance sheet will decrease.

B) The provision will reduce the company's net cash flow.

C) The provision will increase the company's tax payments.

D) Net fixed assets on the balance sheet will increase.

E) The provision will increase the company's net income.

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital is equal to operating current assets minus operating current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

NNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets.All of these assets were required in operations.The firm's current liabilities consisted of $475,000 of accounts payable,$375,000 of 6% short-term notes payable to the bank,and $150,000 of accrued wages and taxes.Its remaining capital consisted of long-term debt and common equity.What was NNR's total investor-provided operating capital?

A) $4,694,128

B) $4,941,188

C) $5,201,250

D) $5,475,000

E) $5,748,750

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The income statement for a given year, say 2012, is designed to give us an idea of how much the firm earned during that year.

B) The focal point of the income statement is the cash account, because that account cannot be manipulated by "accounting tricks."

C) The reported income of two otherwise identical firms cannot be manipulated by different accounting procedures provided the firms follow Generally Accepted Accounting Principles (GAAP) .

D) The reported income of two otherwise identical firms must be identical if the firms are publicly owned, provided they follow procedures that are permitted by the Securities and Exchange Commission (SEC) .

E) If a firm follows Generally Accepted Accounting Principles (GAAP) , then its reported net income will be identical to its reported net cash flow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Swinnerton Clothing Company's balance sheet showed total current assets of $2,250,all of which were required in operations.Its current liabilities consisted of $575 of accounts payable,$300 of 6% short-term notes payable to the bank,and $145 of accrued wages and taxes.What was its net operating working capital that was financed by investors?

A) $1,454

B) $1,530

C) $1,607

D) $1,687

E) $1,771

Correct Answer

verified

Correct Answer

verified

True/False

Total net operating capital is equal to net fixed assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits.

B) The more depreciation a firm reports, the higher its tax bill, other things held constant.

C) People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income statement, hence it is often called "the bottom line."

D) Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

E) Net cash flow (NCF) is often defined as follows:

Net Cash Flow = Net Income + Depreciation and Amortization Charges.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One way to increase EVA is to achieve the same level of operating income but with more investor-supplied capital.

B) If a firm reports positive net income, its EVA must also be positive.

C) One drawback of EVA as a performance measure is that it mistakenly assumes that equity capital is free.

D) One way to increase EVA is to generate the same level of operating income but with less investor-supplied capital.

E) Actions that increase reported net income will always increase net cash flow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Danielle's Sushi Shop last year had (1) a negative net cash flow from operations, (2) a negative free cash flow,and (3) an increase in cash as reported on its balance sheet.Which of the following factors could explain this situation?

A) The company had a sharp increase in its depreciation and amortization expenses.

B) The company had a sharp increase in its inventories.

C) The company had a sharp increase in its accrued liabilities.

D) The company sold a new issue of common stock.

E) The company made a large capital investment early in the year.

Correct Answer

verified

Correct Answer

verified

True/False

The fact that 70% of the interest income received by a corporation is excluded from its taxable income encourages firms to use more debt financing than they would in the absence of this tax law provision.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tibbs Inc.had the following data for the year ending 12/31/12: Net income = $300; Net operating profit after taxes (NOPAT) = $400; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,300.What was its return on invested capital (ROIC) ?

A) 14.91%

B) 15.70%

C) 16.52%

D) 17.39%

E) 18.26%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bartling Energy Systems recently reported $9,250 of sales,$5,750 of operating costs other than depreciation,and $700 of depreciation.The company had no amortization charges,it had $3,200 of outstanding bonds that carry a 5% interest rate,and its federal-plus-state income tax rate was 35%.In order to sustain its operations and thus generate sales and cash flows in the future,the firm was required to make $1,250 of capital expenditures on new fixed assets and to invest $300 in net operating working capital.By how much did the firm's net income exceed its free cash flow?

A) $673.27

B) $708.70

C) $746.00

D) $783.30

E) $822.47

Correct Answer

verified

Correct Answer

verified

True/False

Assets other than cash are expected to produce cash over time,but the amount of cash they eventually produce could be higher or lower than the values at which these assets are carried on the books.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 77

Related Exams