A) current revenues and current expenses

B) operating assets and operating expenses

C) current assets and current liabilities

D) current assets and long-term borrowings

Correct Answer

verified

Correct Answer

verified

Multiple Choice

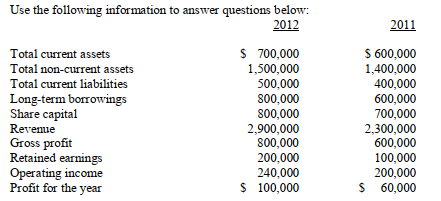

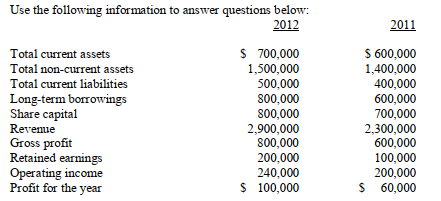

Given the following information, what is the return on equity?

A) 0.301 %

B) 3.31%

C) 30.1%

D) 331%

Correct Answer

verified

Correct Answer

verified

Short Answer

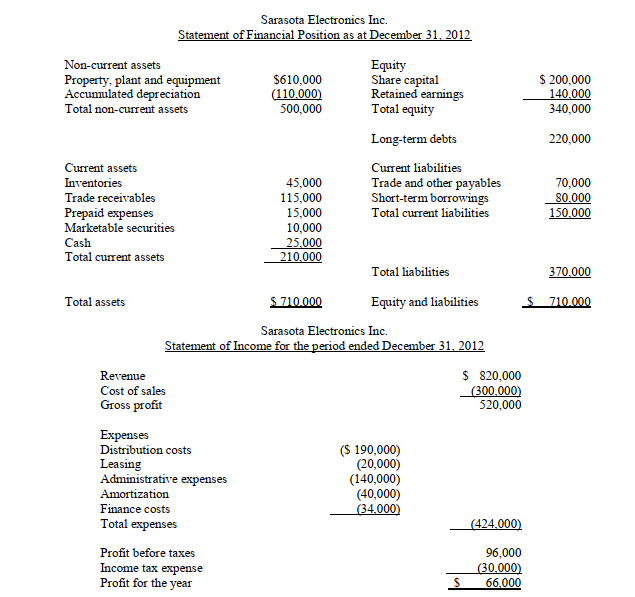

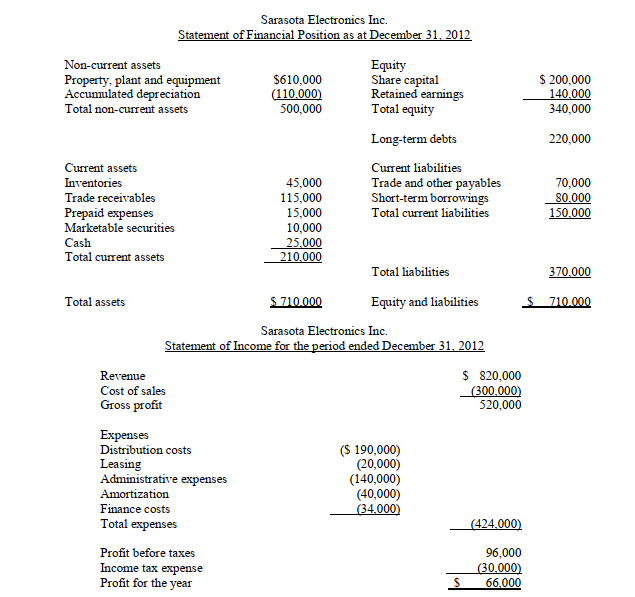

-Cost of sales: _________________

-Cost of sales: _________________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company had a total assets turnover ratio of 2.1 times this year and 2.9 last year, does the ratio seem to be getting better or worse, and why?

A) The turnover is better because the ratio is going down.

B) The turnover is worse because the ratio is going up.

C) The turnover is better because the ratio is going up.

D) The turnover is worse because the ratio is going down.

Correct Answer

verified

Correct Answer

verified

Short Answer

-Calculate the return on total assets ratio for both years:

Ratios ____________ _____________

-Calculate the return on total assets ratio for both years:

Ratios ____________ _____________

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is calculated by dividing profit before taxes + finance costs by finance costs.

Correct Answer

verified

Correct Answer

verified

Short Answer

-The quick ratio is: _________________

-The quick ratio is: _________________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company A shows revenue of $2,500 and company B shows revenue of $2,250. How is revenue shown on a vertical analysis of the statement of income?

A) 75%

B) 100%

C) $ 2,250

D) $ 2,500

Correct Answer

verified

Correct Answer

verified

Short Answer

___________________________ ratios gauge the way investors react to a company's market performance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the words with the term. -market-value ratio

A) lease

B) finance costs

C) trade receivables

D) common shares

E) revenue

Correct Answer

verified

Correct Answer

verified

Short Answer

-The return on equity ratio is:_________________

-The return on equity ratio is:_________________

Correct Answer

verified

Correct Answer

verified

True/False

Asset-management ratios help managers assess the level of profitability of a business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the words with the term. -efficiency measures

A) return

B) liquidity

C) solvency

D) prosperity

E) assets

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is a method that reduces all numbers on the statement of income to a percentage of revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the following information, what is the company's current ratio?

A) 0.44

B) 1.16

C) 2.27

D) 8.16

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these situations will a bank as lender avoid?

A) a debt-to-total assets ratio of 90%.

B) the debt-to-total-assets ratio of one to one

C) a debt-to-total assets ratio of 300% or more

D) a debt-to-total assets ratio of less than 50%

Correct Answer

verified

Correct Answer

verified

True/False

Efficiency has to do with the ability for a company to generate profit for the year relative to revenue.

Correct Answer

verified

Correct Answer

verified

Short Answer

-Calculate the return on revenue ratio for both years:

Ratios ____________ _____________

-Calculate the return on revenue ratio for both years:

Ratios ____________ _____________

Correct Answer

verified

Correct Answer

verified

Short Answer

-The return on revenue ratio is: _________________

-The return on revenue ratio is: _________________

Correct Answer

verified

Correct Answer

verified

Short Answer

-Inventories:_________________

-Inventories:_________________

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 256

Related Exams