A) Depreciation Expense if acquired January 1 is $990 and if acquired March 1 is $825.

B) Depreciation Expense if acquired January 1 is $990 and if acquired March 1 is $743.

C) In both cases, the Depreciation Expense is $990.

D) Depreciation Expense if acquired January 1 is $1080 and if acquired March 1 is $900.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is often rendered obsolete because of technological advancements?

A) Patent

B) Copyright

C) Franchise

D) Goodwill

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would NOT be considered as part of the cost of a constructed building?

A) Building permit fees

B) Contractor charges

C) Realtor commissions

D) Architectural fees

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Woods Corporation purchased $15,000 in bonds which it plans on owning until they're repaid. Woods does not anticipate that it will need to sell the bonds to generate cash. The bonds will be classified as:

A) trading securities.

B) held-to-maturity or available-for-sale.

C) held-to-maturity securities.

D) available-for-sale securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accumulated depletion is a(n) :

A) contra-asset account.

B) contra-liability account.

C) expense account.

D) cash account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

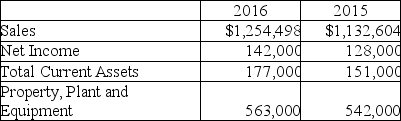

The following is selected data for Bach Co.:  The fixed asset turnover for 2016 was: (Round your final answer to two decimal places.)

The fixed asset turnover for 2016 was: (Round your final answer to two decimal places.)

A) 1.75

B) 0.20

C) 2.27

D) 0.26

Correct Answer

verified

Correct Answer

verified

True/False

Equity securities which management intends to hold for less than one year would be considered other long-term assets.

Correct Answer

verified

Correct Answer

verified

True/False

Realized gains and losses only occur when the security is sold for more or less than the original cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following marketable securities are reported at market value on the Balance Sheet date?

A) Held-to-maturities securities

B) Available-for-sale securities

C) Trading securities

D) Available-for-sale and trading securities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following securities are any increases or decreases in value reported as a separate change in Stockholders' Equity for the period?

A) Trading securities

B) Available-for sale securities

C) Held-to-maturity securities

D) Trading and held-to-maturity securities

Correct Answer

verified

Correct Answer

verified

True/False

When determining the cost of a plant asset, GAAP requires the use of the market value principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TNT Co. has the following assets: I.Timber reserves $400,000, with accumulated depletion of $220,000. II.Property, Plant and Equipment $600,000 with accumulated depreciation $275,000. III.Other long-term assets $125,000. IV.Goodwill $75,000 In what order should these be presented on the Balance Sheet?

A) I, II, IV, III

B) III, II, I, IV

C) II, I, IV, III

D) IV, II, III, I

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an asset produces more revenue in its early years, the depreciation method best suited for this asset would be the:

A) expense method.

B) units-of-production method.

C) double-declining balance method.

D) straight-line method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would NOT be considered part of the cost of machinery and equipment?

A) Repairs and maintenance after start-up

B) Delivery charges

C) Installation costs

D) In-transit insurance costs

Correct Answer

verified

Correct Answer

verified

True/False

Expenditures incurred, such as changing the oil and filter on a delivery truck, would be considered ordinary repairs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

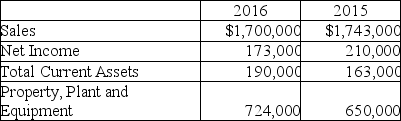

The following is selected data for Northwest Industries:  The return on assets for 2016 was: (Round your final answer two decimal places, X.XX%.)

The return on assets for 2016 was: (Round your final answer two decimal places, X.XX%.)

A) 20.03%.

B) 18.93%.

C) 23.9%.

D) 21.28%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Coyote, Inc. purchased a van for $68,000, with an estimated useful life of 5 years and a residual value of $8000. The company uses the double-declining-balance method of depreciation; however, for year 3 they switch to the straight-line method. There is no change to the estimated useful life or residual value. What is the accumulated depreciation balance at the end of year 4? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

A) $49,013

B) $59,187

C) $54,506

D) $48,000

Correct Answer

verified

Correct Answer

verified

True/False

The process of allocating the cost of intangible assets to expense is called amortization.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In accounting, what is the meaning of capitalized?

A) Capitalized means that a liability account is credited (increased) for the cost of an asset.

B) Capitalized means that an asset account is debited (increased) for the cost of an asset.

C) Capitalized means that the cost of an asset is recorded as a debit (increase) to expense.

D) Capitalized means that a given city has been selected as a government center.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered as part of the cost of purchasing an existing building?

A) Architectural fees

B) Contractor charges

C) Title transfer fees

D) Payment for materials

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 171

Related Exams