A) Because small stock dividends are recorded at market value.

B) Because large stock dividends are recorded at par value.

C) Because small stock dividends are recorded at par value.

D) Because large stock dividends are recorded at market value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

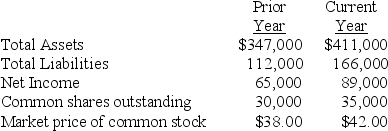

The information below was extracted from the most recent financial statements of Milton Technologies (in millions, except for stock price) :

-Use the information above to answer the following question.What is the P/E ratio for the company's stock for the current year?

-Use the information above to answer the following question.What is the P/E ratio for the company's stock for the current year?

A) 17.7

B) 15.3

C) 14.2

D) 13.9

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues 1 million shares of preferred stock with a par value of $2 at its market price of $26 per share.The issuance should be recorded with a debit to Cash for:

A) $26 million and a credit to Preferred Stock for $26 million.

B) $2 million and a credit to Preferred Stock for $2 million.

C) $26 million, a credit to Additional Paid-in Capital for $2 million, and a credit to Preferred Stock for $24 million.

D) $26 million, a credit to Preferred Stock for $2 million, and a credit to Additional Paid-in Capital for $24 million.

Correct Answer

verified

Correct Answer

verified

True/False

A company that pays no dividends is always a poor investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Par value of a stock refers to the:

A) issue price of the stock.

B) value assigned to a share of stock in the corporate charter.

C) market value of the stock.

D) maximum selling price of the stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At what governmental level are corporate charters issued?

A) State

B) Local

C) Federal

D) International

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of corporate ownership?

A) Stockholders have no liability for the debts of the corporation.

B) Ownership interests are freely transferable.

C) Shares of stock can be purchased in small increments.

D) Corporate earnings are distributed as interest payments.

Correct Answer

verified

Correct Answer

verified

True/False

One reason why a company may choose a stock split over a stock dividend is that the stock split does not reduce Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Squid Roe Company's P/E ratio is 12,which of the following statements is correct?

A) Investors are willing to pay 12 times the current year's earnings per share of stock.

B) Squid Roe's stockholders earned 12 times the owners' average investment.

C) Squid Roe's average stockholders' equity is 12 times its earnings.

D) Squid Roe's net income was 12 times its stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of debt financing over equity financing are that:

A) repayment of debt principal is optional.

B) interest payments on debt are not tax deductible.

C) control is not diluted.

D) more money is available.

Correct Answer

verified

Correct Answer

verified

Short Answer

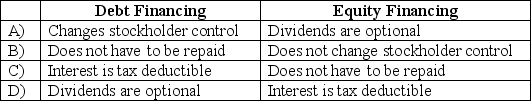

Equity and debt financing both have their advantages and disadvantages.Which of the following pairs of phrases below accurately reflect the advantages of both types of financing?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the best investment?

A) A company that pays no dividends, but has substantial net income.

B) A company that pays substantial dividends, but whose earnings per share has been declining over the past several years.

C) A company whose stock price has increased steadily, but pays no dividends.

D) It depends on one's investment objectives.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about dividends is not correct?

A) Dividends represent a sharing of corporate profits with owners.

B) Both stock dividends and cash dividends reduce Retained Earnings.

C) Cash dividends paid to stockholders reduce net income.

D) Dividends are declared at the discretion of the board of directors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported net income of $6 million.During the year the average number of common shares outstanding was 3 million.The price of a share of common stock at the end of the year was $5.There were 400,000 shares of preferred stock outstanding on average and no dividends were declared and the preferred stock is noncumulative. -Use the information above to answer the following question.The Price/Earnings ratio is approximately:

A) 2.00.

B) 2.50.

C) 2.84.

D) 12.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are a part of contributed capital except:

A) Common Stock.

B) Additional Paid-in Capital.

C) Preferred Stock.

D) Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

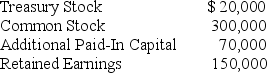

The following information is available from the accounting records of the First Corporation:

What is the amount of stockholders' equity for First Corporation?

What is the amount of stockholders' equity for First Corporation?

A) $350,000

B) $430,000

C) $500,000

D) $520,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson and O'Neill form a partnership that produces gates.Jackson provides $30,000 of capital while O'Neill contributes $90,000 of capital; they agree to split net income by the same proportion.The partnership's net income is $80,000 for the first year.They did not draw any income out of the business or add any additional capital during the first year.At the end of the year,the partners' equity is:

A) $70,000 for Jackson and $130,000 for O'Neill for a total of $200,000.

B) $200,000 minus income tax expense for the partnership.

C) $200,000 minus the income tax paid by each partner.

D) $50,000 for Jackson and $150,000 for O'Neill for a total of $200,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the par value of common stock is not correct?

A) The par value is not the same as the market value of the stock.

B) The par value is a nominal amount identified in the corporate charter.

C) The par value is the amount credited to the common stock account when the stock is issued.

D) The par value is the amount credited to common stock when treasury stock is reissued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividends Payable is recorded as a credit on the:

A) declaration date.

B) date of record.

C) date of payment.

D) last day of the fiscal year.

Correct Answer

verified

Correct Answer

verified

True/False

State laws often restrict dividends to the amount of Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 253

Related Exams