A) has too few reserves and will reduce its lending.

B) has too many reserves and will increase its lending.

C) has the correct amount of reserves and outstanding loans.

D) should increase the amount of its reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Macroland there is $1,000,000 in currency that can either be held by the public as currency or deposited into banks. Banks' desired reserve/deposit ratio is 10 percent. If the public of Macroland decides to hold more currency, increasing the proportion they hold from 50 percent to 75 percent, the money supply in Macroland will ________.

A) increase.

B) decrease.

C) remain the same.

D) either increase or decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Macroland, currency held by the public is 2,000 econs, bank reserves are 300 econs, and the desired reserve/deposit ratio is 10 percent. If the Central Bank prints an additional 200 econs and uses this new currency to buy government bonds from the public, the money supply in Macroland will increase from ________ econs to ________ econs, assuming that the public does not wish to change the amount of currency it holds.

A) 20,000; 22,000

B) 5,000; 2,000

C) 3,000; 5,000

D) 5,000; 7,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you post your car on eBay with a Buy-It-Now price of $1,800, you are using money as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct trade of goods and services for other goods and services is called:

A) financial intermediation.

B) diversification.

C) barter.

D) using a medium of exchange.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

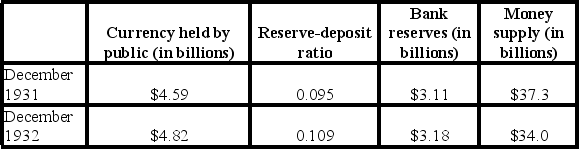

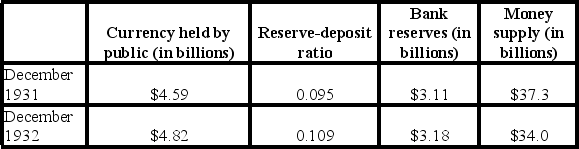

Refer to the information in the table. The amount of currency held by the public ________, and the amount of reserves held by banks ________. It must be the case that, in 1932, the Federal Reserve ________.

A) increased; also increased; increased the discount rate

B) decreased; also decreased; kept the rate of inflation low

C) decreased; increased; performed open-market operations

D) increased; also increased; injected reserves into the economy

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the Federal Reserve increases reserves in the banking system, banks create new deposits through multiple rounds of lending and accepting deposits until the:

A) Federal Reserve requires them to stop.

B) deposit insurance limit is reached.

C) actual reserve-deposit ratio is greater than the desired reserve-deposit ratio.

D) actual reserve-deposit ratio is equal to the desired reserve-deposit ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply in Econland is 1,000, and currency held by the public equals bank reserves. The desired reserve-deposit ratio is 0.25. Bank reserves equal ________.

A) 200

B) 250

C) 500

D) 800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money serves as a basic yardstick for measuring economic value (a unit of account) , allowing:

A) people to hold their wealth in a liquid form.

B) governments to restrict the issuance of private monies.

C) easy comparison of the relative prices of goods and services.

D) goods and services to be exchanged with a double coincidence of wants.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money market mutual funds are ________ the M1 measure of money and ________ the M2 measure of money.

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the public switches from using cash for most transactions to using checks instead, then all else equal, the money supply will:

A) increase.

B) decrease.

C) not change.

D) either increase or decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks hold reserves:

A) to earn interest.

B) to increase profits.

C) only because the government requires them to hold reserves.

D) to meet depositor withdrawals and payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The link between the money supply and prices is strongest in:

A) the long run.

B) the short run.

C) a recession.

D) a boom.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information in the table, the total amount of bank deposits decreased from ________ to ________ over the course of 1932.

A) $37.3 billion; $32.7 billion

B) $32.7 billion; $29.2 billion

C) $34.2 billion; $30.8 billion

D) $37.3 billion; $34.0 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you put a $20 bill in the pocket of your winter coat at the beginning of spring so that you will be surprised when you find it again next winter, you are using money as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Savings deposits are ________ the M1 measure of money and ________ the M2 measure of money.

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity equation, if velocity and output are constant, then an increase in the money supply leads to ________ in inflation.

A) a less than proportional increase

B) a less than proportional decreases

C) the same percentage increase

D) a greater than proportional increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities of the commercial banking system include:

A) reserves and loans.

B) deposits.

C) reserves and deposits.

D) loans and deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real GDP equals 3,500, nominal GDP equals 5,250, and the price level equals 1.5, then what is velocity if the money stock equals 2,100?

A) 1.66

B) 2.33

C) 2.5

D) 3

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three functions of money are:

A) spending for consumption, investment, and government purchases.

B) measuring balance of payments, exchange rates, and interest rates.

C) implementing monetary policy, fiscal policy, and structural policy.

D) serving as a medium of exchange, unit of account, and store of value.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 107

Related Exams