A) seller bias

B) buyer bias

C) government law

D) price

Correct Answer

verified

Correct Answer

verified

Multiple Choice

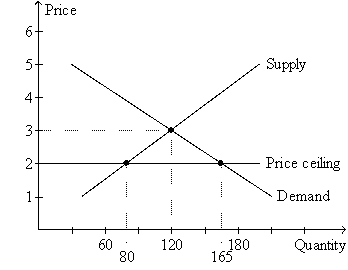

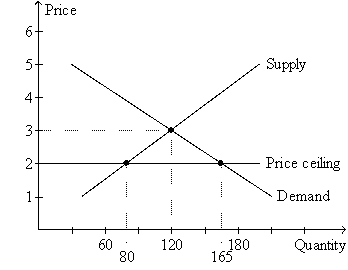

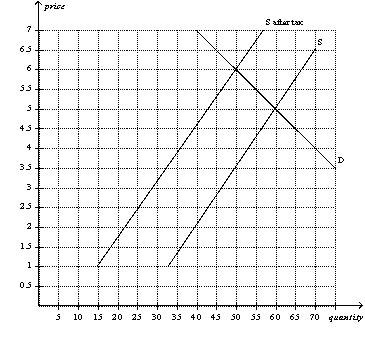

Figure 6-2  -Refer to Figure 6-2. The price ceiling causes quantity

-Refer to Figure 6-2. The price ceiling causes quantity

A) supplied to exceed quantity demanded by 45 units.

B) supplied to exceed quantity demanded by 85 units.

C) demanded to exceed quantity supplied by 45 units.

D) demanded to exceed quantity supplied by 85 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 20-cent tax on the sellers of iced tea. Which of the following is not correct? The tax would

A) shift the supply curve upward by 20 cents.

B) raise the equilibrium price by 20 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

Correct Answer

verified

Correct Answer

verified

True/False

Not all sellers benefit from a binding price floor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The long-run effects of rent controls are a good illustration of the principle that

A) society faces a short-run tradeoff between unemployment and inflation.

B) the cost of something is what you give up to get it.

C) people respond to incentives.

D) government can sometimes improve on market outcomes.

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers shifts the supply curve to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market,

A) price no longer serves as a rationing device.

B) the quantity supplied at the price floor exceeds the quantity that would have been supplied without the price floor.

C) only some sellers benefit.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Rent control may lead to lower rents for those who find housing, but the quality of the housing may also be lower.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 25-cent tax on the buyers of incandescent light bulbs. Which of the following is not correct? The tax would

A) shift the demand curve downward by 25 cents.

B) lower the equilibrium price by 25 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

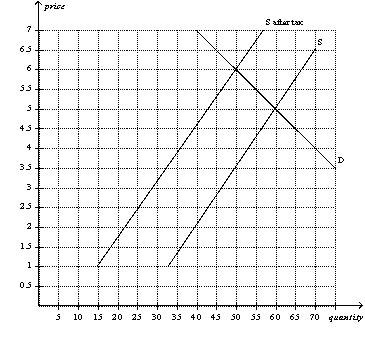

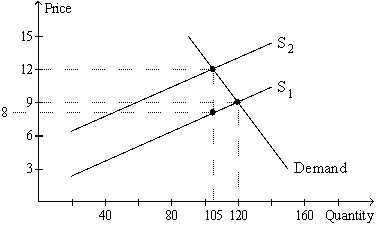

Figure 6-18  -Refer to Figure 6-18. The effective price sellers receive after the tax is imposed is

-Refer to Figure 6-18. The effective price sellers receive after the tax is imposed is

A) $2.50.

B) $3.50.

C) $5.00.

D) $6.00.

Correct Answer

verified

Correct Answer

verified

True/False

If the demand curve is very elastic and the supply curve is very inelastic in a market, then the sellers will bear a greater burden of a tax imposed on the market, even if the tax is imposed on the buyers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market to benefit buyers,

A) every buyer in the market benefits.

B) every buyer and seller in the market benefits.

C) every buyer who wants to buy the good will be able to do so, but only if he waits in long lines.

D) some buyers will not be able to buy any amount of the good.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-2  -Refer to Figure 6-2. The price ceiling

-Refer to Figure 6-2. The price ceiling

A) causes a shortage of 45 units of the good.

B) makes it necessary for sellers to ration the good.

C) is not binding because it is set below the equilibrium price.

D) Both a) and b) are correct.

Correct Answer

verified

Correct Answer

verified

True/False

If a good or service is sold in a competitive market free of government regulation, then the price of the good or service adjusts to balance supply and demand.

Correct Answer

verified

Correct Answer

verified

True/False

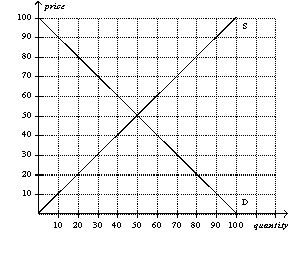

Figure 6-26  -Refer to Figure 6-26. A price ceiling set at $70 would create a shortage of 40 units.

-Refer to Figure 6-26. A price ceiling set at $70 would create a shortage of 40 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-18  -Refer to Figure 6-18. The equilibrium price in the market before the tax is imposed is

-Refer to Figure 6-18. The equilibrium price in the market before the tax is imposed is

A) $3.50.

B) $5.

C) $6.

D) $7.

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling is always a binding price control, whereas a price floor may be either binding or not binding.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

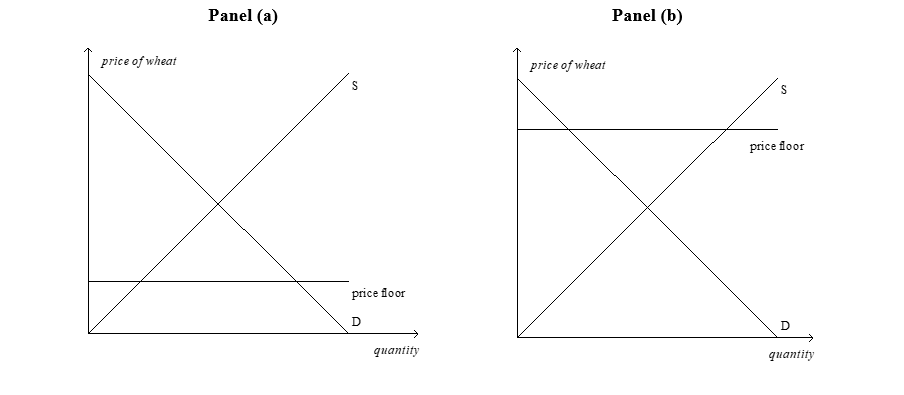

Figure 6-3

-Refer to Figure 6-3. In panel (a) , there will be

-Refer to Figure 6-3. In panel (a) , there will be

A) a shortage of wheat.

B) equilibrium in the market.

C) a surplus of wheat.

D) lines of people waiting to buy wheat.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of energy drinks, the

A) sellers bear the entire burden of the tax.

B) buyers bear the entire burden of the tax.

C) burden of the tax will be always be equally divided between the buyers and the sellers.

D) burden of the tax will be shared by the buyers and the sellers, but the division of the burden is not always equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-17  -Refer to Figure 6-17. What is the amount of the tax per unit?

-Refer to Figure 6-17. What is the amount of the tax per unit?

A) $1

B) $2

C) $3

D) $4

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 556

Related Exams