A) lowers the price buyers pay and raises the price sellers receive.

B) raises the price buyers pay and lowers the price sellers receive.

C) places a wedge between the price buyers pay and the price sellers receive.

D) Both b) and c) are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on a good,

A) government revenues exceed the loss in total welfare.

B) there is a decrease in the quantity of the good bought and sold in the market.

C) the price that sellers receive exceeds the price that buyers pay.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

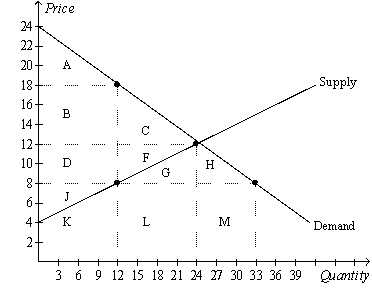

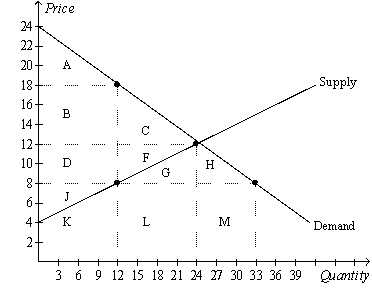

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. The government collects tax revenue that is the area

-Refer to Figure 8-8. The government collects tax revenue that is the area

A) L.

B) B+D.

C) C+F.

D) F+G+L.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit to buyers of participating in a market is measured by

A) the price elasticity of demand.

B) consumer surplus.

C) the maximum amount that buyers are willing to pay for the good.

D) the equilibrium price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

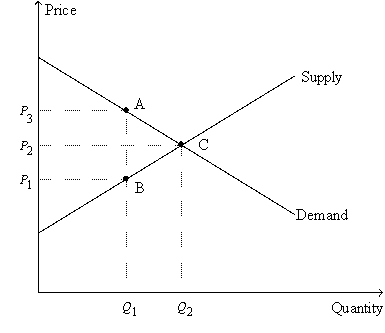

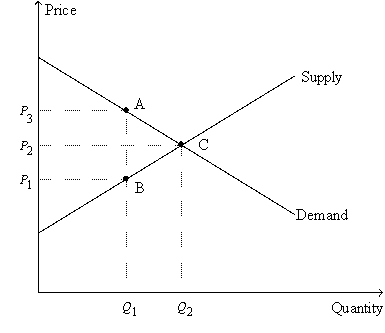

Figure 8-11  -Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then the deadweight loss of the tax is

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then the deadweight loss of the tax is

A) $6.

B) $8.

C) $9.

D) $12.

Correct Answer

verified

Correct Answer

verified

Essay

Using demand and supply diagrams, show the difference in deadweight loss between (a) a market with inelastic demand and supply and (b) a market with elastic demand and supply.

Correct Answer

verified

Correct Answer

verified

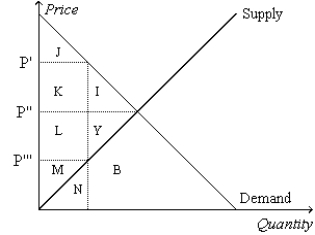

Multiple Choice

Figure 8-1  -Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The consumer surplus before the tax is measured by the area

-Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The consumer surplus before the tax is measured by the area

A) M.

B) L+M+Y.

C) J.

D) J+K+I.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

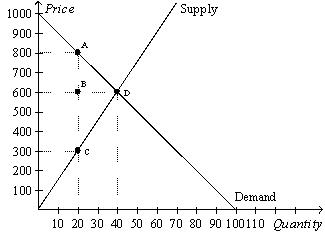

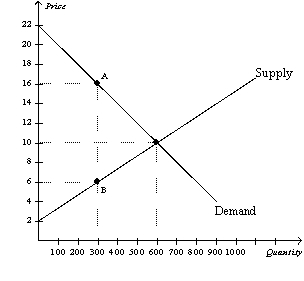

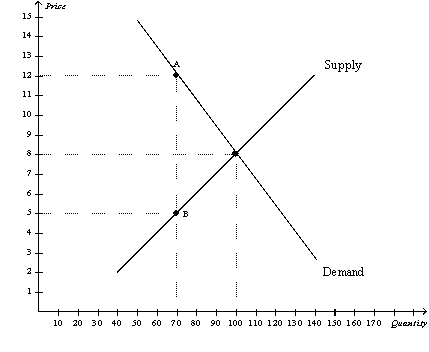

Figure 8-9

The vertical distance between points A and C represent a tax in the market.  -Refer to Figure 8-9. The per-unit burden of the tax on sellers is

-Refer to Figure 8-9. The per-unit burden of the tax on sellers is

A) $20.

B) $200.

C) $300.

D) $500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on buyers of a good,

A) government collects too little revenue to justify the tax if the equilibrium quantity of the good decreases as a result of the tax.

B) there is an increase in the quantity of the good supplied.

C) a wedge is placed between the price buyers pay and the price sellers effectively receive.

D) the effective price to buyers decreases because the demand curve shifts leftward.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

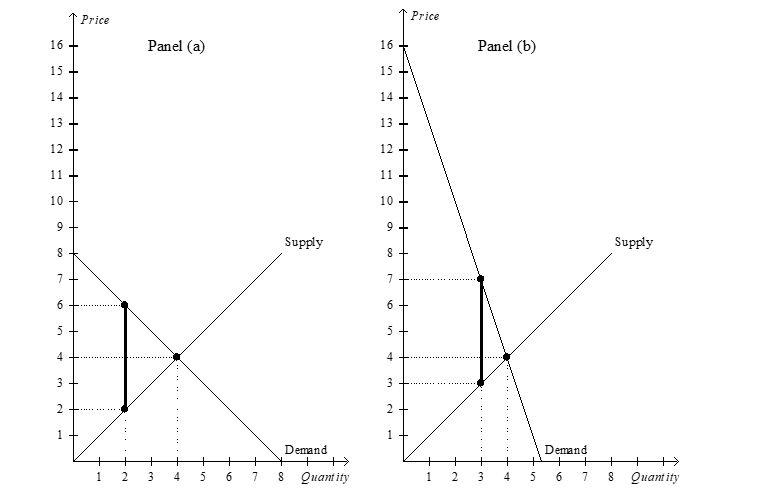

Figure 8-13  -Refer to Figure 8-13. Panel (a) and Panel (b) each illustrate a $4 tax placed on a market. In comparison to Panel (a) , Panel (b) illustrates which of the following statements?

-Refer to Figure 8-13. Panel (a) and Panel (b) each illustrate a $4 tax placed on a market. In comparison to Panel (a) , Panel (b) illustrates which of the following statements?

A) When demand is relatively inelastic, the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic, the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic, the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic, the deadweight loss of a tax is larger than when supply is relatively inelastic.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6. When the tax is imposed in this market, sellers effectively pay what amount of the $10 tax?

-Refer to Figure 8-6. When the tax is imposed in this market, sellers effectively pay what amount of the $10 tax?

A) $0

B) $4

C) $6

D) $10

Correct Answer

verified

Correct Answer

verified

True/False

The more elastic are supply and demand in a market, the greater are the distortions caused by a tax on that market, and the more likely it is that a tax cut in that market will raise tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) the government collects $28 in tax revenue.

B) producer surplus decreases by $13.

C) consumer surplus decreases by $11.

D) the deadweight loss amounts to $9.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

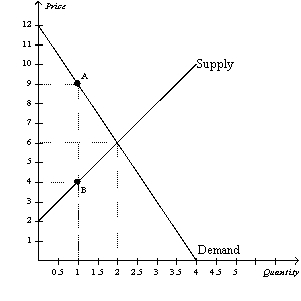

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. Producer surplus without the tax is

-Refer to Figure 8-2. Producer surplus without the tax is

A) $4, and producer surplus with the tax is $1.

B) $4, and producer surplus with the tax is $3.

C) $10, and producer surplus with the tax is $1.

D) $10, and producer surplus with the tax is $3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax on a good is enacted,

A) buyers and sellers share the burden of the tax regardless of whether the tax is levied on buyers or on sellers.

B) buyers always bear the full burden of the tax.

C) sellers always bear the full burden of the tax.

D) sellers bear the full burden of the tax if the tax is levied on them; buyers bear the full burden of the tax if the tax is levied on them.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. The tax causes consumer surplus to decrease by the area

-Refer to Figure 8-8. The tax causes consumer surplus to decrease by the area

A) A.

B) B+C.

C) A+B+C.

D) A+B+C+D+F.

Correct Answer

verified

Correct Answer

verified

True/False

As the size of a tax increases, the government's tax revenue rises, then falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate on labor income for many workers in the United States is almost

A) 30 percent.

B) 40 percent.

C) 50 percent.

D) 65 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $3.50 tax per gallon of paint placed on the sellers of paint will shift the supply curve

A) downward by exactly $3.50.

B) downward by less than $3.50.

C) upward by exactly $3.50.

D) upward by less than $3.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4. The per-unit burden of the tax on buyers is

-Refer to Figure 8-4. The per-unit burden of the tax on buyers is

A) $3.

B) $4.

C) $5.

D) $8.

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 422

Related Exams