A) Firms expect the price of televisions to rise in the future.

B) The number of firms selling televisions decreases.

C) Consumers' income decreases,and televisions are a normal good.

D) The number of consumers buying televisions increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

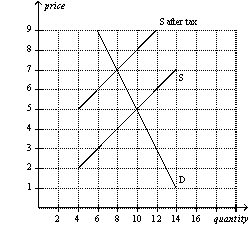

Figure 6-12  -Refer to Figure 6-12.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-12.The price paid by buyers after the tax is imposed is

A) $3.

B) $4.

C) $5.

D) $7.

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers usually causes buyers to pay more the good and sellers to receive less for the good than they did before the tax was levied.

Correct Answer

verified

Correct Answer

verified

True/False

If a price ceiling is not binding,then it will have no effect on the market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) More than one of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of lemonade,

A) the sellers bear the entire burden of the tax.

B) the buyers bear the entire burden of the tax.

C) the burden of the tax will be always be equally divided between the buyers and the sellers.

D) the burden of the tax will be shared by the buyers and the sellers,but the division of the burden is not always equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) imposes a binding price ceiling in that market.

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set above the equilibrium price is not binding.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price floor will be binding only if it is set

A) equal to the equilibrium price.

B) above the equilibrium price.

C) below the equilibrium price.

D) either above or below the equilibrium price.

Correct Answer

verified

Correct Answer

verified

True/False

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on buyers will

A) shift the demand curve upwards by the amount of the tax.

B) shift the demand curve downwards by the amount of the tax.

C) shift the supply curve upwards by the amount of the tax.

D) shift the supply curve downwards by the amount of the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of a product,

A) buyers pay more and sellers receive more than they did before the tax.

B) buyers pay more and sellers receive less than they did before the tax.

C) buyers pay less and sellers receive more than they did before the tax.

D) buyers pay less and sellers receive less than they did before the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price ceiling from a market,then the price paid by buyers will

A) increase and the quantity sold in the market will increase.

B) increase and the quantity sold in the market will decrease.

C) decrease and the quantity sold in the market will increase.

D) decrease and the quantity sold in the market will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of a luxury tax falls

A) more on the rich than on the middle class.

B) more on the poor than on the rich.

C) more on the middle class than on the rich.

D) equally on the rich,the middle class,and the poor.

Correct Answer

verified

Correct Answer

verified

True/False

A price floor is a legal minimum on the price at which a good or service can be sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes a shortage of a good?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) More than one of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a tax is placed on books.If the sellers pay the majority of the tax,then we know that the

A) demand is more inelastic than the supply.

B) supply is more inelastic than the demand.

C) government has required that buyers remit the tax payments.

D) government has required that sellers remit the tax payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One economist has argued that rent control is "the best way to destroy a city,other than bombing." Why would an economist say this?

A) He fears that low rents will cause low-income people to move into the city,reducing the quality of life for other people.

B) He fears that rent control will benefit landlords at the expense of tenants,increasing inequality in the city.

C) He fears that rent controls will cause a construction boom,which will make the city crowded and more polluted.

D) He fears that rent control will eliminate the incentive to maintain buildings,leading to a deterioration of the city.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price floor is imposed on a market to benefit sellers,

A) no sellers actually do benefit.

B) some sellers benefit,but no sellers are harmed.

C) some sellers benefit and some sellers are harmed.

D) all sellers benefit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce smoking,it should impose a tax on

A) buyers of cigarettes.

B) sellers of cigarettes.

C) either buyers or sellers of cigarettes.

D) whichever side of the market is less elastic.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 459

Related Exams