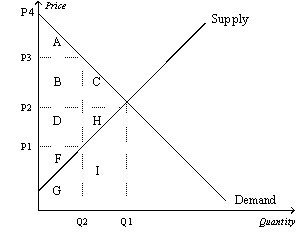

A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of deadweight loss that results from a tax of a given size is determined by

A) whether the tax is levied on buyers or sellers.

B) the number of buyers in the market relative to the number of sellers.

C) the price elasticities of demand and supply.

D) the ratio of the tax per unit to the effective price received by sellers.

Correct Answer

verified

Correct Answer

verified

True/False

Taxes affect market participants by increasing the price paid by the buyer and received by the seller.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the market for widgets,the supply curve is the typical upward-sloping straight line,and the demand curve is the typical downward-sloping straight line.The equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.The price paid by buyers increases by $2 and the after-tax price received by sellers falls by $3.The government is able to raise $750 per month in revenue from the tax.The deadweight loss from the tax is

A) $250.

B) $125.

C) $75.

D) $50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

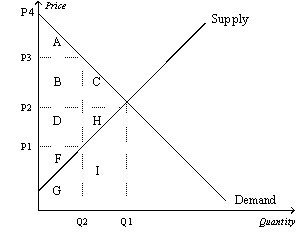

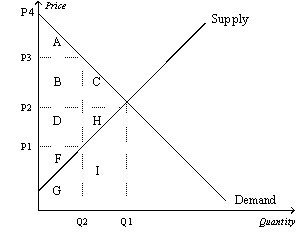

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.The price that sellers effectively receive after the tax is imposed is

-Refer to Figure 8-5.The price that sellers effectively receive after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

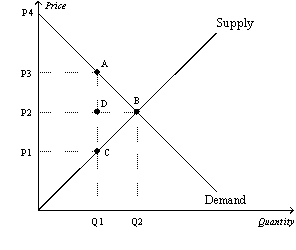

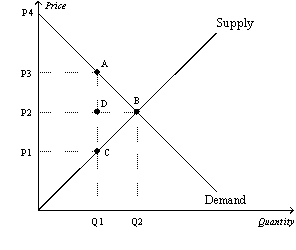

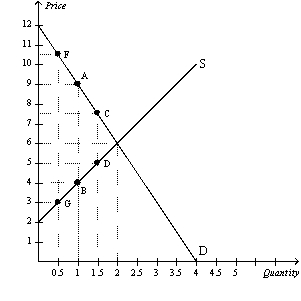

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.Which of the following equations is valid for the deadweight loss of the tax?

-Refer to Figure 8-3.Which of the following equations is valid for the deadweight loss of the tax?

A) Deadweight loss = (1/2) (P2 - P1) (Q2 + Q1)

B) Deadweight loss = (1/2) (P3 - P1) (Q2 + Q1)

C) Deadweight loss = (1/2) (P3 - P2) (Q2 - Q1)

D) Deadweight loss = (1/2) (P3 - P1) (Q2 - Q1)

Correct Answer

verified

Correct Answer

verified

True/False

The demand for bread is less elastic than the demand for donuts;hence,a tax on bread will create a larger deadweight loss than will the same tax on donuts,other things equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on labor have the effect of encouraging

A) workers to work more hours.

B) the elderly to postpone retirement.

C) second earners within a family to take a job.

D) unscrupulous people to take part in the underground economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

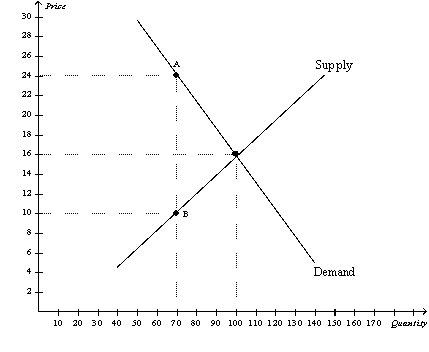

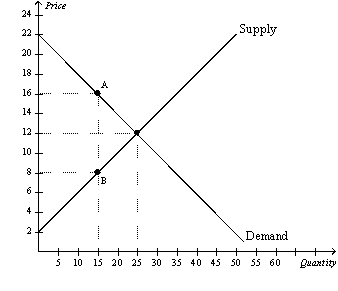

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The amount of tax revenue received by the government is equal to

-Refer to Figure 8-4.The amount of tax revenue received by the government is equal to

A) $210.

B) $420.

C) $980.

D) $1,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The per unit burden of the tax on buyers is

-Refer to Figure 8-3.The per unit burden of the tax on buyers is

A) P3 - P1.

B) P3 - P2.

C) P2 - P1.

D) P4 - P3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.The total surplus with the tax is represented by area

-Refer to Figure 8-5.The total surplus with the tax is represented by area

A) C+H.

B) A+B+C.

C) D+H+F.

D) A+B+D+F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7.As a result of the tax,

-Refer to Figure 8-7.As a result of the tax,

A) consumer surplus decreases from $150 to $60.

B) producer surplus decreases from $125 to $45.

C) the market experiences a deadweight loss of $45.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on a good,

A) government revenues exceed the loss in total welfare.

B) there is a decrease in the quantity of the good bought and sold in the market.

C) the price that sellers receive exceeds the price that buyers pay.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The loss in total surplus resulting from a tax is called

A) a deficit.

B) economic loss.

C) deadweight loss.

D) inefficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that policymakers are considering placing a tax on either of two markets.In Market A,the tax will have a significant effect on the price consumers pay,but it will not affect equilibrium quantity very much.In Market B,the same tax will have only a small effect on the price consumers pay,but it will have a large effect on the equilibrium quantity.Other factors are held constant.In which market will the tax have a larger deadweight loss?

A) Market A

B) Market B

C) The deadweight loss will be the same in both markets.

D) There is not enough information to answer the question.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

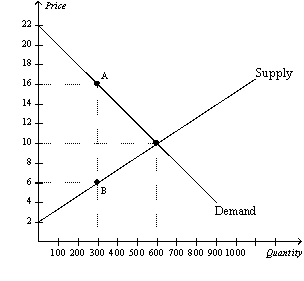

Figure 8-6

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-6.Without a tax,producer surplus in this market is

-Refer to Figure 8-6.Without a tax,producer surplus in this market is

A) $1,500.

B) $2,400.

C) $3,000.

D) $3,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government imposes a tax on dairy products.The deadweight loss from this tax will likely be greater in the

A) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

B) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

C) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

D) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is increased from $1 per unit to $3 per unit,the deadweight loss from the tax increases by a factor of

A) 2

B) 3

C) 9

D) 18

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.The tax causes a reduction in producer surplus that is represented by area

-Refer to Figure 8-5.The tax causes a reduction in producer surplus that is represented by area

A) A.

B) C+H.

C) D+H.

D) F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10

The vertical distance between points A and B represents the original tax.  -Refer to Figure 8-10.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

-Refer to Figure 8-10.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

A) increase government revenue and increase the deadweight loss from the tax.

B) increase government revenue and decrease the deadweight loss from the tax.

C) decrease government revenue and increase the deadweight loss from the tax.

D) decrease government revenue and decrease the deadweight loss from the tax.

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 353

Related Exams