A) Separate entity concept

B) Arm's-length transaction assumption

C) Money measurement concept

D) Going concern assumption

Correct Answer

verified

Correct Answer

verified

Multiple Choice

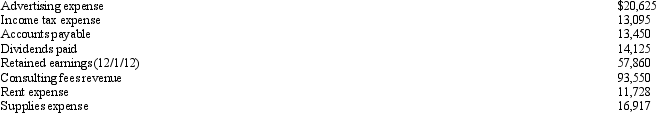

Exhibit 2-2 The following information was taken from the records of Tellers Corporation for the month ended December 31, 2012:

- Refer to Exhibit 2-2. If Tellers has 2,100 shares of stock outstanding, earnings per share is approximately

- Refer to Exhibit 2-2. If Tellers has 2,100 shares of stock outstanding, earnings per share is approximately

A) $46.51

B) $14.85

C) $16.81

D) $4.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following financial statements shows an entity's cash receipts and payments?

A) The statement of financial position

B) The statement of cash flows

C) The statement of earnings

D) The statement of changes in owners' equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

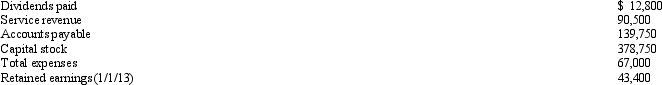

The following information was taken from the records of McDyce Corporation for the year ended December 31, 2013:  The net income at December 31, 2013 was

The net income at December 31, 2013 was

A) $23,500

B) $54,100

C) $43,400

D) $72,750

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of accounts are NOT found on the balance sheet?

A) Revenues

B) Assets

C) Liabilities

D) Owners' equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An independent audit report is usually issued by

A) Management

B) A government accountant

C) A private detective

D) A certified public accountant

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On April 1, Bonita Corporation's retained earnings account had a balance of $785,000. During April, Bonita had revenues of $135,000 and expenses of $93,000. On April 30, retained earnings had a balance of $811,500. What amount of dividends were paid during April?

A) $42,500

B) $30,750

C) $15,500

D) $13,250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transaction that causes an increase in an asset may also cause

A) A decrease in owners' equity

B) An increase in another asset

C) A decrease in a liability

D) An increase in a liability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following usually is NOT considered to be an owners' equity account?

A) Capital stock

B) Retained earnings

C) Inventory

D) All these are owners' equity accounts

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Markanich Company purchased land for $90,000 in 2010. In 2013, the land is valued at $115,000. The land would appear on the company's books in 2013 at

A) $25,000

B) $90,000

C) $75,000

D) $115,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company has assets of $460,000, liabilities of $100,000, and capital stock of $210,000, what is the amount of retained earnings?

A) $150,000

B) $210,000

C) $110,000

D) $310,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered a long-term liability?

A) Mortgage payable

B) Notes payable

C) Accounts payable

D) Land

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount invested to acquire an ownership interest in a corporation is called

A) Retained earnings

B) Capital stock

C) Net assets

D) Owners' equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company sells its equipment for more than it is valued on the balance sheet, the difference is called a(n)

A) Income

B) Revenue

C) Profit

D) Gain

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you decide to purchase a stereo and an independent store dealer offers to sell you a system that retails for $4,000 for a price of $3,695. After some negotiation, you purchase the system for $3,400. The $3,400 is considered the accounting measurement for the transaction because of the

A) Going concern assumption

B) Fair value assumption

C) Double-entry assumption

D) Arm's-length transaction assumption

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of the balance sheet?

A) It includes revenue and expense accounts.

B) It identifies a company's assets and liabilities as of a specific date.

C) It shows the results of operations for an accounting period.

D) It discloses the amount of dividends paid.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that businesses must be accounted for as though they will exist at least for the foreseeable future is the

A) Going concern concept

B) Entity concept

C) Monetary measurement concept

D) Arm's-length transaction assumption

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statement that presents a summary of the revenues and expenses of a business for a specific period of time, such as a month or a year, is called a(n)

A) Statement of Cash Flows

B) Statement of Retained Earnings

C) Income Statement

D) Balance Sheet

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following classifications refers to those activities associated with buying and selling long-term assets?

A) Investing

B) Operating

C) Borrowing

D) Financing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rolf Corporation reported the following data for the period end: Earnings per share, $6.00; Retained Earnings, $54,000; Revenues, $150,000; Capital Stock, $30,000; Expenses, $129,000; Dividends, $24,000. With this information, determine retained earnings for the prior period.

A) $54,000

B) $51,000

C) $57,000

D) $180,000

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 118

Related Exams