A) the standard deduction.

B) a tax credit.

C) an itemized deduction.

D) an exclusion.

E) an exemption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following types of credit plans is the interest tax deductible?

A) home equity loan

B) auto loan

C) credit card

D) life insurance policy cash value loan

E) personal cash loan from a credit union

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A taxpayer with a taxable income of $47,856 and a total tax bill of $5,889 would have an average tax rate of ____ percent.

A) 8.6

B) 10.3

C) 12.3

D) 14.2

E) 16.7

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Not included in the recent tax credits is a/an _______________ tax credit.

A) energy-saving

B) adoption

C) elderly and disabled

D) credit card

E) retirement savings

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of these statements correctly applies to a Roth IRA?

A) earnings on the account are tax-free after five years

B) annual contributions may exceed $2,000

C) deposits must be in federally-insured accounts

D) funds are only to be used for educational expenses

E) only self-employed workers can contribute to a Roth

Correct Answer

verified

Correct Answer

verified

True/False

Money received in the form of dividends or interest is commonly called "earned income."

Correct Answer

verified

Correct Answer

verified

True/False

Capital gains refer to profits from the sale of investments.

Correct Answer

verified

Correct Answer

verified

True/False

Taxes are only considered as financial planning activities in April.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earnings from a limited partnership would be an example of ____________ income.

A) passive

B) capital gain

C) portfolio

D) earned

E) excluded

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Union dues,fees for tax return preparation,and other miscellaneous expenses are:

A) not deductible.

B) fully deductible.

C) deductible for self-employed individuals only.

D) deductible for people in certain income categories.

E) deductible to the extent they exceed two percent of adjusted gross incomE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelly Vernon wants her tax return prepared by a government approved tax expert.Which of the following tax preparers should Kelly use?

A) CPA

B) enrolled agent

C) nationally-certified tax preparer

D) tax attorney

E) local tax preparer

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would result in a reduction of taxable income?

A) portfolio income

B) tax credits

C) exclusions

D) passive income

E) earned income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A taxpayer whose spouse recently died is most likely to use the ____________ filing status.

A) single

B) married filing joint return

C) married filing separate return

D) head of household

E) qualifying widow or widower

Correct Answer

verified

Correct Answer

verified

Not Answered

Explain the difference between a short-term capital gain and a long-term capital gain.

Correct Answer

verified

Correct Answer

verified

True/False

The principal purpose of taxes is to control economic conditions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A traditional IRA,Keogh plan,and 401(k) plan are examples of:

A) tax-exempt retirement plans.

B) tax-deferred retirement plans.

C) capital gains.

D) self-employment insurance programs.

E) job-related expenses that are tax deductiblE.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

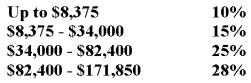

Joan Sanchez is single and earns $40,000 in taxable income.She uses the following tax rate schedule to calculate the taxes she owes.  What is Joan's marginal tax rate?

What is Joan's marginal tax rate?

A) 10%

B) 15%

C) 25%

D) 28%

E) between 10% and 15%

Correct Answer

verified

Correct Answer

verified

True/False

A tax credit is an amount subtracted directly from the amount of taxes owed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax ____________ is an amount subtracted directly from the amount of taxes owed.

A) credit

B) exemption

C) deduction

D) exclusion

E) shelter

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Form 1040 is most helpful to a person who:

A) is single with no other exemptions.

B) makes less than $50,000 with no interest or dividends.

C) itemizes deductions.

D) has exempt income.

E) has a simple tax situation.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 97

Related Exams