A) P3 - P1.

B) P3 - P2.

C) P2 - P1.

D) P4 - P3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The size of the deadweight that results from the tax is smaller,the

A) larger is the price elasticity of demand.

B) smaller is the price elasticity of supply.

C) larger is the amount of the tax.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

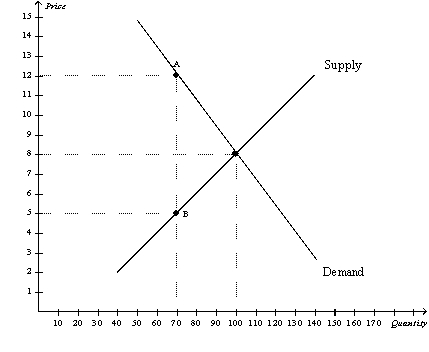

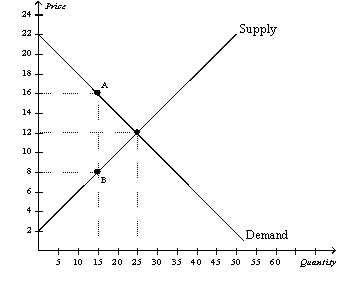

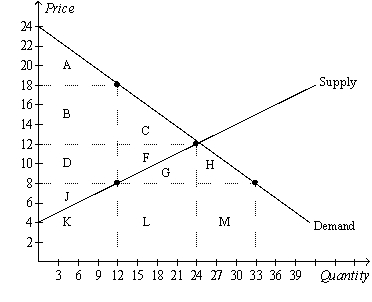

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The tax results in a loss of producer surplus that amounts to

-Refer to Figure 8-4.The tax results in a loss of producer surplus that amounts to

A) $45.

B) $90.

C) $210.

D) $255.

Correct Answer

verified

Correct Answer

verified

True/False

If the size of a tax triples,the deadweight loss increases by a factor of six.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

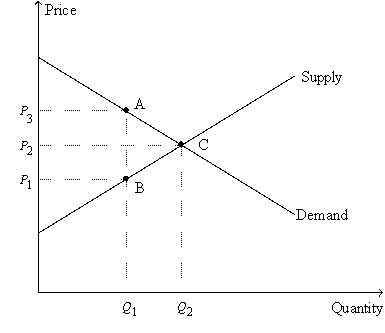

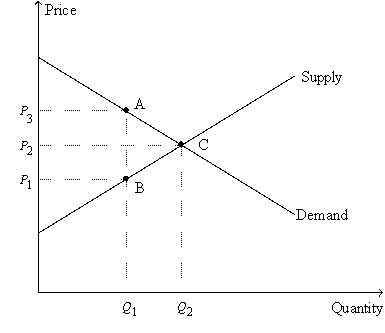

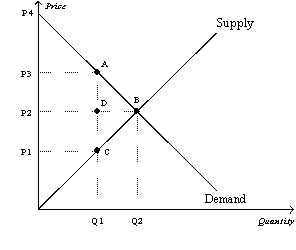

Figure 8-11  -Refer to Figure 8-11.Neither a shift of the demand curve nor a shift of the supply curve is shown on the figure.However,we know that,when the tax is imposed,

-Refer to Figure 8-11.Neither a shift of the demand curve nor a shift of the supply curve is shown on the figure.However,we know that,when the tax is imposed,

A) the demand curve will shift.

B) the supply curve will shift.

C) either the demand curve or the supply curve will shift.

D) None of the above are correct; the tax causes neither the demand curve nor the supply curve to shift.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11.The price labeled as P3 on the vertical axis represents the price

-Refer to Figure 8-11.The price labeled as P3 on the vertical axis represents the price

A) received by sellers before the tax is imposed.

B) received by sellers after the tax is imposed.

C) paid by buyers before the tax is imposed.

D) paid by buyers after the tax is imposed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is tripled,the deadweight loss of the tax

A) remains constant.

B) triples.

C) increases by a factor of 9.

D) increases by a factor of 12.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $0.50 per unit on a good creates a deadweight loss of $100.If the tax is increased to $2.50 per unit,the deadweight loss from the new tax would be

A) $200.

B) $250.

C) $500.

D) $2,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10 ![Figure 8-10 -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is A) [x (P0-P5) x Q5] + [x (P5-0) x Q5]. B) [x (P0-P2) x Q2] +[(P2-P8) x Q2] + [x (P8-0) x Q2]. C) (P2-P8) x Q2. D) x (P2-P8) x (Q5-Q2) .](https://d2lvgg3v3hfg70.cloudfront.net/TB4798/11ea6f3b_0de3_ae7f_af34_49bb46854036_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00_TB4798_00.jpg) -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The deadweight loss of the tax is

A) [x (P0-P5) x Q5] + [x (P5-0) x Q5].

B) [x (P0-P2) x Q2] +[(P2-P8) x Q2] + [x (P8-0) x Q2].

C) (P2-P8) x Q2.

D) x (P2-P8) x (Q5-Q2) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

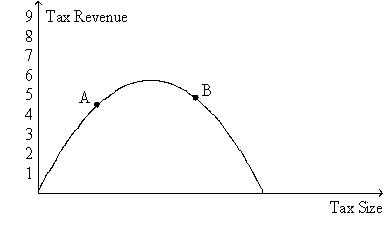

Figure 8-19.The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.  -Refer to Figure 8-19.If the economy is at point A on the curve,then a decrease in the tax rate will

-Refer to Figure 8-19.If the economy is at point A on the curve,then a decrease in the tax rate will

A) increase the deadweight loss of the tax and increase tax revenue.

B) increase the deadweight loss of the tax and decrease tax revenue.

C) decrease the deadweight loss of the tax and increase tax revenue.

D) decrease the deadweight loss of the tax and decrease tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a product will bear the larger part of the tax burden,and buyers will bear a smaller part of the tax burden,when the

A) tax is placed on the sellers of the product.

B) tax is placed on the buyers of the product.

C) supply of the product is more elastic than the demand for the product.

D) demand for the product is more elastic than the supply of the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

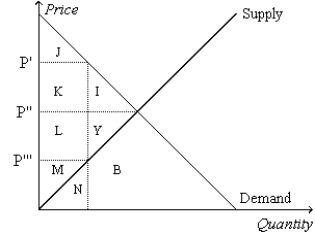

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by J+K+I represents

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by J+K+I represents

A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

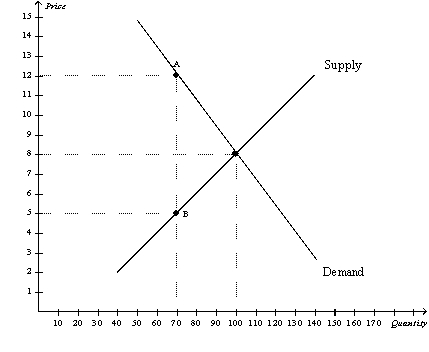

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7.Which of the following statements summarizes the incidence of the tax?

-Refer to Figure 8-7.Which of the following statements summarizes the incidence of the tax?

A) For each unit of the good that is sold,buyers bear one-half of the tax burden,and sellers bear one-half of the tax burden.

B) For each unit of the good that is sold,buyers bear one-third of the tax burden,and sellers bear two-thirds of the tax burden.

C) For each unit of the good that is sold,buyers bear one-fourth of the tax burden,and sellers bear three-fourths of the tax burden.

D) For each unit of the good that is sold,buyers bear three-fourths of the tax burden,and sellers bear one-fourth of the tax burden.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The loss in producer surplus caused by the tax is measured by the area

-Refer to Figure 8-3.The loss in producer surplus caused by the tax is measured by the area

A) ABC.

B) P1P3ABC.

C) P1P2BC.

D) P1C0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government imposes a tax on dairy products.The deadweight loss from this tax will likely be greater in the

A) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

B) first year after it is imposed than in the fifth year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

C) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be more elastic in the first year than in the fifth year.

D) fifth year after it is imposed than in the first year after it is imposed because demand and supply will be less elastic in the first year than in the fifth year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The per-unit burden of the tax on buyers is

-Refer to Figure 8-4.The per-unit burden of the tax on buyers is

A) $3.

B) $4.

C) $5.

D) $8.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The more freedom young mothers have to work outside the home,the

A) more elastic the supply of labor will be.

B) less elastic the supply of labor will be.

C) more vertical the labor supply curve will be.

D) smaller is the decrease in employment that will result from a tax on labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anger over British taxes played a significant role in bringing about the

A) election of John Adams as the second American president.

B) American Revolution.

C) War of 1812.

D) "no new taxes" clause in the U.S.Constitution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit that government receives from a tax is measured by

A) deadweight loss.

B) consumer surplus.

C) tax incidence.

D) tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

-Refer to Figure 8-8.After the tax goes into effect,consumer surplus is the area

A) A.

B) B+C.

C) A+B+C.

D) A+B+D+J+K.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 421

Related Exams