A) registration statement.

B) Green Shoe provision.

C) Securities Exchange Act of 1934.

D) Securities Act of 1933.

E) Federal Reserve Act of 1931.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aaron's Sailboats has decided to take the company public by offering a total of 120,000 shares of common stock to the public.The firm has hired an underwriter who arranges a full commitment underwriting and suggests an initial selling price of $25 a share with a 7 percent spread.As it turns out,the underwriters only sell 97,400 shares.How much cash will Aaron's Sailboats receive from its first public offering?

A) $2,727,200

B) $3,074,400

C) $2,790,000

D) $3,360,000

E) $3,645,600

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Before a seasoned stock offering,you owned 7,500 shares of a firm that had 500,000 shares outstanding.After the seasoned offering,you still owned 7,500 shares but the number of shares outstanding rose to 625,000.Which one of the following terms best describes this situation?

A) overallotment

B) percentage ownership dilution

C) Green Shoe

D) Red herring

E) abnormal event

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning the issuance of long-term debt?

A) A direct long-term loan has to be registered with the SEC.

B) Direct placement debt tends to have more restrictive covenants than publicly issued debt.

C) Distribution costs are lower for public debt than for private debt.

D) It is easier to renegotiate public debt than private debt.

E) Wealthy individuals tend to dominate the private debt market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High Mountain Mining wants to expand its current operations and requires $3.5 million in additional funding to do so.After discussing this with key shareholders,the firm has decided to raise the necessary funds through a rights offering at a subscription price of $18 a share.The current market price of the firm's stock is $22 a share.How many shares of stock will the firm need to sell through the rights offering to fund the expansion plans?

A) 140,015 shares

B) 159,091 shares

C) 166,667 shares

D) 194,444 shares

E) 205,688 shares

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A rights offering in which an underwriting syndicate agrees to purchase the unsubscribed portion of an issue is called a _____ underwriting.

A) standby

B) best efforts

C) firm commitment

D) direct fee

E) tombstone

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blue Stone Builders recently offered to sell 45,000 newly issued shares of stock to the public.The underwriters charged a fee of 8 percent and paid Blue Stone Builders $16.40 a share on 40,000 shares.Which one of the following terms best describes this underwriting?

A) best efforts

B) shelf

C) direct rights

D) private placement

E) firm commitment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barstow Industrial Supply has decided to raise $27.52 million in additional funding via a rights offering.The firm will issue one right for each share of stock outstanding.The offering consists of a total of 860,000 new shares.The current market price of the stock is $38.Currently,there are 5.16 million shares outstanding.What is the value of one right?

A) $0.97

B) $0.86

C) $0.48

D) $0.52

E) $0.60

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total direct costs of underwriting an equity IPO:

A) tends to increase on a percentage basis as the proceeds of the IPO increase.

B) is generally between 7 and 8 percent, regardless of the issue size.

C) can be as high as 25 percent for small issues.

D) excludes the gross spread.

E) excludes both the gross spread and the underpricing cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is probably the most successful means of finding venture capital?

A) internet searches

B) Dutch auctions

C) newspaper advertisements

D) personal contacts

E) personal letters to venture capital firms

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an IPO is underpriced then the:

A) investors in the IPO are generally unhappy with the underwriters.

B) issue is less likely to sell out.

C) stock price will generally decline on the first day of trading.

D) issuing firm is guaranteed to be successful in the long term.

E) issuing firm receives less money than it probably should have.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mountain Homes wishes to expand its facilities.The company currently has 7 million shares outstanding and no debt.The stock sells for $55 per share,but the book value per share is $43.The firm's net income is currently $9.1 million.The new facility will cost $30 million,and it will increase net income by $309,000.Assume the firm issues new equity to fund this expansion while maintaining a constant price-earnings ratio.What will be the EPS be after the new equity issue?

A) $1.25

B) $1.30

C) $1.35

D) $1.40

E) $1.45

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wear Ever is expanding and needs $12.6 million to help fund this growth.The firm estimates it can sell new shares of stock for $35 a share.It also estimates it will cost an additional $340,000 for filing and legal fees related to the stock issue.The underwriters have agreed to a 7 percent spread.How many shares of stock must Wear Ever sell if it is going to have $12.6 million available for its expansion needs?

A) 370,376 shares

B) 385,127 shares

C) 397,543 shares

D) 454,209 shares

E) 461,806 shares

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a preliminary prospectus?

A) tombstone

B) green shoe

C) registration statement

D) rights offer

E) red herring

Correct Answer

verified

Correct Answer

verified

Multiple Choice

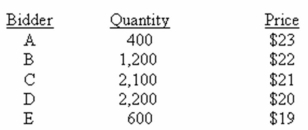

Webster Electrics is offering 1,500 shares of stock in a Dutch auction.The bids include:  How much cash will Webster Electrics receive from selling these shares? Ignore all transaction and flotation costs.

How much cash will Webster Electrics receive from selling these shares? Ignore all transaction and flotation costs.

A) $28,500

B) $30,000

C) $31,500

D) $33,000

E) $34,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the underwriters' cost of buying shares in a firm commitment and the offering price of those securities to the public is called the:

A) gross spread.

B) under price amount

C) filing fee.

D) new issue premium.

E) offer price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With Dutch auction underwriting:

A) each winning bidder pays the price he or she bid.

B) all successful bidders pay the same price.

C) all bidders receive at least a portion of the quantity for which they bid.

D) the selling firm receives the maximum possible price for each security sold.

E) the bidder for the largest quantity receives the first allocation of securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a seasoned equity offering?

A) an offering of shares by shareholders for repurchase by the issuer

B) shares of stock that have been recommended for purchase by the SEC

C) equity securities held by a firm's founder that are being offered for sale to the general public

D) sale of newly issued equity shares by a firm that is currently publicly owned

E) a set number of equity shares that are issued and offered to the public annually

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Executive Tours has decided to take its firm public and has hired an investment firm to handle this offering.The investment firm is serving as a(n) :

A) aftermarket specialist.

B) venture capitalist.

C) underwriter.

D) seasoned writer.

E) primary investor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following have been offered as supporting arguments in favor of IPO underpricing? I.Underpricing counteracts the "winner's curse". II.Underpricing rewards institutional investors for sharing their opinions of a stock's market value. III.Underpricing diminishes the underwriting risk of a firm commitment underwriting. IV.Underpricing reduces the probability that investors will sue the underwriters.

A) I and III only

B) II and IV only

C) I and II only

D) I, II, and III only

E) I, II, III, and IV

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 93

Related Exams