Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday,you entered into a futures contract to buy €62,500 at $1.50 per €.Your initial performance bond is $1,500 and your maintenance level is $500.At what settle price will you get a demand for additional funds to be posted?

A) $1.5160 per €.

B) $1.208 per €.

C) $1.1920 per €.

D) $1.4840 per €.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparing "forward" and "futures" exchange contracts,we can say that

A) delivery of the underlying asset is seldom made in futures contracts.

B) delivery of the underlying asset is usually made in forward contracts.

C) delivery of the underlying asset is seldom made in either contract-they are typically cash settled at maturity.

D) both a) and b)

E) both a) and c)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Empirical tests of the Black-Scholes option pricing formula

A) shows that binomial option pricing is used widely in practice, especially by international banks in trading OTC options.

B) works well for pricing American currency options that are at-the-money or out-of-the-money.

C) does not do well in pricing in-the-money calls and puts.

D) both b) and c)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Find the hedge ratio for a put option on $15,000 with a strike price of €10,000.In one period the exchange rate (currently S($/€) = $1.50/€) can increase by 60% or decrease by 37.5% .

A) -15/49

B) 5/13

C) 3/2

D) 15/49

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A currency futures option amounts to a derivative on a derivative.Why would something like that exist?

A) For some assets, the futures contract can have lower transactions costs and greater liquidity than the underlying asset.

B) Tax consequences matter as well, and for some users an option contract on a future is more tax efficient.

C) Transactions costs and liquidity.

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "open interest" shown in currency futures quotations is

A) the total number of people indicating interest in buying the contracts in the near future.

B) the total number of people indicating interest in selling the contracts in the near future.

C) the total number of people indicating interest in buying or selling the contracts in the near future.

D) the total number of long or short contracts outstanding for the particular delivery month.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which equation is used to define the futures price?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday,you entered into a futures contract to buy €62,500 at $1.50/€.Your initial margin was $3,750 (= 0.04 * €62,500 * $1.50/€ = 4 percent of the contract value in dollars) .Your maintenance margin is $2,000 (meaning that your broker leaves you alone until your account balance falls to $2,000) .At what settle price (use 4 decimal places) do you get a margin call?

A) $1.4720/€

B) $1.5280/€

C) $1.500/€

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor believes that the price of a stock,say IBM's shares,will increase in the next 60 days.If the investor is correct,which combination of the following investment strategies will show a profit in all the choices? (i) - buy the stock and hold it for 60 days (ii) - buy a put option (iii) - sell (write) a call option (iv) - buy a call option (v) - sell (write) a put option

A) (i) , (ii) , and (iii)

B) (i) , (ii) , and (iv)

C) (i) , (iv) , and (v)

D) (ii) and (iii)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) The value (in dollars) of a call option on £5,000 with a strike price of $10,000 is equal to the value (in dollars) of a put option on $10,000 with a strike price of £5,000 only when the spot exchange rate is $2 = £1.

B) The value (in dollars) of a call option on £5,000 with a strike price of $10,000 is equal to the value (in dollars) of a put option on $10,000 with a strike price of £5,000.

Correct Answer

verified

Correct Answer

verified

Essay

If the call finishes in-the-money what is your portfolio cash flow?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the event of a default on one side of a futures trade,

A) the clearing member stands in for the defaulting party.

B) the clearing member will seek restitution for the defaulting party.

C) if the default is on the short side, a randomly selected long contract will not get paid.That party will then have standing to initiate a civil suit against the defaulting short.

D) both a) and b)

Correct Answer

verified

Correct Answer

verified

Essay

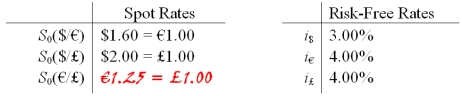

Consider an option to buy €12,500 for £10,000. In the next period, the euro can strengthen against the pound by 25% (i.e. each euro will buy 25% more pounds) or weaken by 20%.

Big hint: don't round, keep exchange rates out to at least 4 decimal places.  -Calculate the current €/£ spot exchange rate.

-Calculate the current €/£ spot exchange rate.

Correct Answer

verified

Correct Answer

verified

Essay

Use your results from the last three questions to verify your earlier result for the value of the call.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Find the dollar value today of a 1-period at-the-money call option on €10,000.The spot exchange rate is €1.00 = $1.25.In the next period,the euro can increase in dollar value to $2.00 or fall to $1.00.The interest rate in dollars is i$ = 27.50%; the interest rate in euro is i€ = 2%.

A) $3,308.82

B) $0

C) $3,294.12

D) $4,218.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For European currency options written on euro with a strike price in dollars,what of the effect of an increase in the exchange rate S(€/$) ?

A) Decrease the value of calls and puts ceteris paribus

B) Increase the value of calls and puts ceteris paribus

C) Decrease the value of calls, increase the value of puts ceteris paribus

D) Increase the value of calls, decrease the value of puts ceteris paribus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the perspective of the writer of a put option written on €62,500.If the strike price is $1.55/€,and the option premium is $1,875,at what exchange rate do you start to lose money?

A) $1.52/€

B) $1.55/€

C) $1.58/€

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that you have written a call option on €10,000 with a strike price in dollars.Suppose further that the hedge ratio is ½.Which of the following would be an appropriate hedge for a short position in this call option?

A) Buy €10,000 today at today's spot exchange rate.

B) Buy €5,000 today at today's spot exchange rate.

C) Agree to buy €5,000 at the maturity of the option at the forward exchange rate for the maturity of the option that prevails today .

D) Buy the present value of €5,000 discounted at i€ for the maturity of the option.

E) Both c) and d) would work.F.None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Empirical tests of the Black-Scholes option pricing formula

A) have faced difficulties due to nonsynchronous data.

B) suggest that when using simultaneous price data and incorporating transaction costs they conclude that the PHLX American currency options are efficiently priced.

C) suggest that the European option-pricing model works well for pricing American currency options that are at- or out-of-the money, but does not do well in pricing in-the-money calls and puts.

D) all of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 100

Related Exams