Correct Answer

verified

Correct Answer

verified

True/False

Some of the fears that people have concerning government are well-founded and some are not.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Retiring the federal debt will

A) Decrease the supply of government bonds

B) Increase government bond prices

C) Lower the interest rate on government bonds

D) Decrease the demand for money

E) Do all of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

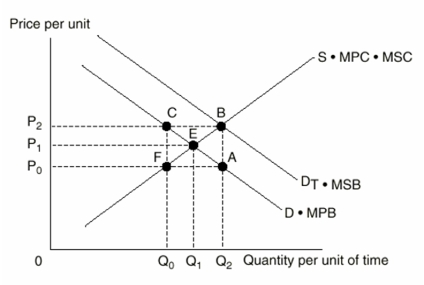

Assuming negative externalities in production,the type of government action that could bring about an efficient level of production would be

A) A tax levied on each unit produced equal to marginal external costs

B) A tax levied on each unit produced greater than marginal external costs

C) A subsidy to consumers equal to marginal external benefits

D) A subsidy to consumers greater than marginal external benefits

E) None of the above

Correct Answer

verified

Correct Answer

verified

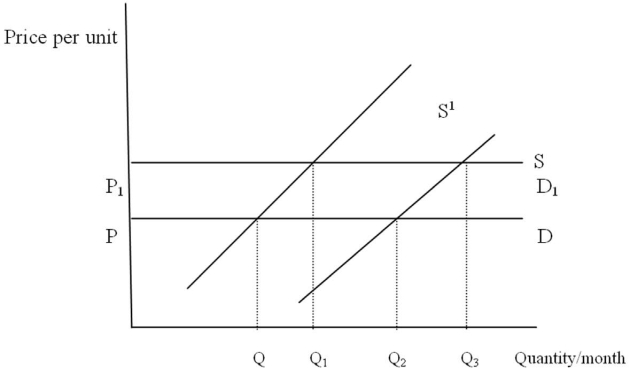

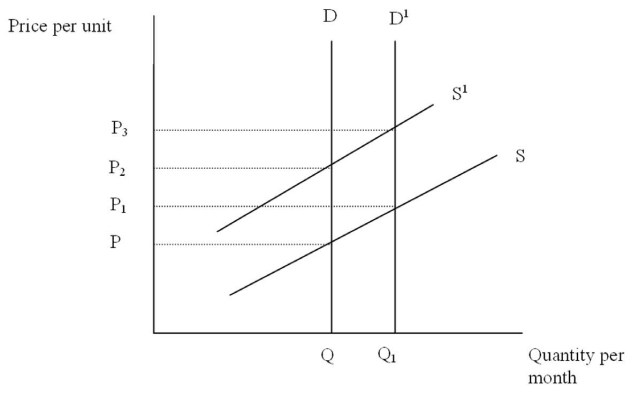

Multiple Choice

The Following Questions Refer to the graph below.  -Given demand curve D,if an output tax per unit of P- P2 is levied on this good,how much of the tax will be shifted forward?

-Given demand curve D,if an output tax per unit of P- P2 is levied on this good,how much of the tax will be shifted forward?

A) None

B) One-fourth

C) Half

D) All

E) It can not be determined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the federal level,the largest revenue generating tax is the

A) Corporate income tax

B) Personal income tax

C) Property tax

D) Sales tax

E) Customs duty

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fears of people concerning the size of government are

A) Always without any foundation

B) Well-founded in some instances and not well-founded in some instances

C) Difficult to appreciate

D) Due to low income and low educational levels of many people

E) Based solely on economic efficiency

Correct Answer

verified

Correct Answer

verified

True/False

Before an intelligent decision can be made about whether government is too large or small,the benefits and costs must be weigheD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Following Questions Refer to the graph below.  -If external benefits are associated with the consumption of the good,consumers could be induced to purchase the efficient quantity if the price were set at

-If external benefits are associated with the consumption of the good,consumers could be induced to purchase the efficient quantity if the price were set at

A) P2

B) P1

C) P0

D) 0

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

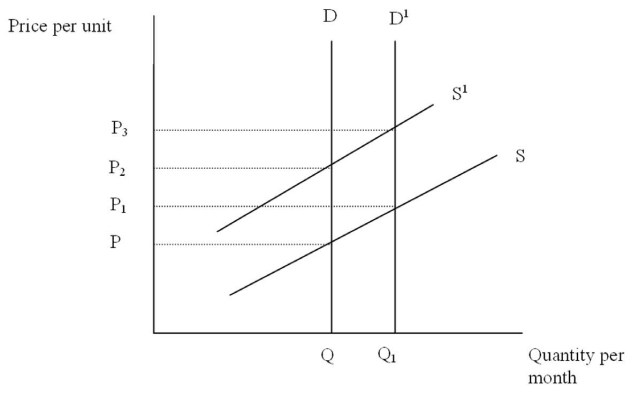

The Following Questions Refer to the graph below.

-The demand curve for this product can be described as

-The demand curve for this product can be described as

A) Perfectly elastic

B) Perfectly inelastic

C) Unitary elastic

D) Hyper elastic

E) Price elastic

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the equimarginal principle,the efficient level of government expenditures occurs when the benefit of the last dollar spent for each government purchase is

A) Greater than the benefit of the last dollar spent in the private sector

B) Less than the benefit of the last dollar spent in the private sector

C) Equal to the benefit of the last dollar spent in the private sector

D) Paid for out of current tax collections

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The federal tax system is much more progressive than is generally believeD.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Assuming positive externalities in consumption,the type of government action that could bring about an efficient level of production would be

A) A tax levied on each unit produced equal to marginal external costs

B) A tax levied on each unit produced greater than marginal external costs

C) A subsidy on each unit consumed equal to marginal external benefits

D) A subsidy on each unit consumed greater than marginal external benefits

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity implies that

A) People in different states should pay the same taxes

B) People with comparable incomes should pay the same taxes

C) People in different economic circumstances should pay different amounts

D) Taxes should rise as the size of your family increases

E) Taxes should be based upon how tall the taxpayer is

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The Following Questions Refer to the graph below.  -The demand curve for this product can be described as

-The demand curve for this product can be described as

A) Perfectly elastic

B) Perfectly inelastic

C) Unitary elastic

D) Hyper elastic

E) Price elastic

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The highest effective federal tax rate in the United States is approximately

A) 10%

B) 15%

C) 20%

D) 24%

E) 34%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability to pay the principle of taxation suggests that people with more income should pay more taxes.This means that

A) Progressive income rates are consistent with the ability to pay principle

B) Proportional income rates are consistent with the ability to pay principle

C) Regressive income rates may or may not be consistent with the ability to pay principle depending on the rate of regression

D) Sales taxes are consistent with the ability to pay principle

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An efficient level of government expenditures is that level where net benefits to society are maximizeD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gasoline tax is often used to illustrate the benefits received principle of taxation because

A) Everyone benefits from the gasoline tax

B) Those who pay the tax receive benefits,since the revenues are used for road and highway construction and maintenance

C) The amount we pay is consistent with our incomes

D) Everyone knows when they pay the tax

E) The gasoline tax is a poor example of the benefits received principle

Correct Answer

verified

Correct Answer

verified

True/False

The existence of externalities in production or consumption does not negate the possibility that these goods and services can be supplied efficiently in the market.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 125

Related Exams