A) ($40,000)

B) $40,000

C) ($2,000)

D) $50,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milford Corporation has in stock 16,100 kilograms of material R that it bought five years ago for $5.75 per kilogram.This raw material was purchased to use in a product line that has been discontinued.Material R can be sold as is for scrap for $3.91 per kilogram.An alternative would be to use material R in one of the company's current products,S88Y,which currently requires 2 kilograms of a raw material that is available for $7.60 per kilogram.Material R can be modified at a cost of $0.77 per kilogram so that it can be used as a substitute for this material in the production of product S88Y.However,after modification,4 kilograms of material R is required for every unit of product S88Y that is produced.Milford Corporation has now received a request from a company that could use material R in its production process.Assuming that Milford Corporation could use all of its stock of material R to make product S88Y or the company could sell all of its stock of the material at the current scrap price of $3.91 per kilogram,what is the minimum acceptable selling price of material R to the company that could use material R in its own production process?

A) $0.88 per kg

B) $3.03 per kg

C) $4.57 per kg

D) $3.91 per kg

Correct Answer

verified

Correct Answer

verified

Multiple Choice

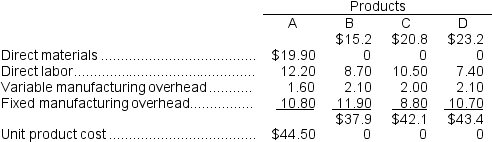

Bruce Corporation makes four products in a single facility. These products have the following unit product costs:

Additional data concerning these products are listed below.

Additional data concerning these products are listed below.

The grinding machines are potentially the constraint in the production facility. A total of 9,800 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

-How many minutes of grinding machine time would be required to satisfy demand for all four products?

The grinding machines are potentially the constraint in the production facility. A total of 9,800 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

-How many minutes of grinding machine time would be required to satisfy demand for all four products?

A) 10,800

B) 9,800

C) 10,500

D) 12,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

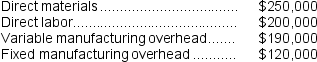

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

-At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

-At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

A) $29 per unit

B) $25 per unit

C) $21 per unit

D) $24 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

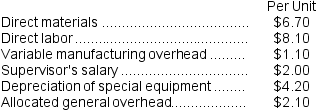

Norgaard Corporation makes 8,000 units of part G25 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:

An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $2,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part G25 would be used to make more of one of the company's other products,generating an additional segment margin of $16,000 per year for that product.

The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $2,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part G25 would be used to make more of one of the company's other products,generating an additional segment margin of $16,000 per year for that product.

The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

A) ($8,400)

B) $16,000

C) ($8,000)

D) ($40,000)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

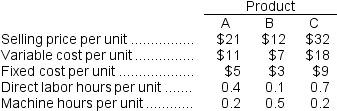

The Wester Corporation produces three products with the following costs and selling prices:

The company has insufficient capacity to fulfill all of the demand for these three products.

-If machine hours are the constraint,then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

The company has insufficient capacity to fulfill all of the demand for these three products.

-If machine hours are the constraint,then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

A) A, B, C

B) B, C, A

C) A, C, B

D) C, A, B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

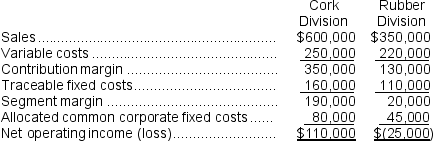

Vanik Corporation currently has two divisions which had the following operating results for last year:

Because the Rubber Division sustained a loss,the president of Vanik is considering the elimination of this division.All of the division's traceable fixed costs could be avoided if the division was dropped.None of the allocated common corporate fixed costs could be avoided.If the Rubber Division was dropped at the beginning of last year,the financial advantage (disadvantage) to the company for the year would have been:

Because the Rubber Division sustained a loss,the president of Vanik is considering the elimination of this division.All of the division's traceable fixed costs could be avoided if the division was dropped.None of the allocated common corporate fixed costs could be avoided.If the Rubber Division was dropped at the beginning of last year,the financial advantage (disadvantage) to the company for the year would have been:

A) ($20,000)

B) $20,000

C) $25,000

D) ($25,000)

Correct Answer

verified

Correct Answer

verified

True/False

Two or more products that are produced from a common input are known as joint products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Carter Corporation makes products A and B in a joint process from a single input, R. During a typical production run, 50,000 units of R yield 20,000 units of A and 30,000 units of B at the split-off point. Joint production costs total $90,000 per production run. The unit selling price for A is $4.00 and for B is $3.80 at the split-off point. However, B can be processed further at a total cost of $60,000 and then sold for $7.00 per unit. -If product B is processed beyond the split-off point,the financial advantage (disadvantage) as compared to selling B at the split-off point would be:

A) $36,000 per production run

B) $96,000 per production run

C) ($42,000) per production run

D) ($10,000) per production run

Correct Answer

verified

Correct Answer

verified

True/False

In a special order situation that involves using capacity that is not idle,opportunity costs are zero.

Correct Answer

verified

Correct Answer

verified

True/False

It may be a good decision to replace an asset before its original cost has been fully recovered through increased revenues or decreased costs.

Correct Answer

verified

Correct Answer

verified

True/False

Eliminating nonproductive processing time is particularly important in a bottleneck operation.

Correct Answer

verified

Correct Answer

verified

True/False

In a special order situation,any fixed cost associated with the order would be irrelevant.

Correct Answer

verified

Correct Answer

verified

True/False

Future costs that do differ among the alternatives are not relevant in a decision.

Correct Answer

verified

Correct Answer

verified

True/False

An avoidable cost is a sunk cost that can be eliminated (in whole or in part)as a result of choosing one alternative over another.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paine Corporation processes sugar beets in batches that it purchases from farmers for $72 a batch.A batch of sugar beets costs $11 to crush in the company's plant.Two intermediate products,beet fiber and beet juice,emerge from the crushing process.The beet fiber can be sold as is for $27 or processed further for $16 to make the end product industrial fiber that is sold for $40.The beet juice can be sold as is for $43 or processed further for $28 to make the end product refined sugar that is sold for $100.Which of the intermediate products should be processed further?

A) beet fiber should NOT be processed into industrial fiber; beet juice should be processed into refined sugar

B) beet fiber should NOT be processed into industrial fiber; beet juice should NOT be processed into refined sugar

C) beet fiber should be processed into industrial fiber; beet juice should NOT be processed into refined sugar

D) beet fiber should be processed into industrial fiber; beet juice should be processed into refined sugar

Correct Answer

verified

Correct Answer

verified

Multiple Choice

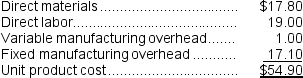

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the financial advantage (disadvantage) of purchasing the part rather than making it?

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the financial advantage (disadvantage) of purchasing the part rather than making it?

A) $273,000

B) ($126,000)

C) $147,000

D) $448,000

Correct Answer

verified

Correct Answer

verified

True/False

Payment of overtime to a worker in order to relax a production constraint could increase the profits of a company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

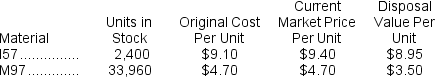

Munafo Corporation is a specialty component manufacturer with idle capacity.Management would like to use its extra capacity to generate additional profits.A potential customer has offered to buy 6,500 units of component VGI.Each unit of VGI requires 1 unit of material I57 and 5 units of material M97.Data concerning these two materials follow:

Material I57 is in use in many of the company's products and is routinely replenished.Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials,in total,for purposes of determining a minimum acceptable price for the order for product VGI?

Material I57 is in use in many of the company's products and is routinely replenished.Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials,in total,for purposes of determining a minimum acceptable price for the order for product VGI?

A) $174,850

B) $213,130

C) $213,850

D) $171,925

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A study has been conducted to determine if one of the departments in Carry Corporation should be discontinued.The contribution margin in the department is $80,000 per year.Fixed expenses charged to the department are $95,000 per year.It is estimated that $50,000 of these fixed expenses could be eliminated if the department is discontinued.These data indicate that if the department is discontinued,the yearly financial advantage (disadvantage) for the company would be:

A) ($15,000)

B) $15,000

C) ($30,000)

D) $30,000

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 203

Related Exams