A) Since depreciation increases the firm's net cash provided by operating activities, the more depreciation a company has, the larger its retained earnings will be, other things held constant.

B) A firm can show a large amount of retained earnings on its balance sheet yet need to borrow cash to make required payments.

C) Common equity includes common stock and retained earnings, less accumulated depreciation.

D) The retained earnings account as reported on the balance sheet shows the amount of cash that is available for paying dividends.

E) If a firm reports a loss on its income statement, then the retained earnings account as shown on the balance sheet will be negative.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mantle Corporation is considering two equally risky investments: ∙A $5,000 investment in preferred stock that yields 7%. ∙A $5,000 investment in a corporate bond that yields 10%. What is the break-even corporate tax rate that makes the company indifferent between the two investments?

A) 34.27%

B) 36.08%

C) 37.97%

D) 39.87%

E) 41.87%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garner Grocers began operations in 2011.Garner has reported the following levels of taxable income (EBT) over the past several years.The corporate tax rate was 34% each year.Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions,and assume that the current provisions were applicable in 2011.What is the amount of taxes the company paid in 2014?

A) $ 92,055

B) $ 96,900

C) $102,000

D) $107,100

E) $112,455

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow is the amount of cash that if withdrawn would harm the firm's ability to operate and to produce future cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Uniontown Books began operating in 2010.The company lost money its first three years of operations,but has had an operating profit during the past two years.The company's operating income (EBIT) for its first five years was as follows:

The company has no debt,and therefore,pays no interest expense.Its corporate tax rate has remained at 34% during this 5-year period.What was Uniontown's tax liability for 2014? (Assume that the company has taken full advantage of the carry-back and carry-forward provisions,and assume that the current provisions were applicable in 2010.)

A) $466,412

B) $490,960

C) $516,800

D) $544,000

E) $571,200

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital is equal to current assets minus the difference between current liabilities and notes payable.This definition assumes that the firm has no "excess" cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Congress recently passed a provision that will enable Bev's Beverages Inc.(BBI) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or the tax rate.Prior to the new provision,BBI's net income was forecasted to be $4 million.Which of the following best describes the impact of the new provision on BBI's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.

A) The provision will reduce the company's cash flow.

B) The provision will increase the company's tax payments.

C) The provision will increase the firm's operating income (EBIT) .

D) The provision will increase the company's net income.

E) Net fixed assets on the balance sheet will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hayes Corporation has $300 million of common equity,with 6 million shares of common stock outstanding.If Hayes' Market Value Added (MVA) is $162 million,what is the company's stock price?

A) $66.02

B) $69.49

C) $73.15

D) $77.00

E) $80.85

Correct Answer

verified

Correct Answer

verified

Multiple Choice

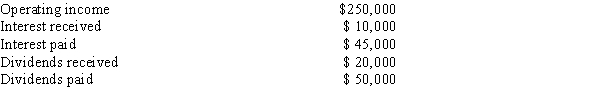

Your corporation has the following cash flows:

If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

A) $ 83,980

B) $ 88,400

C) $ 92,820

D) $ 97,461

E) $102,334

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On its 12/31/14 balance sheet,Barnes Inc showed $510 million of retained earnings,and exactly that same amount was shown the following year.Assuming that no earnings restatements were issued,which of the following statements is CORRECT?

A) If the company lost money in 2014, it must have paid dividends.

B) The company must have had zero net income in 2014.

C) The company must have paid out half of its 2014 earnings as dividends.

D) The company must have paid no dividends in 2014.

E) Dividends could have been paid in 2014, but they would have had to equal the earnings for the year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Van Dyke Corporation has a corporate tax rate equal to 30%.The company recently purchased preferred stock in another company.The preferred stock has an 8% before-tax yield.What is Van Dyke's after-tax yield on the preferred stock?

A) 6.57%

B) 6.92%

C) 7.28%

D) 7.64%

E) 8.03%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lintner Beverage Corp.reported the following information from their financial statements:

Operating income (EBIT) = $20,000,000

Interest payments on long-term debt = $1,750,000

Dividend income = $1,000,000

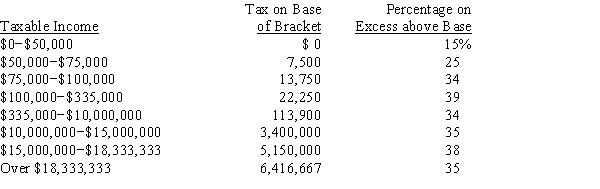

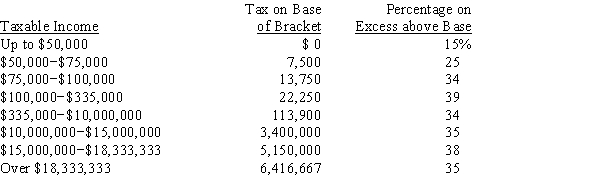

Calculate Lintner's total tax liability using the corporate tax schedule below:

A) $6,167,875

B) $6,492,500

C) $6,817,125

D) $7,157,982

E) $7,515,881

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prezas Company's balance sheet showed total current assets of $4,250,all of which were required in operations.Its current liabilities consisted of $975 of accounts payable,$600 of 6% short-term notes payable to the bank,and $250 of accrued wages and taxes.What was its net operating working capital?

A) $2,874

B) $3,025

C) $3,176

D) $3,335

E) $3,502

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation can earn 7.5% if it invests in municipal bonds.The corporation can also earn 8.5% (before-tax) by investing in preferred stock.Assume that the two investments have equal risk.What is the break-even corporate tax rate that makes the corporation indifferent between the two investments?

A) 35.39%

B) 37.25%

C) 39.22%

D) 41.18%

E) 43.24%

Correct Answer

verified

Correct Answer

verified

True/False

An increase in accounts payable represents an increase in net cash provided by operating activities just like borrowing money from a bank.An increase in accounts payable has an effect similar to taking out a new bank loan.However,these two items show up in different sections of the statement of cash flows to reflect the difference between operating and financing activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Granville Co.recently purchased several shares of Kalvaria Electronics' preferred stock.The preferred stock has a before-tax yield of 8.6%.If the company's tax rate is 40%,what is Granville Co.'s after-tax yield on the preferred stock?

A) 6.49%

B) 6.83%

C) 7.19%

D) 7.57%

E) 7.95%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporations face the following tax schedule:

Company Z has $80,000 of taxable income from its operations,$5,000 of interest income,and $30,000 of dividend income from preferred stock it holds in other corporations.What is Company Z's tax liability?

A) $17,328

B) $18,240

C) $19,200

D) $20,210

E) $21,221

Correct Answer

verified

Correct Answer

verified

True/False

Its retained earnings is the actual cash that the firm has generated through operations less the cash that has been paid out to stockholders as dividends.If the firm has sufficient retained earnings,it can purchase assets and pay for them with cash from retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Dividends paid reduce the net income that is reported on a company's income statement.

B) If a company uses some of its bank deposits to buy short-term, highly liquid marketable securities, this will cause a decline in its current assets as shown on the balance sheet.

C) If a company issues new long-term bonds to purchase fixed assets during the current year, this will increase both its reported current assets and current liabilities at the end of the year.

D) Accounts receivable are reported as a current liability on the balance sheet.

E) If a company pays more in dividends than it generates in net income, its retained earnings as reported on the balance sheet will decline from the previous year's balance.

Correct Answer

verified

Correct Answer

verified

True/False

The value of any asset is the present value of the cash flows the asset is expected to provide.The cash flows a business is able to provide to its investors is its free cash flow.This is the reason that FCF is so important in finance.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 130

Related Exams