A) $0 and $24,000

B) $960 and $12,000

C) $8,640 and $23,040

D) $5,184 and $28,224

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets include patents,copyrights,and franchises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be the main determinant for selection of the allocation method for long-term operational assets?

A) The method that is most convenient to compute.

B) The method that best matches the pattern of asset use.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson Incorporated purchased a truck for $36,000.The truck had a useful life of 150,000 miles over 4 years and a $6,000 salvage value.Jackson drove the truck 40,000 miles in Year 1 and 24,000 miles in Year 2.If Jackson uses the units-of-production method,what is the accumulated depreciation at the end of Year 2?

A) $4,800

B) $8,000

C) $12,800

D) $16,000

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

Which of the following statements is true concerning the modified accelerated cost recovery system (MACRS) for the recognition of depreciation expense,for tax purposes?

A) 7-year property will be depreciated more rapidly than 10-year property under the MACRS depreciation method.

B) Under MACRS more depreciation will be recorded in the second accounting period than in the first accounting period because of the half-year convention.

C) MACRS is used for the determination of depreciation expense that is reported on an income tax return.

D) All of these answer choices are true.

Correct Answer

verified

Correct Answer

verified

True/False

Depletion of a natural resource is usually calculated using the straight-line method.

Correct Answer

verified

Correct Answer

verified

True/False

Tangible assets include land,equipment,and goodwill.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the current accounting period,Ringgold Co.recorded depreciation of $15,000 on its equipment.What is the effect of this event on the company's balance sheet?

A) Decrease assets and increase liabilities

B) Decrease stockholders' equity and decrease assets

C) Decrease assets and increase stockholders' equity

D) Decrease stockholders' equity and increase liabilities

Correct Answer

verified

Correct Answer

verified

True/False

When a building is purchased simultaneously with land,the purchase price must be allocated between the building and the land.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Phillips Company made a basket purchase including land,a building and equipment for $380,000.The appraised values of the assets are $20,000 for the land,$340,000 for the building and $40,000 for equipment.Phillips uses the double-declining-balance method for the equipment which is estimated to have a useful life of four years and a salvage value of $5,000.What is the depreciation expense for the equipment for Year 1?

A) $17,000

B) $20,000

C) $9,500

D) $19,000

Correct Answer

verified

Correct Answer

verified

True/False

The use of estimates and revision of estimates are uncommon in financial reporting.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Monroe Minerals Company purchased a copper mine for $120,000,000.The mine was expected to produce 50,000 tons of copper over its useful life.During Year 1,the company extracted 6,000 tons of copper.The copper was sold for $4,500 per ton.Assume that the company incurred $8,040,000 in operating expenses during Year 1.What is the amount of net income for Year 1?

A) $12,600,000

B) $4,560,000

C) $6,360,000

D) $14,400,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Farmer Company purchased machine on January 1, Year 1 for $82,000. The machine is estimated to have a 5-year life and a salvage value of $4,000. The company uses the straight-line method. -If the original expected life remained the same (i.e.,5-years) ,but at the beginning of Year 4,the salvage value was revised to $8,000,what is the annual depreciation expense for each of the remaining years?

A) $5,440

B) $27,200

C) $13,600

D) $14,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Li Company purchased an asset that cost $80,000.The asset had an expected useful life of five years and an estimated salvage value of $16,000.Li uses the straight-line method for the recognition of depreciation expense.At the beginning of the fourth year,the company revised its estimated salvage value to $8,000.What is the amount of depreciation expense to be recognized during Year 4?

A) $12,800

B) $16,800

C) $33,600

D) $20,800

Correct Answer

verified

Correct Answer

verified

True/False

Accumulated Depreciation is reported on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Harding uses the units-of-production method when depreciating its equipment.Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has a salvage value of $34,000.Harding produced 265,000 units with the equipment by the end of the first year of purchase.Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A) $193,450

B) $125,200

C) $157,145

D) $165,890

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

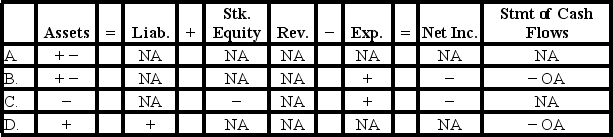

EFG Transportation Company uses the straight-line method to depreciate its delivery truck.Which of the following reflects how recognizing depreciation expense would affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gillock,Inc.uses MACRS for its income tax return and the straight-line method for its financial statements.On January 1,Year 1,the company purchased a long-term asset that cost $130,000 and has a $10,000 salvage value and an expected 8-year useful life.MACRS specifies a 5-year life for that asset and a depreciation rate of 20% for the first year of its life.Which of the following would the company show on its financial records?

A) Less depreciation expense on the tax return than on the income statement

B) The same amount of depreciation expense for financial reporting as for income tax preparation

C) Depreciation expense of $26,000 on the income statement and $15,000 on the tax return

D) A deferred tax liability will be reported on the balance sheet

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 122

Related Exams