A) by voting on issues that concern them

B) by electing members of a board of directors

C) by vetting the decisions of the board of directors

D) by providing oversight of the day-to-day running of the corporation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be best considered to be an agency conflict problem in the behavior of the following financial managers?

A) Bill chooses to pursue a risky investment for the company's funds because his compensation will substantially rise if it succeeds.

B) Sue instructs her staff to skip safety inspections in one of the company's factories, knowing that it will likely fail the inspection and incur significant costs to fix.

C) James ignores an opportunity for his company to invest in a new drug to fight Alzheimer's disease, judging the drug's chances of succeeding as low.

D) Michael chooses to enhance his firm's reputation at some cost to its shareholders by sponsoring a team of athletes for the Olympics.

Correct Answer

verified

Correct Answer

verified

True/False

In most corporations, the owners exercise direct control of a corporation.

Correct Answer

verified

Correct Answer

verified

True/False

It is generally not the duty of financial managers to ensure that a firm has the cash it needs for day-to-day transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a function of the board of directors?

A) determining how top executives should be compensated

B) monitoring the performance of the company

C) answering to shareholders of the company

D) day-to-day running of the company

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A typical company has many types of shareholders, from individuals holding a few shares, to large institutions that hold very large numbers of shares. How does a financial manager ensure that the priorities and concerns of such disparate stockholders are met?

A) The financial manager should seek to make investments that do not harm the interests of the stockholders.

B) The decisions taken by the financial manager should be solely influenced by the benefit to the company since, by maximizing its fitness, he or she will also maximize the benefits of that company to the shareholders.

C) The financial manager should consider the interests and concerns of large shareholders a priority so the needs of those who hold a controlling interest in the company are met.

D) In general, all shareholders will agree that they are better off if the financial manager works to maximize the value of their investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a role of financial institutions?

A) moving funds from savers to borrowers

B) spreading out risk-bearing

C) printing money for borrowers

D) moving funds though time

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is it possible for a corporation to enter into contracts, acquire assets, incur obligations, and enjoy protection against the seizure of its property?

A) The number of owners, and hence the spread of risk among these owners, is not limited.

B) Its owners are liable for any obligations it enters into.

C) The state in which a corporation is incorporated provides safeguards against any wrongdoing by the corporation.

D) It is a legally defined, artificial entity that is separate from its owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

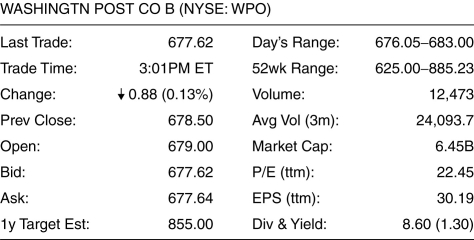

Use the figure for the question(s) below.  -Using the above information, how much would you receive if you sold a share of Washington Post stock?

-Using the above information, how much would you receive if you sold a share of Washington Post stock?

A) $683.00

B) $677.62

C) $678.50

D) $677.64

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Put the following steps of the financial cycle in the correct order. I. Money flows to companies who use it to fund growth through new products. II. People invest and save their money. III. Money flows back to savers and investors.

A) I, II, and III

B) II, I, and III

C) III, II, and I

D) II, III, and I

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes why the Valuation Principle is a key concept in making financial decisions?

A) It shows how to assign monetary value to intangibles such as good health and well-being.

B) It allows fixed assets and liquid assets to be valued correctly.

C) It gives a good indication of the net worth of a person, item, or company and can be used to estimate any changes in that net worth.

D) It shows how to make the costs and benefits of a decision comparable so that we can weigh them properly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the most common way that agency conflict problems are addressed in most corporations?

A) by minimizing the number of decisions that a manager makes where there is a conflict between the managers interests and those of the shareholders

B) by terminating the employment of employees who are found to have put their own interests above those of the company

C) by using disinterested outside bodies to adjudicate between managers and shareholders when such conflicts arise

D) by prosecuting managers who have been found to have illegally used company moneys for their own benefit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valiant Corp. is a C corporation that earned $3.4 per share before it paid any taxes. Valiant Corp. retained $1 of after-tax earnings for reinvestment and distributed what remained in dividend payments. If the corporate tax rate was 35% and dividend earnings were taxed at 12.5%, what was the value of the dividend earnings received after-tax by a holder of 100,000 shares of Valiant Corp.?

A) $105,875

B) $127,050

C) $148,225

D) $84,700

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following features of a corporation is LEAST accurate?

A) The owners' identity is separate from a corporation.

B) The owners of a corporation are not liable for any obligations the corporation enters into.

C) Changes in ownership do not result in the dissolution of the corporation.

D) Earnings from a corporation are taxed only once.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is a stock exchange like NASDAQ considered a secondary market?

A) It trades the second largest volume of shares in the world.

B) Shares sold on it are exchanged between investors without any involvement of the issuing corporation.

C) The exchange has rules that attempt to ensure that bid and ask prices do not get too far apart.

D) NASDAQ is called a secondary market because NYSE is considered a primary market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is unique for an S corporation?

A) The profits and losses of an S corporation are not taxed at the corporate level, but shareholders must include these profits and losses on their individual tax returns.

B) The shareholders of an S corporation must include the firm's profit and losses in their individual income taxes even if no money is distributed to them.

C) There is a maximum limit on the number of shareholders for an S corporation.

D) None of the above statements is unique.

Correct Answer

verified

Correct Answer

verified

True/False

If broker will buy a share of stock from you at $3.85 and sell it to you at $3.87, the ask price would be $3.85.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the major way in which the roles and obligations of the owners of a limited liability company differ from the roles and obligations of limited partners in a limited partnership?

A) The owners of a limited liability company have personal obligation for debts incurred by the company.

B) There is no separation between the company and its owners in a limited liability company.

C) The owners of a limited liability company can withdraw from the company without the company being dissolved.

D) The owners of a limited liability company can take an active role in running the company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In most corporations, to whom does the chief financial officer report?

A) shareholders

B) the board of directors

C) the chief executive officer

D) the controller

Correct Answer

verified

Correct Answer

verified

True/False

The fact that corporations' shares are easily traded within the market has a net effect of acting as a disincentive for managers to favor the interests of shareholders over their own interests.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 86

Related Exams