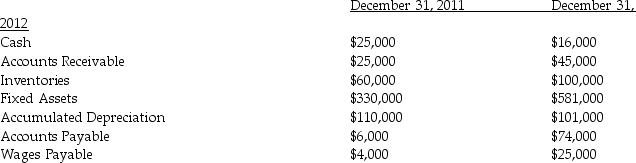

For the year ending December 31,2012,Magadena Company reports net income of $23,000 and depreciation expense of $17,000.The income tax expense for the year ending December 31,2012 is $20,000.The following data is available:  What is the net cash provided(used) by operating activities for the year ended December 31,2012? Assume the indirect method is used.

What is the net cash provided(used) by operating activities for the year ended December 31,2012? Assume the indirect method is used.

A) $(20,000)

B) $23,000

C) $40,000

D) $69,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Goodwill is a tangible asset.

B) False

Correct Answer

verified

Correct Answer

verified